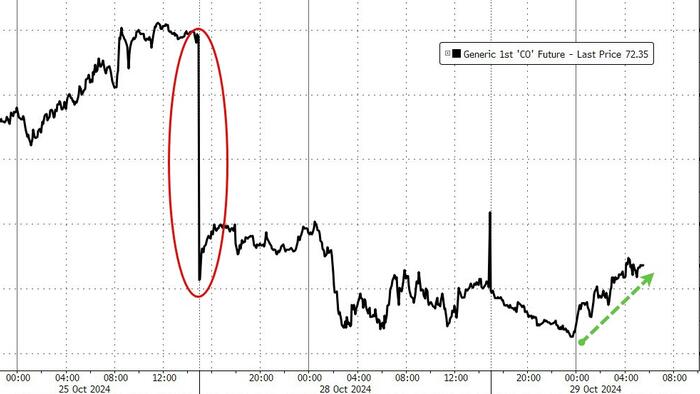

After experiencing its most significant decline in two years due to yet another inconclusive conflict between Israel and Iran, oil prices have rebounded, rising by 1.4%. This increase follows a report from Reuters indicating that China is contemplating an issuance of over 10 trillion yuan (approximately $1.4 trillion) in additional debt over the coming years to revitalize its struggling economy. This fiscal initiative is expected to gain traction, particularly if Donald Trump secures victory in the upcoming U.S. presidential election. According to sources privy to the situation, the National People’s Congress (NPC) in China is set to deliberate on this fiscal package, which includes the issuance of special sovereign bonds. The anticipated 6 trillion yuan in new debt, to be raised over the next three years, aims to assist local governments in managing off-the-books debt risks.

The proposed total debt issuance accounts for more than 8% of China’s GDP, which has been adversely affected by a prolonged crisis in the property sector and surging local government debts. In reaction to the news, oil prices, alongside industrial metals, registered an increase, with West Texas Intermediate (WTI) oil climbing to around $68 per barrel and copper rising by 0.9%. Financial analysts had speculated about a potential 10 trillion yuan stimulus package for weeks, and the Reuters report has confirmed these anticipations. While the spending anticipates a shift in approach by Beijing to enhance economic support, it lacks the robust fiscal measures witnessed during the 2008 financial crisis, which some investors had hoped for amidst China’s current economic challenges.

Despite the proposed fiscal package, there is apprehension regarding its finalization, as sources indicate that plans remain fluid and subject to modification. There is an underlying expectation for a range of measures aimed at addressing local governments’ liquidity and debt challenges, bolstered by up to 4 trillion yuan in special-purpose bonds targeting idle land and property acquisitions over the coming five years. Additionally, local governments would be allowed to issue this amount beyond their existing quota primarily used for financing infrastructure projects. The intended move would empower local authorities to better navigate land supply management and relieve financial stress on both property developers and local governments.

The urgency in Beijing’s approach to bolster the economy is underscored by the anticipated issuance of approximately 2 trillion yuan in new central government debt annually, reflecting ongoing financial challenges. Earlier this year, China launched 1 trillion yuan in sovereign bonds to upgrade flood prevention infrastructure and maintain its economic growth target of approximately 5%. The NPC generally convenes bi-monthly, with their meetings tailored to address critical fiscal strategies. The timing of the impending session coincides with the U.S. presidential election week, providing significant flexibility for Beijing to adapt its fiscal package, especially in response to potential economic pressures if Trump wins reelection.

Given the context of underlying economic strains, China’s initial plan to issue 1 trillion yuan in special sovereign debt is viewed as merely a preliminary step, one likely to be expanded due to growth discrepancies and concerns about a longer-term structural slowdown. While the slated fiscal stimulus appears substantial, it is considerably less than the sweeping measures enacted in 2008, which accounted for around 13% of GDP at the time. This previous stimulus fueled a housing market boom and led to rampant lending practices through local government financing entities, highlighting concerns over potential consequences of inadequate financial strategies amidst evolving economic conditions.

In addition to the broader fiscal strategy under consideration, China may also deliberate on further initiatives, potentially exceeding 1 trillion yuan, aimed at boosting consumption and restructuring consumer goods. However, despite the ambitious projections surrounding the planned 10 trillion yuan stimulus, there are doubts about its potential efficacy in rejuvenating the economy. Analysts underscore that China’s peak credit impulse—vital for global economic reflation—has diminished, necessitating a far more substantial fiscal injection to elicit comparable stimulus effects relative to GDP. Without a significant scaling up of financial intervention, concerns persist over continued declines in property values and broader economic stagnation. This situation portends a future possibility where, faced with relentless economic pressure, Beijing will be compelled to launch a more aggressive monetary stance capable of instigating a comprehensive reflationary response globally.