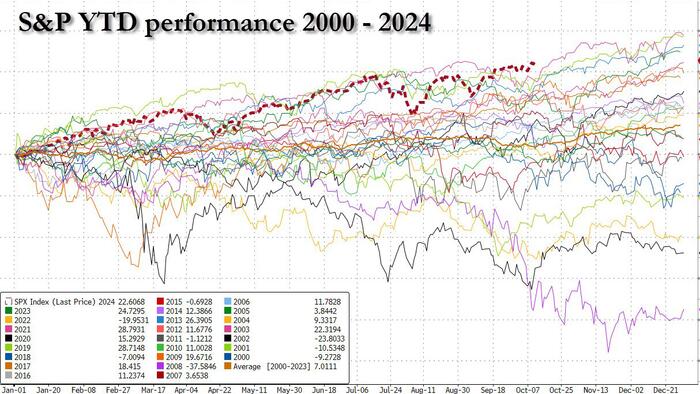

The second half of the year has witnessed a precarious yet notable rise in stock prices, largely characterized by record stock buybacks. Throughout this period, despite a prevailing sense of apprehension among investors, the S&P 500 index experienced a remarkable ascent, closing at its 45th all-time high for the year. This achievement has made the performance of the S&P in 2024 the best of the 21st century thus far. This climb approached the market with cautious optimism, as investors grappled with uncertainties surrounding economic conditions and global events, which contributed to a sustained atmosphere of worry amidst the record highs.

However, a significant shift occurred last week, marking a departure from the preceding trend. According to Goldman Sachs’ Prime Brokerage’s Weekly Rundown report, hedge funds (HFs) engaged in a substantial net purchase of US equities after a period of eight consecutive weeks of selling. This drastic change in sentiment demonstrated a renewed confidence among traders, who began to actively seek opportunities in the market once more. The recent buying spree was driven significantly by single stocks, which recorded their largest net purchasing activity since December 2021. This surge illustrated a strategic pivot, as market participants moved toward individual company investments, signaling a potential recovery in investor sentiment.

The driving forces behind this sudden and robust buying activity included both long positions and short-covering actions by traders. The ratio of long buys to short covers stood at a noteworthy 1.2 to 1, revealing a greater inclination among investors toward accumulating long positions in anticipation of further market gains. This dynamic played a critical role in reshaping the investment landscape, as market participants began to express a more favorable outlook on equities. The combination of heightened buying interest and limited selling pressure could suggest that we may be witnessing the early stages of a bullish turnaround in the stock market.

This newfound enthusiasm among hedge funds and investors may also reflect broader market dynamics at play. External factors, such as economic indicators, corporate earnings reports, and geopolitical developments, undoubtedly influence investor behavior and sentiment. The improved buying trends come in the wake of updated insights from analysts and economists, who may be signaling potential growth trajectories that fuel investor confidence. The stock market’s ability to stage a resurgence hinges on a delicate balance of these factors, contributing to the cautious optimism observed in recent trading sessions.

While the prior weeks were dominated by selling, the ability of hedge funds to pivot decisively indicates resilience within the market. Such rapid shifts in investment strategies underscore the volatility inherent in equity markets. Analysts remain vigilant in monitoring these developments, as investor reactions could set the tone for future performance. Moreover, the significance of this turnaround may not merely be temporary; it may hint at a longer-term transformation in market dynamics as traders adjust their strategies in alignment with emerging trends and macroeconomic signals.

In conclusion, the juxtaposition of record highs amidst a backdrop of investor apprehension encapsulates the complexities of the current stock market environment. As hedge funds engage in aggressive buying following an extended selling period, there is potential for renewed bullish momentum. Understanding this market shift and its underlying motivations will be essential for investors looking to navigate the intricacies of the evolving economic landscape. The interplay between investor sentiment, strategic positioning, and external factors will ultimately determine whether this latest wave of buying represents a sustainable trend or a fleeting reaction to market developments.