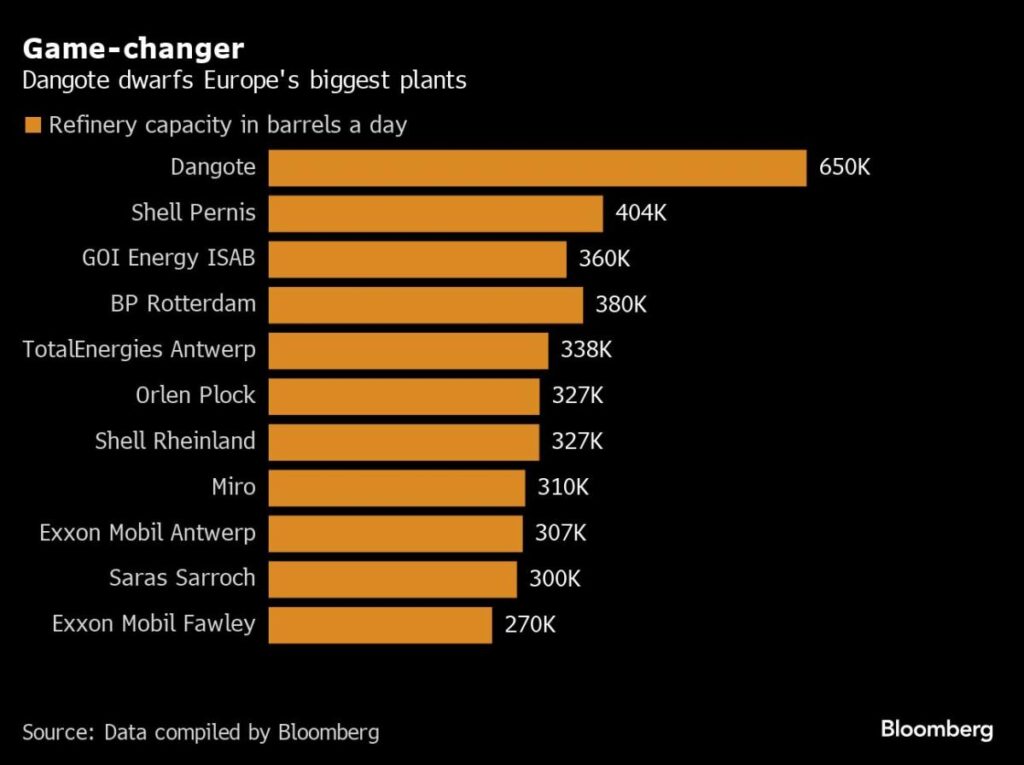

The Dangote oil refinery, located near Lagos, Nigeria, is poised to significantly impact both local and international oil markets as it prepares to process up to 400,000 barrels per day (bpd) of Nigerian crude over the next two months. Spanning an ambitious schedule, the refinery will aim to receive approximately 24 million barrels of crude oil during October and November. This marked shift towards utilizing local feedstock represents a critical turning point for the region, signaling a potential decrease in Nigeria’s historical reliance on oil imports while simultaneously altering the country’s crude export profile. By taking advantage of its capacity, which is larger than any other refinery in both Africa and Europe, Dangote is expected to take 13 to 14 cargoes from Nigeria’s typically monthly supply of around 50, drastically changing the dynamics in the West African crude marketplace.

Industry analysts predict that this sudden increase in domestic processing will place significant pressure on the crude oil market in West Africa. Ronan Hodgson, an analyst at FGE based in London, indicated that the fourth quarter is anticipated to be “substantially tighter,” with potential constraints on supply pushing Nigerian crude exports below 1 million bpd. Although certain shipments have faced delays, including two cargoes carried over from September, the expected volume of crude coming into the Dangote facility represents a notable increase from its earlier operations, which averaged around 255,000 bpd during the initial half of the year. This upward trend reflects a determined effort by the new refinery to bolster local resources while addressing both domestic demands and export constraints.

As of now, the Dangote refinery is reportedly operating at a capacity between 60-70%, with plans to ramp up to full capacity in the near future. Such improvements signify a substantial operational milestone for the facility, which has faced delays over its formative years. Equipped with the technical expertise from project management firm Engineers India Ltd., Dangote aims to escalate its production levels and deliver refined oil products to meet both local and international markets. There are indications that the refinery has also begun to decrease its importing of U.S. crude oil, pivoting instead to a focus on Nigerian crude to ensure its supply chains remain streamlined.

The recent agreement between the Nigerian National Petroleum Corporation and Dangote, allowing for a structured supply of crude in exchange for the distribution rights of the refinery’s gasoline production, is another underlying factor propelling the refinery’s ambitions. This partnership could mark the beginning of a more sustainable model for Nigeria in terms of crude supply and refined oil product distribution, significantly reducing the nation’s history of oil product imports. With the refinery on track to stabilize its output, various market shifts are anticipated as Nigeria works towards fulfilling its longstanding goals of enhancing self-sufficiency in oil production and refining capabilities.

Moreover, experts forecast that increased refining activity at the Dangote plant could substantially diminish the West African market for gasoline and diesel imports. As domestic production rises, the reliance on imported fuels is expected to plummet, rendering a remarkable transformation in the region’s energy landscape. This opportunity for curtailing costly imports supports Nigeria’s broader economic strategy of maximizing local resources and minimizing the expenditure on fuel from external sources, a challenge that the nation has grappled with for years.

In summary, the Dangote oil refinery heralds a new chapter for Nigeria’s crude oil and refined product markets. With a capacity that dwarfs other facilities in Africa and Europe, operational ramp-up, and strategic partnerships, the refinery stands as a testament to Nigeria’s efforts to regain control over its oil narrative. Analysts remain watchful for further developments that could reshape the West African markets, as the increased local processing capacity encourages a shift towards self-reliance and economic stability in the face of global fluctuations. The ramifications of this refinery’s operation are set to resonate not just within Nigeria but across the broader landscape of fossil fuel markets, showcasing the dynamic transformation and evolution in oil dependency patterns.