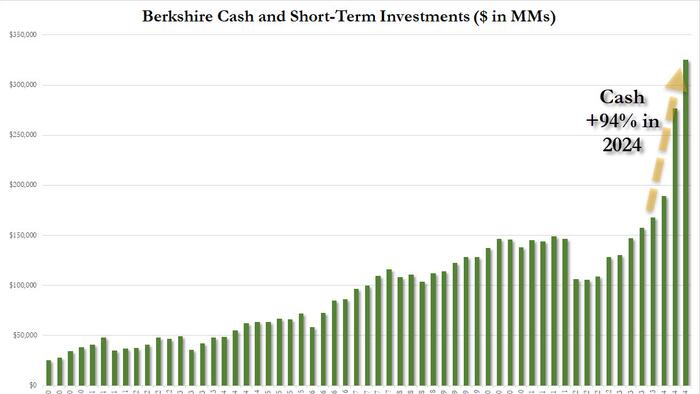

In recent months, Warren Buffett’s Berkshire Hathaway has drawn considerable attention for its strategic decisions, particularly regarding its cash holdings and stock liquidations. Back in August, it was noted that Buffett’s ongoing liquidation of his Bank of America stake suggested that Berkshire was struggling to find attractive investment opportunities in what many analysts regard as an overvalued economy. Shortly after, it was revealed that Buffett was not only reducing his Bank of America holdings but was also engaging in a significant selling spree that led to an unprecedented increase in Berkshire’s cash reserves. By the end of the second quarter, Berkshire’s cash stockpile soared to an all-time high of $277 billion, reflecting a record $88 billion increase—an alarming signal of the company’s cautious sentiment toward the current market landscape.

As the third quarter closed, it became evident that Buffett’s strategy was continuing unabated. Berkshire Hathaway accrued an additional $48 billion in cash, bringing its total to a staggering $325.2 billion, a near doubling of its cash holdings since the beginning of the year. This sharp increase can primarily be attributed to the selling of stocks; in just the third quarter, Berkshire sold a net $34.6 billion in stocks on top of the record $75.5 billion liquidated in Q2, marking eight consecutive quarters of being a net seller. Notably, a significant portion of the sales stemmed from Buffett’s decision to divest half of his Apple shares, which reflected his shifting view on one of his most prominent investments.

The value of Buffett’s Apple holdings has diminished significantly, with only $69.9 billion remaining by the end of September, down from $84.2 billion in June and $135.4 billion by the end of March. This dramatic reduction translates into possessing approximately 300 million shares of Apple—a stark decline from the billion shares held in 2018. Buffett’s motivation for these sales appears multifaceted, encompassing both tax-related considerations and a broader apprehension about the market’s overvaluation. He hinted at this sentiment during Berkshire’s annual shareholder meeting, emphasizing a willingness to build cash reserves rather than invest hastily during uncertain conditions.

Further examination of Berkshire’s portfolio reveals a more intricate picture. Aside from the notable reductions in its Apple and Bank of America holdings, Buffett’s positions in other major companies, including American Express and Coca-Cola, remained largely untouched in the third quarter. Despite the sizable cash inflow from safety-net sales, Berkshire generated operating earnings of $10.09 billion, a decrease from previous quarters, largely due to struggles in the insurance sector. This operational decline, coupled with losses in foreign currency exchanges, has left the company grappling with the challenge of effectively deploying its capital amid a sluggish deal-making environment, as Buffett has long lamented the scarcity of attractive investment opportunities.

In light of the prevailing economic conditions, Buffett’s cautious approach has become apparent. He has publicly reiterated his reluctance to engage in investments that do not align with the company’s rigid risk-to-reward calculus. Reflecting this cautious stance, Berkshire refrained from repurchasing its own shares for the first time since revising its buyback policy in 2018, signaling a broader belief that the market is currently overvalued. The so-called Buffett Indicator, which assesses the relationship between market capitalization and national GDP, has never indicated a more expensive market, reinforcing Buffett’s stance against investing in shares at inflated prices during a volatile economic period.

While Buffett’s previous approach was characterized by a strong advocacy for American investments, his current selling spree indicates a stark departure from that strategy. The shift encapsulates a growing fear of market instability and mispricing. Buffett’s actions, reflective of his longstanding investment philosophy, hint at an underlying belief that the current market conditions do not present the risk-adjusted opportunities he seeks. Thus, the ongoing liquidation of Berkshire’s significant holdings serves not only as a tactical maneuver but also as a warning to potential investors about the state of the economic landscape. Rather than seizing opportunities, Buffett appears to be hedging against the prevailing market risks, urging caution among investors navigating this unpredictable terrain.