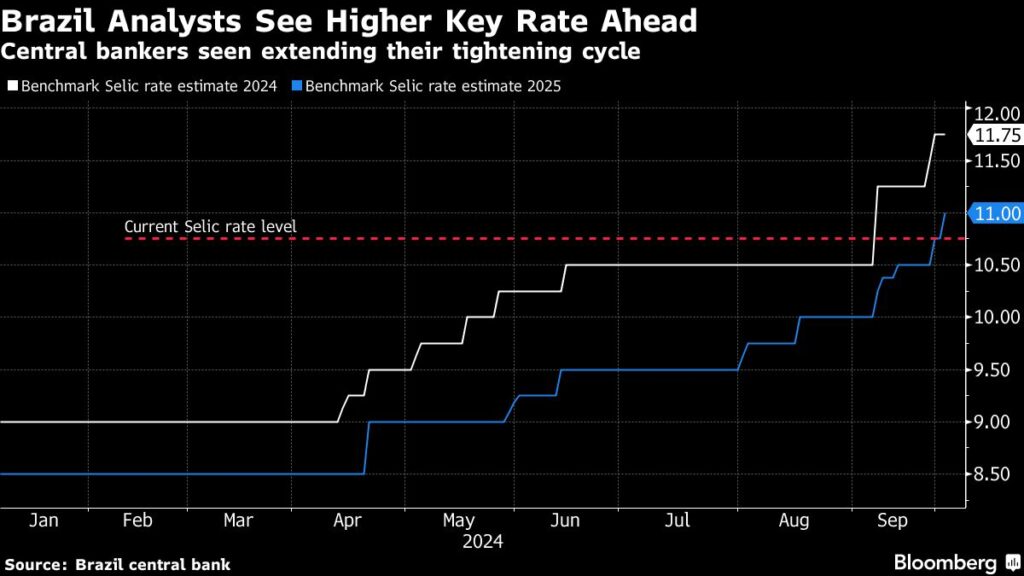

Brazil’s economic landscape is undergoing significant scrutiny as analysts adjust their forecasts for interest rates against a backdrop of governmental fiscal policies and prevailing economic indicators. As reported by Bloomberg, expectations for the benchmark Selic rate have increased for the end of 2025 from 10.75% to 11%, a reflection of heightened concerns regarding loose fiscal policies ahead. Despite current estimates for borrowing costs remaining stable at 11.75% for December, the adjustments signify a complex economic climate, characterized by resilience in economic performance and underlying inflationary pressures. This pivot in forecast underscores the delicate balance policymakers must maintain as they navigate the challenging waters of economic growth and fiscal responsibility.

The Brazilian economy’s resilience has defied initial expectations, which influenced the central bank’s decision to initiate a cycle of tightening in September by raising borrowing costs to 10.75%. This resilience can be attributed to a robust labor market, a weakening real, and increased disposable income for families, buoyed by government transfers. Central bank officials, including Gabriel Galipolo, who is slated to assume the role of governor, have acknowledged these dynamics, suggesting that the disinflation process could prove more arduous and drawn out due to these ongoing economic indicators. Galipolo emphasized that the growth in service prices exceeds the central bank’s target of 3%, asserting the need for a vigilant and data-driven approach to policymaking.

In conjunction with these developments, Brazil’s economic activity exhibited a noticeable uptick, recording a 0.2% rise in August—surpassing the 0.1% estimate provided by analysts. Year-over-year data indicated substantial growth, with the economic gauge rising 3.1%, indicative of strong underlying economic health. However, the optimism is tempered by inflation concerns, with estimates for consumer price inflation standing at 4.39% for this December and slightly lower at 3.96% for the end of the subsequent year. Such figures, notably above the Bank’s target, signal persistent inflation threats reminiscent of the cost-of-living increase driven largely by food and energy prices amid environmental challenges like drought.

September marked a period of inflationary pressure, with consumer prices rising by 4.42% from the previous year. These rising costs lead market participants to speculate about potential rate hikes in the coming months. The uncertainty regarding the scale of these rate adjustments has left investors assuming that the Selic rate could potentially exceed 13% by 2025. Such market sentiment reflects broader concerns about the government’s fiscal commitments amid an overheated economy and challenges associated with maintaining budgetary discipline.

Further complicating matters for policymakers is President Luiz Inacio Lula da Silva’s recent declarations regarding fiscal policy. His intentions to expand income tax exemptions, targeting individuals earning up to 5,000 reais (approximately $893), have raised alarms among investors. The vagueness surrounding compensation for potential revenue losses has been particularly concerning for market analysts, leading to increased skepticism about the government’s fiscal integrity. The juxtaposition of Lula’s plans with the call for increased fiscal restraint poses a significant challenge for Brazil’s financial stability.

Central bankers, including Galipolo, have reiterated the necessity for balancing the budget within this volatile economic environment. Supporting Finance Minister Fernando Haddad’s aim for budgetary equilibrium, Galipolo emphasized the importance of clarity and transparency in fiscal policies. As the central bank prepares to react to ongoing market dynamics, the emphasis on fiscal contraction remains crucial. However, the lack of tangible positive developments in the budgetary landscape may provoke further skepticism among investors, heightening the urgency for Brazil’s economic team to solidify a coherent fiscal strategy that aligns with the overarching goal of sustainable growth and inflation control.