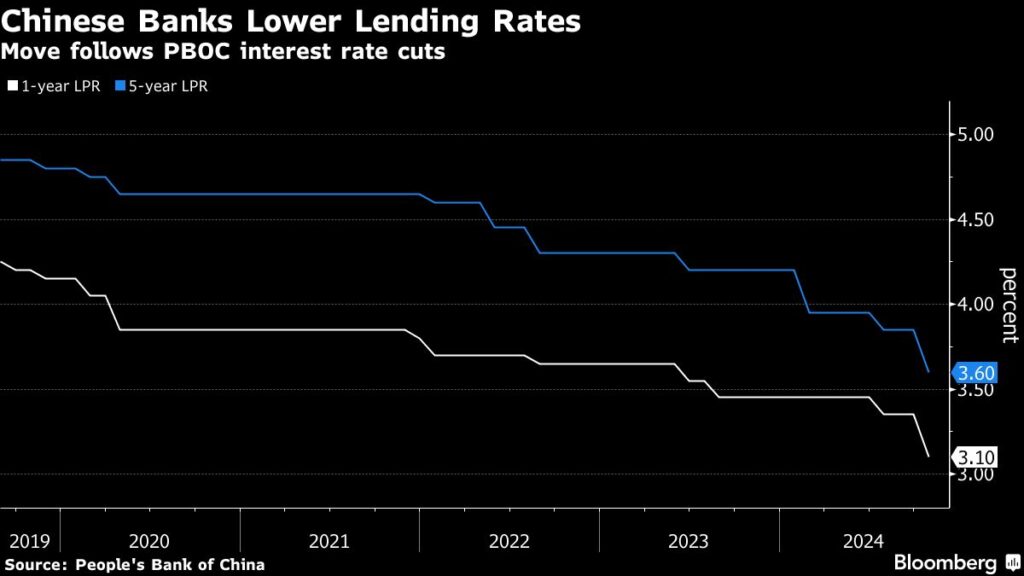

In a significant monetary policy shift aimed at revitalizing China’s struggling economy and addressing a steep decline in the housing market, the People’s Bank of China (PBOC) has implemented substantial cuts to its benchmark lending rates. Following a series of measures announced in September, the one-year loan prime rate (LPR) was reduced from 3.35% to 3.10%, while the five-year LPR saw a decrease from 3.85% to 3.60%. These changes exceeded the expectations laid out by the PBOC Governor Pan Gongsheng, who had hinted at smaller cuts in previous speeches, and surpassed the consensus forecast of economists surveyed by Bloomberg, thus signaling a more aggressive approach to monetary easing.

The recent cuts are part of ongoing efforts by the Chinese government to stimulate borrowing among households and businesses, which is crucial for economic recovery amidst a slowdown. Alongside the interest rate reductions, the PBOC announced measures designed to enhance liquidity in the banking sector, making it easier for institutions to lend. Analysts, such as Beckly Liu from Standard Chartered, noted that these significant adjustments reflect a commitment to swiftly easing monetary policy, aligning with discussions from the Politburo aimed at stabilizing the critical property market, which has faced considerable challenges in recent times.

In a broader context, the Chinese leadership, gathered in a Politburo meeting, explicitly called for aggressive cuts to interest rates and reiterated the need for interventions to prevent further declines in the property sector. The aim of these larger-than-expected LPR cuts is to bolster the housing market and help restore confidence, which has been shaken by tightening credit conditions and a slowed economy. Experts, including Bruce Pang from Jones Lang LaSalle, emphasize that stabilizing the real estate market is integral to the overall economic landscape and can pave the way for recovery in related sectors.

Looking ahead, the PBOC has indicated the possibility of further easing in the near future. Governor Pan suggested that the reserve requirement ratio could be slashed by an additional 25 to 50 basis points by the end of the year, contingent upon prevailing liquidity conditions. Although market analysts predict that further interest rate reductions may be postponed until next year due to the substantial cuts already made, there are concerns that should the economy face significant shocks or turmoil, the PBOC might resort to a more aggressive stance on monetary policy to avert deeper financial distress.

China’s lending landscape relies heavily on the one-year LPR for most new and outstanding loans, while the five-year LPR plays a crucial role in determining mortgage rates and the cost of long-term borrowing. Recently, major state-owned banks have also adjusted their deposit rates downwards in response to reduced loan rates. This strategic move is aimed at mitigating the impacts of tighter profit margins due to the prevailing economic environment.

In conclusion, China’s recent decision to cut its benchmark lending rates is a clear indication of the government’s resolve to tackle economic stagnation and revitalize the housing market. The larger-than-expected adjustments showcase a decisive shift towards a more accommodative monetary policy aimed at stimulating activity across various economic sectors. As the PBOC positions itself for potential further easing, the response from financial markets and consumer behavior will be critical in gauging the effectiveness of these measures in fostering a sustainable recovery in the Chinese economy.