Emerging-market (EM) assets are reflecting growing uncertainty regarding the sustainability of the Federal Reserve’s recent decision to lower interest rates, which some investors fear may have been premature. Since the Fed implemented a substantial 50 basis point cut—twice what many had expected—on September 18, concerns have emerged that the effects of this easing cycle may not be sufficient to overcome the prevailing risks. The upward trajectory of Treasury yields, a strengthening dollar, and rising currency market volatility all denote a cautious investment environment. While easing financial conditions typically benefit developing economies, these markets are currently stagnating due to underlying issues of rising inflationary pressures in the U.S. combined with sluggish stimulus efforts in China, placing emerging-market traders in a defensive posture.

As emerging markets grapple with these dual threats, strategists express continued concern over the implications of a potential return of Donald Trump to the U.S. presidency. This political uncertainty, coupled with insufficient Chinese economic stimulus, leads to a fraught environment for investment in EM assets. Notably, economic indicators in the U.S. reflect vigor, but any sustained inflation could hinder the Fed’s capacity to implement further rate cuts, significantly impacting emerging markets. Traders are cautious as they anticipate a tariff-heavy agenda from Trump, which would likely elevate consumer prices in the U.S. and restrain export demand from developing countries. The volatile positioning ahead of the U.S. elections complicates trading strategies, leaving managers uncertain about the appropriate local market trades.

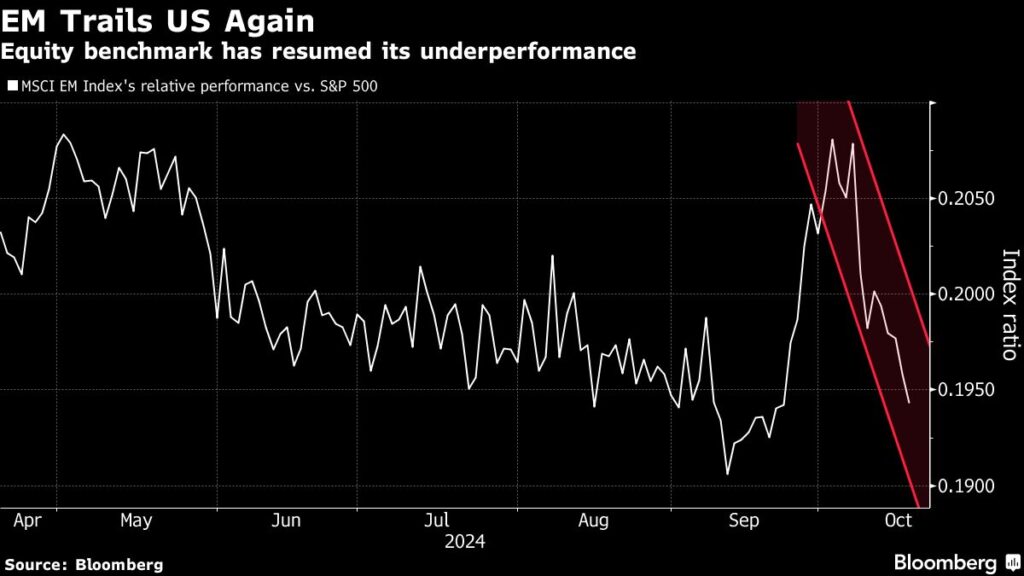

Recent responses from hedge funds illustrate a growing inclination to speculate on the performance of the U.S. dollar over emerging economies exposed to heightened tariff risks. Following the Fed’s interest rate cut, EM equities enjoyed a brief uptick, but they are now again facing declines that could echo previous record lows. Local currencies and bonds within EM markets are poised to experience their worst performance since February 2023. The stagnation in bond markets post-rate reduction reflects a pronounced shift in investor expectations for future rate adjustments, with monetary policy in several emerging nations stalling or hesitating amidst rising economic caution.

The Fed’s monetary policy decisions have not only complicated the outlook for emerging-market bonds but have also disrupted the yield curves in these markets. Many investors have developed a preference for short-duration bonds, a contrast to the typical expectation of lower rates supporting long-duration bonds. Since the Fed’s double cut, long-term yields have waned while shorter-dated bonds have shown negligible gains. As financial markets digest robust U.S. economic data, many analysts have adjusted their forecasts, suggesting that the anticipated continuation of Fed rate cuts may be overly optimistic.

In parallel, China’s economic landscape has contributed to increased volatility for emerging-market equities. Subsequent to the Chinese government instituting several stimulus measures, investors have reacted with skepticism—signifying that initial market rallies were insufficient to instill confidence in a meaningful economic turnaround. As a consequence, the benchmark for EM equities, heavily influenced by Chinese performance, has not kept pace with the S&P 500 Index. Market observers are mindful of China’s critical role as a driver of EM returns and are strategically shifting their focus in light of the ongoing uncertainty leading up to the U.S. presidential election.

Looking ahead, the evolving economic conditions across various emerging markets and their responses to the U.S. economic situation will be pivotal. In Brazil, upcoming inflation reports may influence speculation about monetary policy adjustments, while Russia is poised to raise interest rates in response to domestic economic pressures. Meanwhile, China’s financial institutions are expected to adapt their loan prime rates in line with central bank policies. The prospect of recovery in South Korea’s GDP offers a semblance of hope amid the uncertainty. Ultimately, with the U.S. election looming and central banks positioned to calibrate their responses, there remains an acute need for caution and strategic reassessment by investors in the emerging markets sphere.