The European Central Bank (ECB) has taken significant steps to accelerate its quantitative tightening (QT) measures, marking a shift in its monetary policy following expansive quantitative easing (QE) strategies employed during the pandemic. At its recent policy meeting, the ECB announced both a 25-basis point rate cut and the plan to eliminate the last cap on bond-roll-offs after December 17. This move indicates that maturing bonds from the ECB’s extensive holdings will no longer be replaced, leading to a continuous reduction of its balance sheet going forward. The decision highlights the contrast with the Federal Reserve, which continues to maintain caps on its bond QT to moderate the pace of reduction.

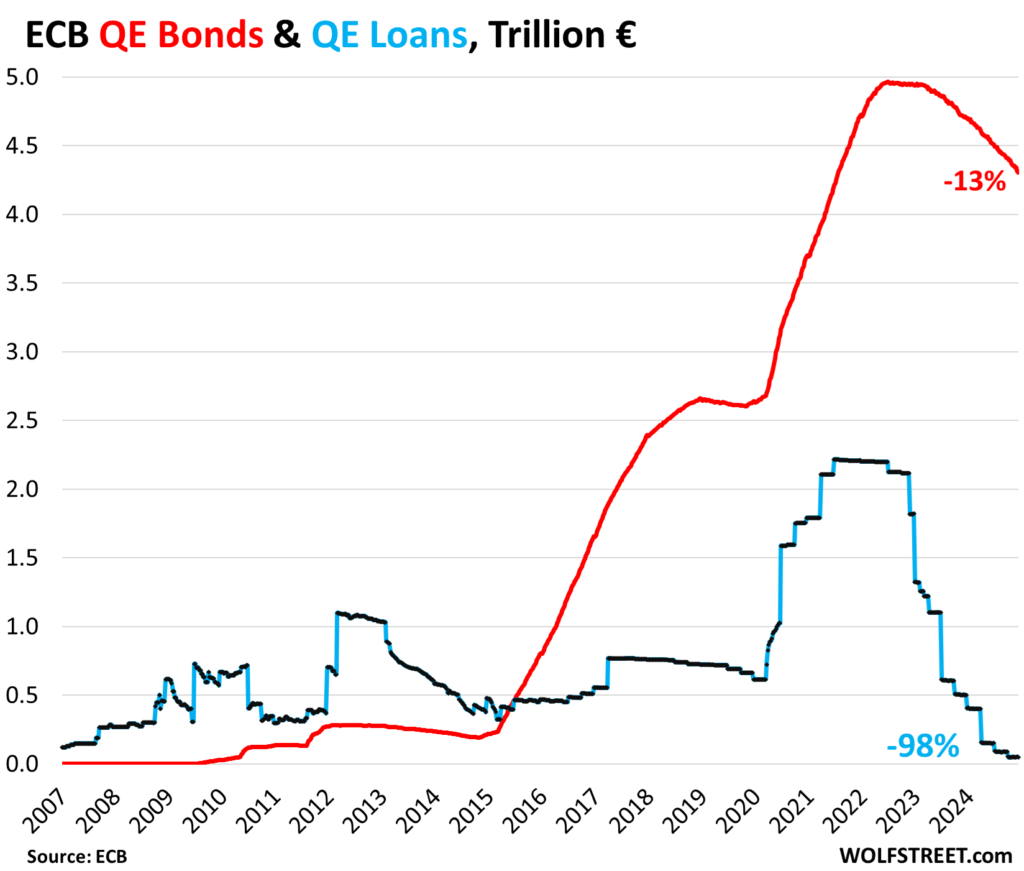

Historically, the ECB engaged in two major QE programs, which included substantial loans to banks and the purchase of government and corporate bonds. These QE initiatives peaked at €4.96 trillion in June 2022, with loans reaching up to €2.22 trillion. The recent QT policies have already resulted in a significant balance sheet reduction, totaling €2.48 trillion, which accounts for roughly 28% of the ECB’s total assets since late 2022. The reduction was predominantly driven by aggressive loan repayments from banks following unfavorable changes to the loan terms, which resulted in a staggering decline of about 98% for the ECB’s loan portfolio.

As of now, the ECB has made considerable progress in its bond QT program, which began earlier this year. Initially, the ECB allowed bonds from its Asset Purchase Program (APP) to roll off its balance sheet at maturity, subject to limits. However, in July 2023, these caps were also removed for the APP, allowing bonds to roll off freely. The forthcoming removal of the cap on the Pandemic Emergency Purchase Program (PEPP) bonds on December 17 marks the culmination of the ECB’s transition toward a more aggressive tightening stance. Presently, the ECB still holds €4.30 trillion in bonds, a notable reduction from the peak, demonstrating the ongoing effects of its QT initiative.

To date, the ECB’s QT has effectively eliminated 60% of the assets accrued during the extensive QE phase initiated during the pandemic. The shift in policy to increase the pace of QT, while concurrently lowering policy rates amid a faltering economic landscape, indicates a strategic pivot away from the previous reliance on QE. The ongoing reduction in the balance sheet demonstrates an understanding of the changing economic conditions and highlights the ECB’s commitment to rendering a stable financial environment.

The acceleration of bond QT alongside the completion of loan QT signifies a significant evolution in the ECB’s monetary policy approach. This reflects the institution’s attempts to navigate through the complexities of economic recovery, inflation management, and interest rate adjustments without overstimulating the economy. As economic growth shows signs of slowing down, the ECB’s decision to continue reducing its bond holdings underscores its resolve to balance the competing priorities of supporting growth while curbing inflationary pressures.

Ultimately, these policy changes serve as critical indicators of the ECB’s and broader European economic strategies in the face of ongoing uncertainties. The central bank’s transition from expansive monetary policies to tighter fiscal environments poses questions about the future economic landscape in Europe. As the ECB forges ahead with its QT measures, it will be essential for market participants and policymakers alike to monitor the impacts of these actions on economic growth, inflation, and overall financial stability in the region.