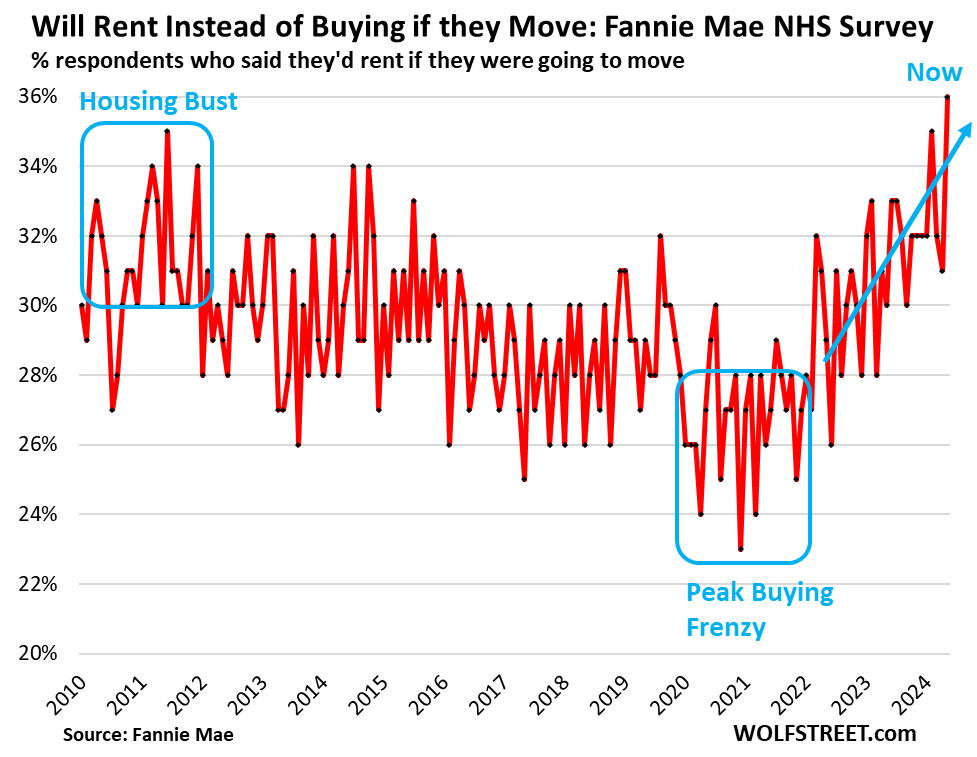

The current housing market is characterized by sky-high home prices, rising mortgage rates, and increasing property taxes and homeowners’ insurance, contributing to a significant shift in consumer sentiment. According to Fannie Mae’s National Housing Survey, the percentage of individuals indicating they would prefer to rent rather than buy a home has surged to 36%. This figure marks an all-time high since 2010, surpassing previous peaks during the housing downturn around 2010 and 2011. The preference for renting over buying represents a clear response to the unaffordability prevalent in the current real estate climate, where soaring home prices have made purchasing property less attractive financially.

The drastic increase in home prices, which have soared by approximately 50% since the onset of 2020, can be attributed to aggressive monetary policies that encouraged buying during the pandemic. This inflationary pressure has led to a situation where the monthly costs of purchasing a home now far exceed the costs of renting an equivalent property across much of the United States. Consumers are beginning to recognize this disparity. As they evaluate their housing expenses, many are opting for the rental market as a more fiscally responsible choice, especially in light of the expectation that rent growth will remain modest in the coming years. This strategy allows potential buyers to save for future home purchases while benefiting from lower immediate living costs.

The relationship between rent increases and home price escalation illustrates a deeper issue. When examining the Consumer Price Index for Rent and Zillow’s Home Value Index—while excluding variables such as mortgage rates, property taxes, and insurance premiums—the data reveal that rents have indeed risen but at a significantly lower rate than home prices. This discrepancy underscores how the rapid inflation of home values has outpaced the rental market, effectively burying the idea of home ownership under excessive costs, even for those who possess the financial means to buy.

Many individuals are performing a basic economic analysis when considering home purchases. They recognize that buying property at today’s inflated prices would primarily enrich sellers, real estate agents, and financial institutions involved in mortgage-backed securities, while simultaneously straining their finances due to high ongoing costs. This awareness has resulted in a marked decline in demand for existing homes, reaching levels not seen since 1995. As demand wanes, inventory levels for both new and existing homes have surged, reflecting a reversal of fortunes for sellers in this market.

The ongoing shift toward renting over buying is likely to persist, especially as potential buyers face significant economic barriers. With soaring home prices contributing to a drop in demand, many consumers are realizing that renting offers greater flexibility and lower financial risk. Instead of draining their resources into a mortgage, renters can allocate their funds towards savings or investment opportunities, alleviating concerns of being “house-poor.” As these trends continue, home sales are anticipated to fall further, fundamentally altering the landscape of the housing market in response to economic realities.

Lastly, broader monetary policy changes are also affecting the housing market. The Federal Reserve’s ongoing quantitative tightening and increased mortgage rates play a significant role in curtailing the appeal of home purchases. Renters benefit from this environment by maintaining their financial stability, as they are insulated from market fluctuations that could impact property values. The dual pressures of high-interest rates and the lingering consequences of previous high home prices suggest that the current trend toward increased rental preference will not only endure but may strengthen as more consumers opt for the security and flexibility afforded by renting.