In the third quarter of 2023, the U.S. economy experienced positive growth, driven primarily by a significant increase in consumer spending and government expenditures. Pocketing the term “drunken sailors,” analysts noted that consumers were responsible for 69% of GDP, indicaing a marked increase in their disposable income, which spurred consumption of both goods and services. This spending phenomenon was somewhat mirrored by federal government spending, which also saw an uptick, largely funded through borrowing. As a consequence, this increased government spending contributed to rising national debt levels, putting further strain on the debt-to-GDP ratio, as GDP growth was not enough to counteract the rising debt levels.

Despite the positive GDP growth, several external factors detracted from the overall economic performance. Major contributors to this included a worsening trade deficit, which stemmed from heightened imports due to robust domestic consumer demand. Companies had been front-loading imports in anticipation of potential disruptions caused by strikes at East Coast ports, contributing to this pronounced trade imbalance. Additionally, there was a slowdown in private inventory investment, which also negatively impacted GDP growth figures. These challenges highlighted the complexity of the economic landscape, where positive consumer trends can be offset by external trade variables.

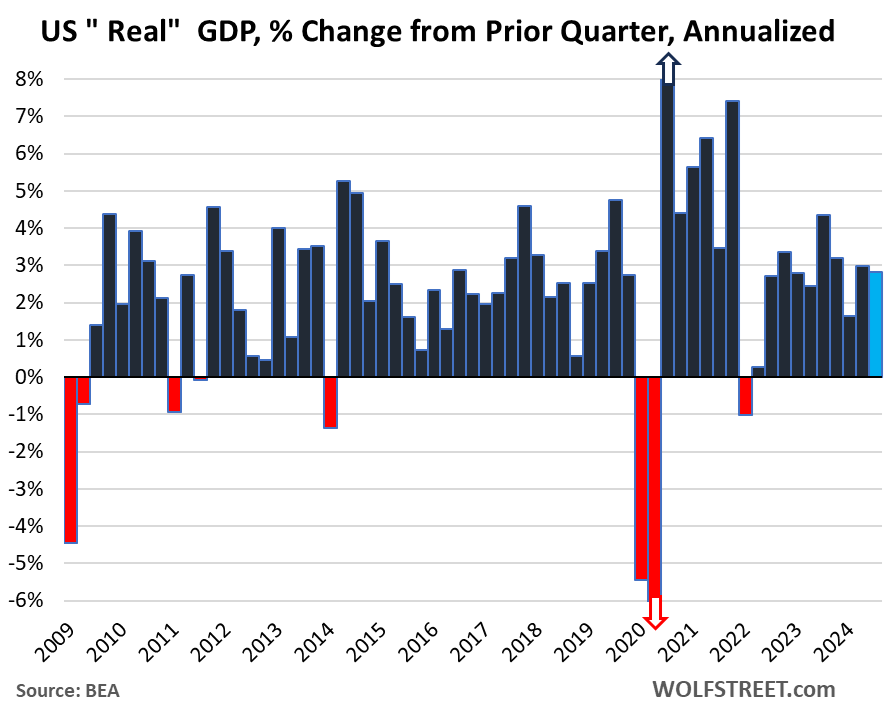

The Bureau of Economic Analysis reported a real GDP growth rate of 2.8% on an annualized basis for Q3 when compared to Q2, which is notably above the long-term average growth rate of 2.0% observed over the past 15 years. Comparing the quarterly performance, Q2 exhibited a growth rate of 3.0% and Q1 showed a slower rate of 1.6%. On a year-over-year basis, GDP rose by 2.7%, reflecting resilient economic performance. Within this context, consumer spending growth accelerated to 3.7% from Q2’s 2.8%, further driven by an exceptional 8.1% surge in spending on durable goods, pointing to strong consumer sentiment.

In breaking down the GDP components, private fixed investment growth slowed to 1.3%, a drop from previous quarters, and the residential investment sector significantly declined by 5.1%. Contrarily, non-residential investments rose by 3.3%. Government consumption and investment surged by 5.0%, with federal government spending climbing significantly by 9.7%, largely attributed to increases in defense expenditures. The contribution of government spending to overall GDP growth was minimal in comparison to consumer spending, illustrating the dominant role personal consumption plays in driving economic growth.

The trade deficit dynamics presented a challenging picture for the economy, worsening for the third consecutive quarter. U.S. exports rose by 8.9%, which contributed positively to GDP, but the import surge of 11.2% overshadowed this gain, ultimately subtracting from GDP growth. This led to a net export outcome that subtracted approximately 0.55 percentage points from GDP. The exports totaled $2.63 trillion, while imports reached $3.71 trillion, reflecting America’s dependence on foreign goods to satisfy domestic demand.

Although the overall economic growth appears encouraging, there are underlying issues exemplified by the nation’s rising debt-to-GDP ratio, which climbed to 120.8% in Q3. This increase indicates that while GDP growth was robust, it wasn’t sufficient to keep pace with the rapid growth in national debt. As the economy continues to navigate these complexities, the balance between consumer confidence, government spending, and trade dynamics remains crucial in shaping future economic outcomes. As analysts and economists look ahead, the sustainability of this growth will depend on addressing these imbalances while fostering a stable economic environment conducive to continued consumer expenditure and investment.