In November, home sales in Canada saw a notable increase of 2.8% on a seasonally adjusted basis compared to October, marking the fourth consecutive month of growth and reflecting a trend towards pre-pandemic sales levels. Year-over-year, home sales surged by 26% compared to the stark declines experienced in November of the previous year. However, it is important to note that sales remained over 20% lower than in the same months of 2020 and 2021, indicating that while the market is recovering, it has not yet reached its previous heights. The Canadian Real Estate Association (CREA) reported that new listings declined slightly by 0.5% from the previous month, yet inventory levels were still 160,000 listings, indicating an increase of 8.9% compared to the previous year. This resulted in a slight decrease in supply, landing at 3.7 months in November, down from 3.8 in October.

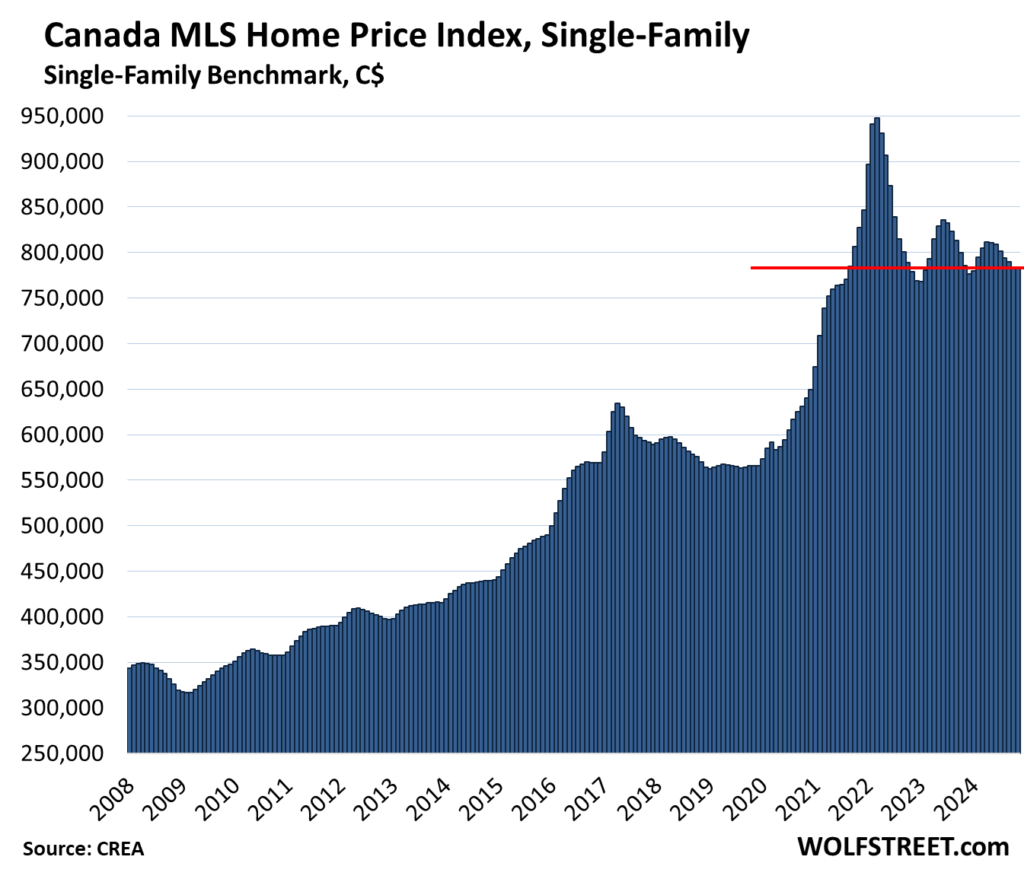

Home prices present a mixed landscape as single-family properties demonstrated little change month-to-month, with a slight decline of 0.3% year-over-year marking the eighth consecutive month of year-over-year price drops. Since the price peak observed in March 2022, home prices have plunged by 17.4%, largely reverting to levels last seen in August 2021. Conversely, condo prices fell by 0.7% from October and witnessed a notable 3.9% decrease year-over-year, reaching a three-year low. This ongoing decline in prices reflects a broader trend in the housing market post-pandemic, as economic conditions continue to evolve.

Examining specific metro areas reveals diverse trends in home prices. In the Greater Toronto Area (GTA), single-family home benchmark prices slightly increased by 0.1% month-to-month, though they remain 19.1% lower than their peak in February 2022. Condominiums in the GTA, however, saw a negligible decrease of 0.1%, marking the lowest level since October 2021. In Hamilton-Burlington, single-family benchmark prices fell 0.2% from the previous month, while condo prices experienced a more considerable decrease, highlighting market adaptations in response to economic pressures. Similarly, in Greater Vancouver, single-family homes and condos experienced slight declines, reflecting a broader trend of cooling prices across major urban centers.

Victoria’s housing market exhibited stability in single-family pricing, with an unchanged month-to-month benchmark price, while condo prices declined slightly. In contrast, Ottawa’s housing market displayed a minor reduction in single-family and condo prices month-over-month, although year-over-year gains were noted. Calgary also showed a multifaceted price response, with single-family home prices experiencing a marginal decline while maintaining a notable year-over-year increase. This inconsistency in pricing across Canadian cities paints a comprehensive picture of a market in flux, adapting to shifting economic conditions.

The housing market in Montreal faced slight month-to-month declines in single-family homes while experiencing modest year-over-year growth. In Halifax-Dartmouth, both single-family homes and condominiums faced price drops, signifying ongoing adjustments in response to market dynamics. Edmonton showcased a robust annual increase for both single-family homes and condos despite slight month-to-month declines, indicating resilience in the face of broader market fluctuations. Meanwhile, Quebec City demonstrated positive growth, especially in single-family benchmarks, pointing to localized market strengths amidst national trends.

As the Canadian housing market continues to grapple with the effects of economic pressures and changing consumer sentiment, it remains essential to monitor these pricing trends and sales figures closely. The ongoing declines in home prices and shifting sales volumes highlight a market adapting post-pandemic while struggling to regain momentum. Comparisons with the U.S. housing market also reveal similar patterns of decline in major metros, suggesting that challenges in real estate may be a broader phenomenon. Overall, the data reinforces the notion of a transitional housing market in Canada, with individual regions exhibiting varied performance based on localized economic factors.