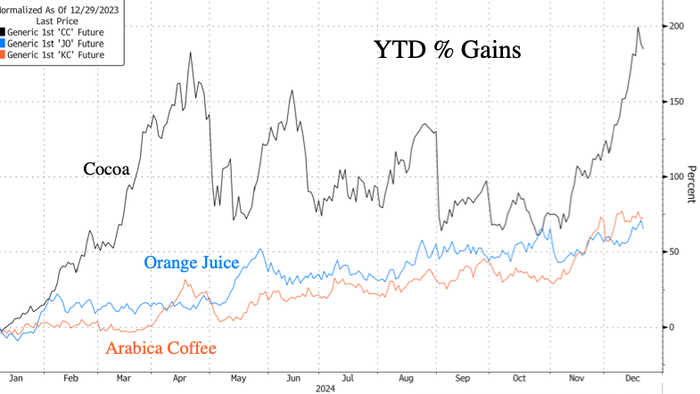

In recent discussions surrounding global food prices, the persistent surge in various commodities has captured significant attention as the new year approaches. Notably, the cocoa market has experienced remarkable growth, surpassing other major commodities in 2024. This increase has largely been attributed to dwindling global supplies, forcing cocoa prices to new peaks. Simultaneously, orange juice and coffee have exhibited substantial price increases, indicating entrenched food price inflation that consumers are continuing to feel acutely.

The cocoa crisis is particularly acute in West Africa, the region that produces the bulk of the world’s cocoa. The combination of crop diseases and adverse weather phenomena has created a severe supply shortage, leading to skyrocketing cocoa bean prices. Recently, Goldman Sachs analysts recommended a long position in cocoa, forecasting an impending rally driven by structural supply deficits, consumers who are under-hedged, and historically low levels of warehouse stocks. This has resulted in cocoa futures in New York nearing $13,000 per ton, with prices escalating nearly 200% in 2023 alone, solidifying cocoa’s status as a standout performer among commodities.

Alongside cocoa, orange juice has seen a price surge, with futures in New York soaring by 73% this year. This escalation is primarily driven by drastically declining citrus production in Florida, a significant contributor to the U.S. orange juice supply. The challenges in citrus production have compounded the rise in prices, signaling ongoing concerns regarding agricultural outputs. Coffee prices extend this trend; Arabic coffee futures have surged 72% due to fears surrounding global supply shortages as climate conditions and other factors continue to threaten adequate production levels.

The overarching trends in food prices have been documented by the Food and Agriculture Organization (FAO) of the United Nations, which tracks a basket of internationally traded food commodities through its Food Price Index. The data reveals a troubling reacceleration in food prices this year. Experts have warned that food price inflation is in a precarious state and forecast that the alarming trends contributing to inflated food prices are likely to intensify into 2025.

Additionally, specific sectors within the food market have drawn attention due to unprecedented price hikes. Recent analysis indicated retail egg prices have skyrocketed to all-time highs, a situation compounded by various factors, including avian influenza outbreaks and rising feed costs. Beef prices also remain at record levels, driven by shifts in demand and supply chain constraints affecting meat production. These rising prices are indicative of a broader inflationary environment that consumers are grappling with daily.

As the year draws to a close, the interplay of weather, disease, and market conditions continues to present significant challenges for food supply chains globally. The persistent increase in cocoa, orange juice, and coffee prices exemplifies the ongoing struggle within the agricultural sector to maintain stability amid intense external pressures. With forecasts predicting further elevation in food prices, it is vital for consumers, producers, and policymakers to be acutely aware of the dynamics at play within these markets as we move into 2024 and beyond.