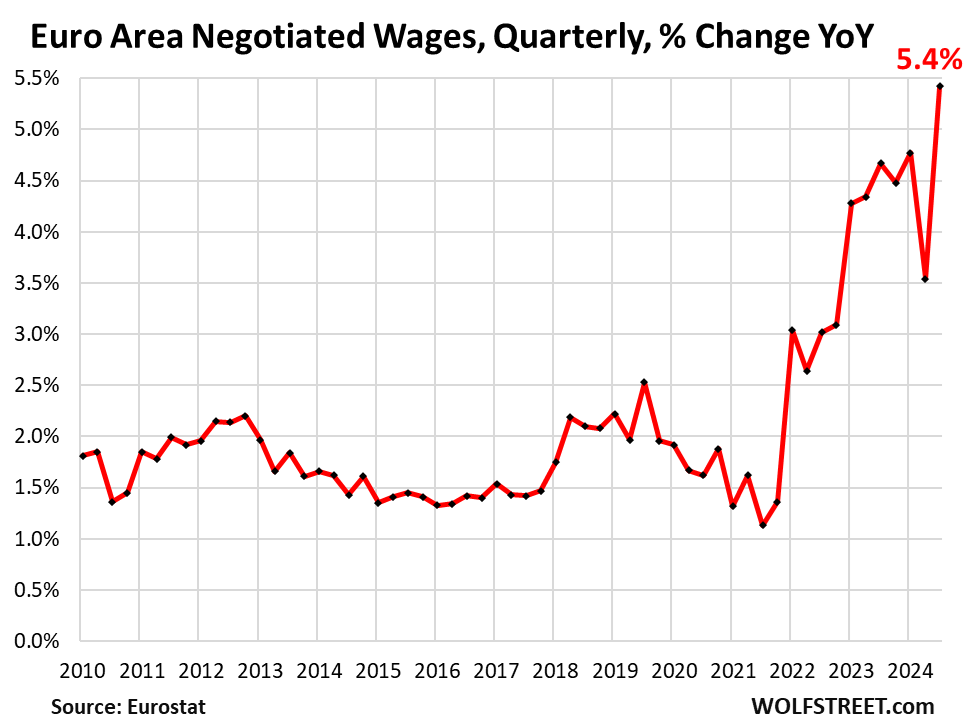

The European Central Bank (ECB) continues its quantitative tightening (QT) measures, having reduced its balance sheet by €2.45 trillion, which is a significant 59% decrease from the peak levels observed during the pandemic-related quantitative easing (QE). This ongoing process reflects the ECB’s commitment to tightening monetary policy in response to macroeconomic dynamics, particularly concerning wage growth and inflationary pressures across the Euro Area. As part of its analytical framework, the ECB uses the index of “Negotiated Wages,” which measures wage increases stemming from collective bargaining agreements, impacting about two-thirds of the economic activities in the region. This indicator provides a forward-looking perspective on wage inflation, as it tracks wage changes before they are implemented.

In the third quarter of 2023, the ECB reported a significant surge in “negotiated wages,” which increased by 5.4% year-over-year. This figure raised alarms among policymakers, especially following a perceived moderation in wage growth in the second quarter that had initially encouraged expectations of a decline in inflation. The ECB emphasized the critical role that wages play in the broader inflation landscape, particularly in the service sector, where labor costs are a key driver of price increases. This development poses a challenge for the ECB, which had banked on wage growth slowing down to achieve its inflation targets. The resilience of wage growth directly complicates the bank’s efforts to control inflation, known as the primary objective of its monetary policy.

Households stand to benefit from these rising “negotiated wages,” which can enhance their purchasing power and stimulate overall economic demand, ultimately supporting growth and job creation. However, the ECB’s concern lies in the duality of wage increases; while beneficial for households, high wage growth also has the potential to perpetuate inflationary trends, particularly in services, which have remained stubbornly high even amidst falling energy prices and shifting goods prices. The inflation trajectory within the service sector is of particular concern for the ECB, as it reached an annual inflation rate of 4.0% in October 2023, contradicting the central bank’s inflation ambitions of targeting a 2% rate.

Over the past year, inflation within the service sector has demonstrated a persistent upward trend, with significant spikes that saw rates surpassing historical averages. The service Consumer Price Index (CPI) rose dramatically in 2022, reaching mid-year figures as high as 5.6% before entering a deceleration phase which ultimately stalled at approximately 4.0% year-over-year by late 2023. Comparatively, this rate is more than double the increases seen in the preceding decade, indicating a notable inflationary shift that the ECB must address. Meanwhile, core CPI figures, which exclude volatile items such as food and energy, have been consistently observable at around 2.7%, reflecting ongoing inflationary pressures even in more stable economic segments.

The latest spike in “negotiated wages” is anticipated to lead to significant actual wage growth over the coming months and into 2024, further fueling the persistent inflation in services that the ECB seeks to contain. The bank’s policymakers will face crucial discussions regarding the pace and extent of potential interest rate reductions, needing to balance supporting economic growth against the risk of igniting further inflation. The ECB is aware that any rate cuts must be approached cautiously to prevent exacerbating the already complex inflation environment. In this context, they also retain the flexibility to adjust policy rates should inflation trends worsen again.

The ECB’s QT measures, on the other hand, are progressing effectively as it strives to unwind the massive balance sheet accumulated during the pandemic. The ECB reported that its total assets have decreased to €6.38 trillion, representing a significant contraction of €2.45 trillion since the peak periods amid QE programs. This reduction of 59% of the pandemic-era QE is a testament to the ECB’s determination to restore more traditional monetary conditions in response to evolving economic needs in the Eurozone. Ultimately, the entwined challenges of wage inflation and QT highlight the complexities of modern monetary policy, compelling the ECB to navigate this landscape judiciously while ensuring economic stability.