In 2023, financial conditions in the United States have markedly loosened, reminiscent of the overly accommodating monetary policy era of 2021. This period was characterized by near-zero interest rates and extensive quantitative easing, which occurred despite a significant rise in inflation. Key indicators, such as the Chicago Fed’s National Financial Conditions Index (NFCI) and the St. Louis Fed Financial Stress Index, have shown a dramatic easing, primarily due to the narrowing of yield spreads across various financial instruments. However, this loosening of financial conditions does not imply that corporate borrowing costs are low or favorable; in fact, they are significantly higher than in 2021. The apparent contradiction lies in the fact that while the yield spreads have been compressed, suggesting lower risk premiums, the underlying cost of borrowing for corporations has actually escalated.

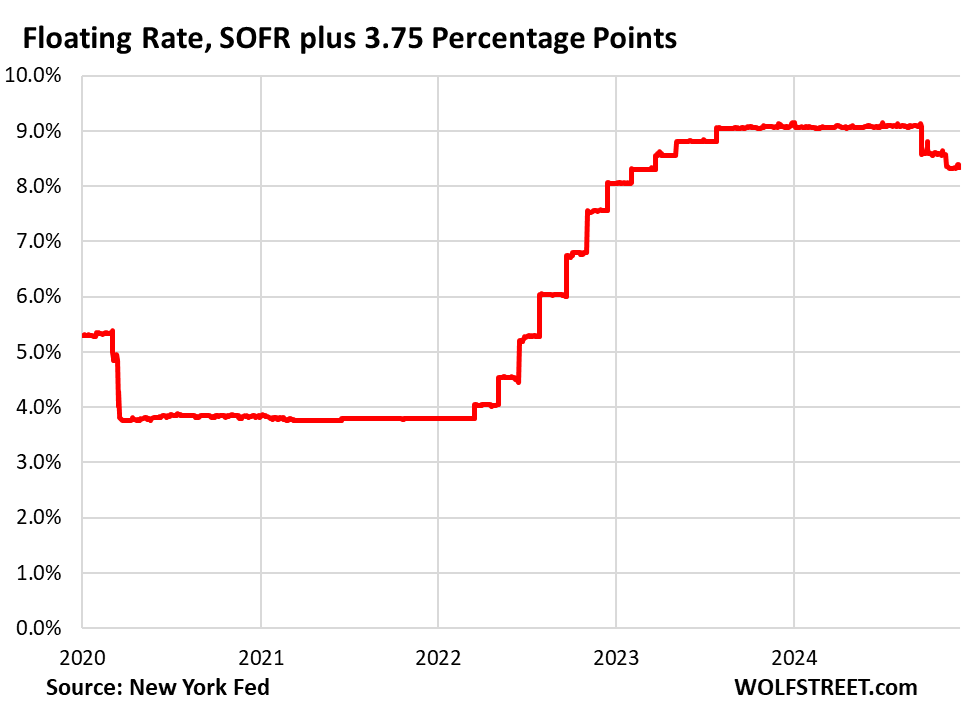

To delve deeper into the current borrowing landscape, particularly in the realm of junk-rated corporate credit, the focus shifts to leveraged loans and junk bonds. Leveraged loans, which have become increasingly popular, are predominantly floating-rate instruments based on the Secured Overnight Financing Rate (SOFR), which has replaced LIBOR as the benchmark. This transition brings about a new structure for pricing these loans, where borrowers face higher interest costs as rates rise. For instance, recent issuance from companies like Cornerstone Generation is reflective of this trend, where loans are pegged at rates like SOFR plus 3.75%, resulting in total borrowing costs approximately 8.35%—a significant increase from the roughly 3.80% seen in 2021. The current climb in floating rates limits the financial advantages that borrowers may experience, especially when juxtaposed with the anticipated interest rate cuts that could alleviate costs going forward.

As financial conditions remain loose, the demand for riskier corporate credits has surged, resulting in record levels of issuance in leveraged loans. Investors seeking yield in a low-interest environment have shifted strategies, leading to the current trend of issuing loans at narrower spreads over SOFR. This creates a scenario where companies that would typically pay higher premiums for risk in a tighter financial landscape can now issue loans with seemingly lower additional costs. However, this exuberance in the market raises questions regarding the sustainability of such lending practices, particularly in light of rising defaults in commercial real estate (CRE), which often features floating rates that have drastically increased amidst the tightening supply and demand dynamics.

In contrast to leveraged loans, junk bonds, typically offered as fixed-rate debt, exhibit a different set of dynamics under current economic conditions. Once these bonds are issued, the interest rates remain static, exposing issuers to varying long-term financial realities. As of the latest reports, the yield for BB-rated corporate bonds averages around 5.71%, marking a stark comparison to the low yield environment of 2021. This increase denotes a nearly doubling of yields since that low period while remaining significantly below the highs observed last October. The recent declines in treasury yields and narrowing yield spreads between junk bonds and treasury bonds reflect an ongoing trend towards investor demand in riskier assets, despite the broader market remaining precarious.

Furthermore, the yield spreads associated with junk bonds have contracted to levels not seen since the late 1990s, evidencing a strong investor appetite for these types of securities. Such behavior points towards a potential credit-market mania, where investors are aggressively pursuing higher returns, even as overall risk continues to escalate. The recorded yield spread of BB-rated junk bonds in relation to treasury debt has tightened to around 1.62 percentage points. This represents a significant departure from historical norms and highlights the eagerness of investors to chase yield in the current financial climate, even in the face of higher overall interest rates.

In summary, while the metrics of financial conditions suggest a loosened environment conducive to borrowing, the reality for corporations reveals a complicated narrative. High borrowing costs, particularly for leveraged loans and junk bonds, stand in stark contrast to the low rate expectations predicated by investor sentiment. The current credit landscape showcases a divergent reality—yield spreads may be compressing, but the underlying risks and costs associated with borrowing have escalated dramatically. This juxtaposition begs introspection into the sustainability of such financial conditions, which may ultimately lead to repercussions as the market navigates potential interest rate cuts and the persisting threat of higher default rates in the face of ongoing economic uncertainty.