Bristol Myers Squibb has recently been recognized as a Top Socially Responsible Dividend Stock by Dividend Channel, reflecting the company’s strong performance in both dividend yield and socially responsible investing criteria. With a notable dividend yield of 4.0%, Bristol Myers Squibb (BMY) has become an attractive option for investors seeking reliable income streams. The distinction of being a socially responsible investment is critical, as it shows that prominent asset managers consider BMY’s operations in light of various environmental, social, and governance (ESG) factors. Notably, these criteria evaluate the impact that the company’s products and services have on the environment and their overall sustainability, as well as the adherence to social values such as human rights and corporate diversity.

The environmental criteria focus on how effectively the company utilizes energy and resources while minimizing its ecological footprint. This includes analyzing factors like waste production and sustainable practices. On the social front, Bristol Myers Squibb’s policies around human rights, the prohibition of child labor, and initiatives to foster corporate diversity are vital considerations. Additionally, scrutiny of the company’s business associations reveals a commitment to avoiding sectors typically viewed as socially irresponsible, such as weapons manufacturing, gambling, alcohol, and tobacco. These values align the company with a growing demographic of responsible investors who prioritize their financial decisions around ethical standards.

According to data from ETF Finder at ETF Channel, Bristol Myers Squibb Co. is included in the iShares USA ESG Select ETF (SUSA), which signifies broader recognition within sustainable investment frameworks. Within this fund, BMY accounts for 0.36% of holdings, representing an investment totaling approximately $17.97 million. This inclusion further bolsters the company’s profile as a viable and responsible dividend stock that attracts socially conscious investors. The ETF’s focus on ESG factors helps to legitimize BMY’s commitment to responsible practices, positioning it favorably against competitors in the pharmaceuticals sector.

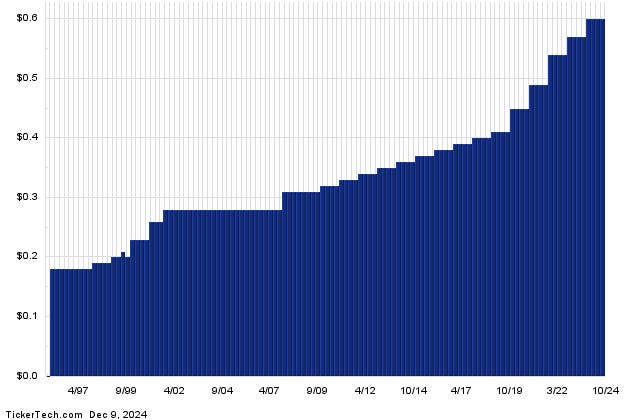

Examining the financial returns, Bristol Myers Squibb offers an annualized dividend of $2.4 per share, disbursed in quarterly payments. The latest ex-dividend date was reported as October 4, 2024, indicating a consistent commitment to returning value to shareholders. This regularity in dividend payments is a crucial benchmark for investors analyzing the company’s financial health and future stability in this turbulent economic climate. Historical analysis of dividend distributions is a crucial part of evaluating whether recent dividend levels are sustainable, as past performance can often inform future expectations.

Furthermore, the company operates within the competitive Drugs & Pharmaceuticals sector, engaging with industry giants such as Eli Lilly and Novo Nordisk. BMY is noted for its innovation and research in biopharmaceuticals, drawing on extensive investments in research and development to create life-saving medications. Given the blending of social responsibility with robust financial offerings, BMY is viewed as a strong candidate for both income-focused and socially conscious investment portfolios.

In summary, Bristol Myers Squibb’s recognition as a Top Socially Responsible Dividend Stock not only highlights its robust dividend yield and financial health but also underscores its commitment to environmental and social governance. The company’s proactive stance on ethical considerations, backed by significant institutional investment through the iShares USA ESG Select ETF, positions it favorably among its peers. As the demand for socially responsible investing continues to grow, BMY’s contributions to sustainability and social impact further solidify its standing as an attractive investment, appealing to both ethical investors and those seeking reliable income over the long term.