In recent updates from the Bureau of Economic Analysis, significant revisions have been made to the data regarding personal income, disposable income, and consumer spending in the post-pandemic economy. Notably, these revisions indicate that consumers have earned and saved considerably more than previously estimated, and have also spent more than initially believed. This improvement in economic indicators has contributed to upward revisions of gross domestic product (GDP) figures, particularly for the years 2022-2024. The updated data signal resilience among consumers, which might explain their continued ability to maintain spending despite economic uncertainties.

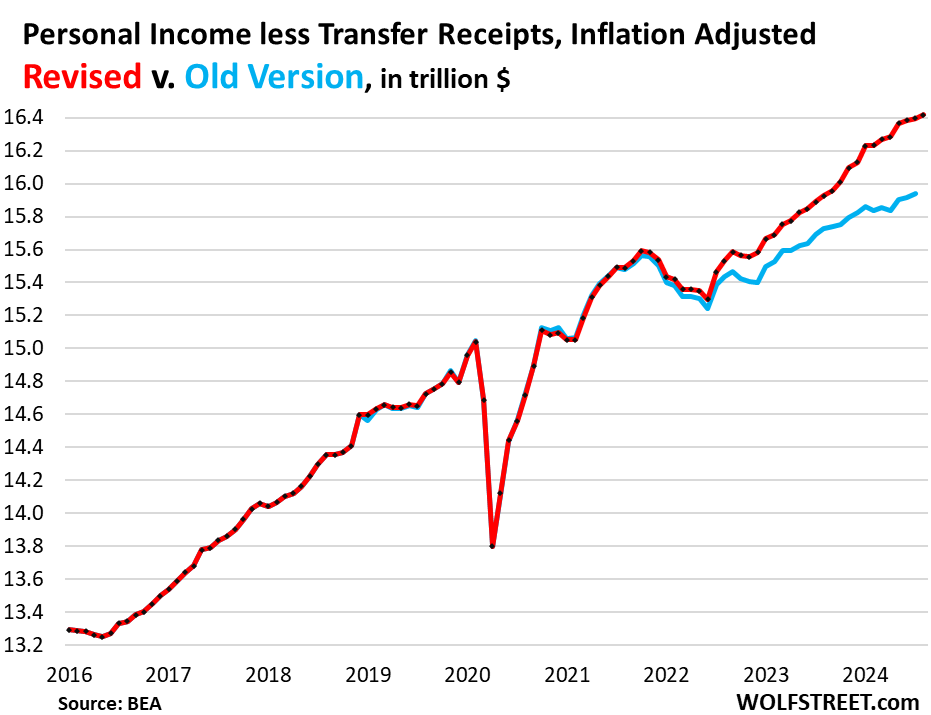

Particularly compelling are the adjustments made to personal income figures, excluding transfer payments. In recent reports, the year-over-year change for August was revised up to an increase of 3.1%, significantly higher than the earlier estimate of 1.6% for July. The two-year period between July 2022 and July 2024 showed a cumulative gain of 6.0% in real personal income, a considerable increase when compared to the previous figure of 3.6%. This suggests that many consumers have experienced a stronger financial footing than was previously recognized, attributed to higher earnings from various sources, including wages, rental properties, and small businesses.

The adjustments in disposable income, which represents income remaining after taxes and mandatory payments, also revealed a positive trend. Revised figures for disposable income show an increase of 3.1% in August, up from an earlier estimate of 1.1% for July. Looking at the broader context, disposable income is now projected to have risen by 8.5% between July 2022 and July 2024, compared to the old estimate of 5.5%. Consequently, a substantial portion of this disposable income seems to have been available for consumer expenditure, leading to additional spending capacity even amidst inflation concerns.

Consumer spending adjusted for inflation has also seen upward revisions, albeit to a lesser degree than income. Revisions indicated spending rose by 2.9% year-over-year for August, compared to an initial estimate of 2.7% for July. Over the two-year period, inflation-adjusted consumer spending showed a revised increase of 5.6%, surpassing the old estimate of 5.3%. While spending growth has been positive, the comparatively smaller increase may highlight that even with higher earnings, consumers are exhibiting caution in their expenditure patterns.

Perhaps most notably, these revisions have led to a reevaluation of the savings rate, which reflects the portion of disposable income that consumers choose to save instead of spend. The revised savings rate suggests that consumers have been saving a larger percentage than previously thought. For instance, the savings rate was adjusted to 4.8% for August, up from a previous estimate of only 2.9% for July, showcasing a pronounced shift in consumer behavior toward saving rather than consuming.

The implications of these adjustments extend into the broader economic landscape, impacting GDP calculations significantly. The revised GDP figures from Q2 2024 indicated an increase of $305 billion, demonstrating that the economy has grown more robustly than previously acknowledged. The revised real GDP growth from the end of 2021 showed an increase of 5.8%, compared to 4.9% in the older estimates. These developments suggest that the economic recovery is more vigorous than anticipated, underscoring the strength of consumer finances and spending behavior in the wake of the pandemic.