This week is marked by significant market activity, particularly with the upcoming quarterly refunding on Wednesday, where investors anticipate a substantial increase in new Bill issuance that is projected to drain reverse repo balances over the coming weeks. The financial landscape is primed for rapid changes as auction events unfold. The week kicked off with the initial rounds of coupon issuance, including the significant 2-year and 5-year bond auctions. Specifically, the 2-year auction, which occurred today, saw a substantial offering of $69 billion, pricing at a high yield of 4.130%. This yield is markedly higher than the previous month’s 3.520%, reflecting a shift in market sentiment attributed to the resurgence of what some are calling “Trumpflation.” The looming possibility of increased debt issuance under a Biden administration has spurred expectations, leading to this sharp uptick in yields, which are now at their highest levels since July.

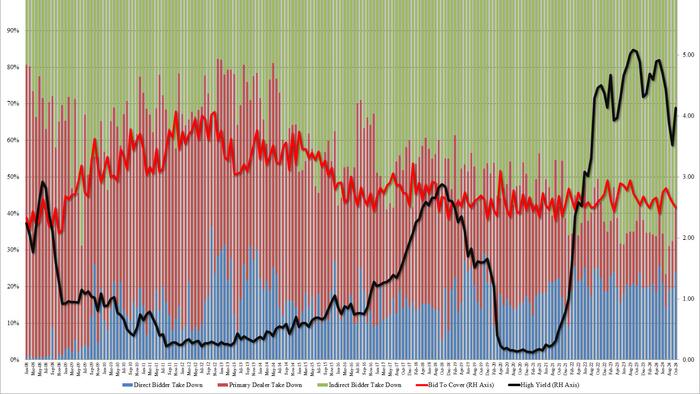

Despite the increased demand for bonds, the auction revealed some troubling signs. It tailed the expected yield of 4.122% by 0.8 basis points, marking the first instance of a tailing 2-year auction since May. Additionally, the bid-to-cover ratio of 2.504 fell from 2.588 in the previous month, indicating a decrease in investor appetite compared to the trend observed over the last several months. This decline marks the lowest bid-to-cover ratio seen since May, suggesting potential concerns among buyers regarding future yield trajectories. The internal breakdown of the auction also raised eyebrows, with only 58.2% of the securities being allocated to indirect bidders, the least since May. Conversely, direct bidders took down an unusually high 23.8%, the highest percentage since May, leaving dealers with a large portion of the issuance at 17.9%, the largest share since December 2023.

The implications of these auction results sent ripples through the broader market, with yields spiking as investors recalibrated their expectations. As 10-year Treasury yields approached the 4.30% mark, tensions in the stock market began to build as well; such elevated yield levels are historically significant and usually prompt a response from equity markets. The growing realization that interest rates might remain higher for longer due to potential increases in debt issuance is beginning to alter market dynamics. Investors are facing a complex interplay of factors, including inflationary pressures, changes in fiscal policy, and the anticipated impacts of increased supply in the bond market.

The atmosphere of uncertainty and volatility is compounded by the broader economic context, which has seen rising inflation rates and shifting fiscal strategies. The current economic climate is being shaped by ongoing regulatory changes, global market pressures, and domestic policy adjustments that are all interconnected. The potential return of a Trump presidency is becoming a major point of consideration for many investors, stirring debates about future fiscal and monetary policies. Trump’s historical approach to economic management—marked by aggressive spending coupled with tax cuts—has led many to speculate about how such policies could influence long-term interest rates and government debt levels.

As the financial markets continue to digest these developments, investors are closely monitoring the yield curve and the broader implications for asset allocations. The bond market’s reaction to these auction results reflects a cautious outlook, leading to possible repositioning across various asset classes. In particular, stocks are beginning to feel the pinch of rising yields, which is historically indicative of tighter financial conditions. The market is witnessing a recalibration, where investors may start to shift their strategies to accommodate the perceived risk of sustained higher rates in the face of increasing government debt.

In summary, this week’s busy schedule, characterized by pivotal auctions and anticipated policy changes, highlights the increasingly complex interplay between yields, government debt, and market sentiment. With significant fluctuations in auction dynamics and yields, especially in the context of potential macroeconomic shifts, investors are confronted with a rapidly evolving market landscape. As they brace for the impacts of a possible Trump-led administration, the focus remains firmly on how these changes will affect both the bond and equity markets in the coming weeks. The outlook remains uncertain as market participants navigate these challenging conditions, making it a critical time for informed investment strategies amidst the swirling economic climate.