Traders today engaged in profit-taking across several markets associated with former President Donald Trump, including Bitcoin and gold, as well as a Republican policy investment basket, which aimed to capitalize on anticipated political outcomes. This shift suggests a conscious strategy among investors to realize gains amidst uncertainties leading into an upcoming political event. The dynamic highlights the correlation between political events and trading behaviors, particularly in assets perceived to have significant exposure to Republican policies or Trump-related sentiment.

Despite today’s profit-taking, the overall performance of the “Trump Trade” has been robust. The continued interest in assets like Bitcoin and gold reflects a broader trend where market participants anticipate that political developments could lead to increased volatility and opportunities for gains in these sectors. This pattern points to a sustained bullish sentiment in Republican-linked investments, with many traders positioning themselves ahead of potential market movements resulting from political outcomes.

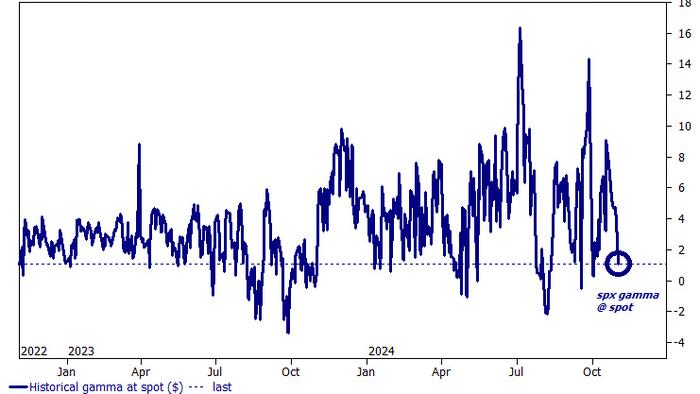

The VIX, a widely followed measure of market volatility, reflects the current sentiments and risks in the market. An inverted VIX curve typically indicates that traders are concerned about future volatility despite a period of relative calm. This condition suggests that while there may be short-term profit-taking, investors are bracing for potential market swings that could accompany forthcoming electoral developments, such as announcements or debates that may sway public opinion or influence markets dramatically.

As the market anticipates the upcoming political event, the interplay between sentiment, risk appetite, and asset performance emerges as a critical aspect for traders. The mixed signals from profit-taking and the ongoing interest in Trump-related assets underline the underlying sentiment of cautious optimism among Republican supporters. Traders are likely weighing their positions carefully as they navigate the uncertainties inherent in political cycles while hoping to leverage any favorable outcomes.

In summary, the trading landscape today illustrated a significant moment where profit-taking occurred amidst sustained performance in Trump-related investments. As traders prepare for an important political event, balancing risk and opportunity remains essential. The evident volatility, as illustrated by the VIX indicators and the trends in various trading assets, signals ongoing caution, with traders keenly observing shifts that could lead to further opportunities in the market.

Ultimately, the current environment emphasizes the interconnectedness of politics and finance, where shifts in sentiment can spark rapid changes in market behavior. As traders eye the future, their strategies will likely continue to reflect both optimism and caution, with a firm emphasis on positioning digitally and in traditional assets to navigate the unpredictable waters of political influence on market dynamics.