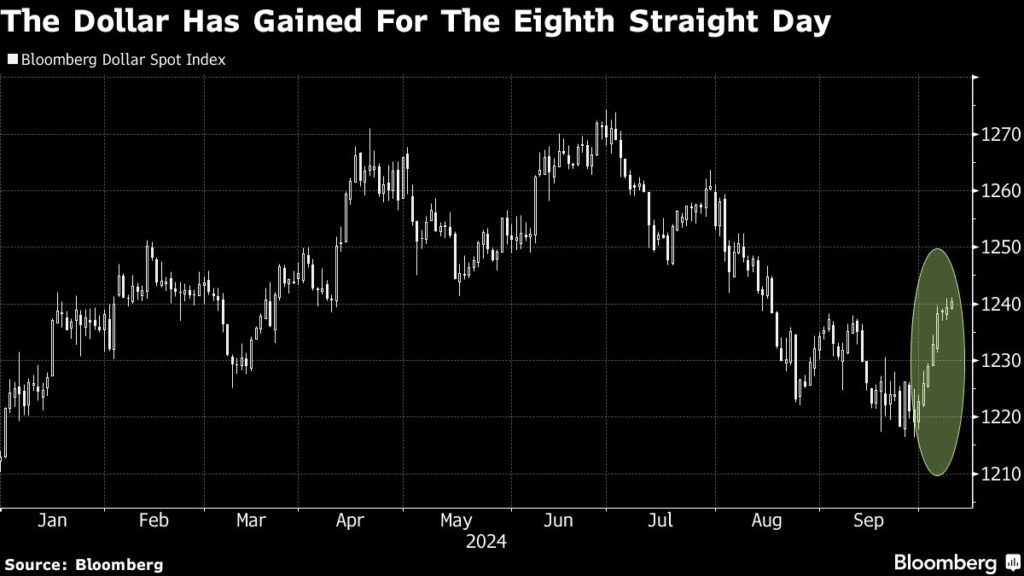

The US dollar is experiencing its longest win streak in over two years, driven by the resilience of the US economy, which is prompting traders to reassess their expectations regarding Federal Reserve interest-rate cuts. The Bloomberg Dollar Spot Index rose for the eighth consecutive day, reflecting a nearly 2% increase during this period. Trader sentiment shifted significantly after a stronger-than-anticipated US jobs report last week. The new data underlines a robust economy, leading market participants to rethink projections of rate cuts that had previously suggested a half-point reduction was imminent.

The prevailing strength of the US economy—often described as “resilient”—is robust enough that it has led some analysts to advocate for a reconsideration of investment strategies that favor US assets. Erik Wytenus, the head of investment strategy at JPMorgan Private Bank EMEA, emphasized that this resilience makes it difficult to argue against a favorable outlook for the dollar. The dollar’s strength was particularly noticeable against most major G-10 currencies on a recent trading day, where the New Zealand dollar faced declines following the New Zealand central bank’s half-point interest rate cut as it accelerated its easing measures.

In the United States, money market expectations around the Fed’s future rate cuts have shifted, with projections suggesting only about 48 basis points of cuts by year-end, a notable drop from nearly 70 basis points at the start of the month. A previously anticipated quarter-point cut in November is now assigned an approximately 80% likelihood, restructuring the expectations for the upcoming Fed meetings. Traders are particularly focused on the forthcoming Fed meeting minutes and a key inflation report, which is expected to show a slight decrease in year-over-year consumer price inflation from 2.5% to 2.3%.

Market behavior indicates an increased appetite for dollar-based assets. Reports indicate that corporate entities are actively buying dollars against the pound, while hedge funds are expanding their long positions against the yen. Following the positive US jobs report, there has been heightened demand for bearish euro options. This shift in sentiment marks the most bullish outlook for the dollar in over three months, suggesting a changing landscape for currency trading.

Corporate investor behavior reflects a strategic move towards the dollar, with long-term investors in regions like Asia and the Middle East moving away from previously bullish positions on the euro and pound. This shift impacts how traders are constructing their positions, with many now preferring to limit their short dollar bets. Neil Jones from TJM Europe noted an ongoing and gradual reduction in short positions on the dollar, highlighting the perception of the dollar’s resilience.

In summary, the resilience of the US economy has stimulated a bullish outlook for the dollar, reshaping trader bets around Federal Reserve monetary policy. The dollar’s recent eight-day upswing reflects increased confidence in US economic stability, diminishing expectations for significant rate cuts, and a noticeable shift in investor preferences, with a greater inclination towards dollar-denominated assets and a retreat from bullish positions on other currencies. This change not only signals a potential strengthening of the dollar but also suggests broader implications for global currency trading strategies as the market adjusts to evolving economic indicators and central bank policy feedback.