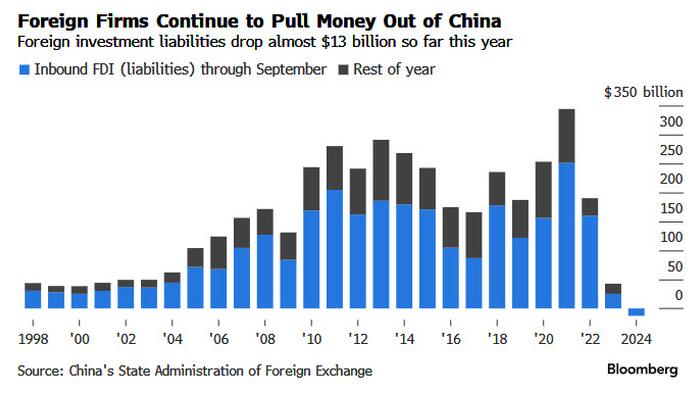

In the third quarter of 2023, China faced a notable decline in foreign direct investment (FDI), marking a historical low— the first time on record that FDI has turned negative. Recent data from the State Administration of Foreign Exchange highlights a drop in direct investment liabilities by $8.1 billion for that quarter alone, contributing to an overall decline of nearly $13 billion for the first nine months of the year. This downturn follows a peak in FDI in 2021 and has been influenced by escalating geopolitical tensions, economic pessimism regarding China’s growth, and intensified competition from domestic firms. Should this trend continue, 2023 may witness the first annual net outflow of foreign direct investments since 1990.

Various international corporations have begun re-evaluating their operations in China amidst this climate of uncertainty. Notable players like Nissan Motor and Volkswagen have scaled back their presence, while IBM has announced the closure of a hardware research team, impacting around 1,000 employees. The potential for an expanded trade conflict, particularly with the United States, is a prominent concern, leading to hesitation among foreign investors to undertake significant investments. Allan Gabor, chair of the American Chamber of Commerce in Shanghai, emphasized that while large investments are being stifled by geopolitical concerns, small and medium-scale investments continue to flourish.

Despite these challenges in attracting foreign investment, the Chinese government has initiated stimulus measures designed to stabilize the economy. A notable impact was observed in the performance of the stock market, with a dramatic surge of 26% in stock values held by foreign investors from August to September. Although the benchmark stock index experienced a considerable increase of 21% after a concerted effort by the government, it has since retracted some gains, highlighting the volatile nature of the investment environment and the uncertainty amongst foreign investors about China’s long-term economic perspective.

In contrast to the decline in inbound foreign investment, there has been a marked increase in China’s outbound investment. Preliminary data from SAFE indicates that Chinese firms expanded their overseas assets by approximately $34 billion in the third quarter, bringing total outflows this year to $143 billion, which ranks as the third-highest on record. This upward trend in outbound investments reflects a strategic pivot by many Chinese companies to secure essential raw materials and enhance production capabilities abroad, particularly in reaction to tariffs imposed on Chinese goods by various countries.

The growing trend of Chinese companies, notably BYD Co., expanding their operations overseas is indicative of the shifting dynamics in global trade influenced by tariffs and geopolitical tensions. As protectionist measures gain momentum, Chinese firms are increasingly compelled to look outside their borders for opportunities. This strategic adjustment not only aims to mitigate the risks associated with potential tariffs but also positions these companies to tap into international markets more effectively. Such efforts reflect a broader transformation within China’s business ecosystem, which is adapting to the challenges of rising nationalism and competition in global trade.

In summary, the landscape for foreign direct investment in China is undergoing significant changes due to a combination of factors, including geopolitical tensions, economic uncertainties, and the strategic moves of both foreign and domestic companies. Despite official efforts to stimulate investments and stabilize the economy, many foreign businesses express concern over long-term viability, while Chinese firms actively seek to expand their global footprint. As the year progresses, the trends of both declining FDI in China and rising outbound investments suggest a fundamental realignment of international economic relationships, one that is likely to shape the future of China’s participation in the global economy significantly.