After a week marked by intensive engagement with clients, Tony Pasquariello, the head of hedge fund coverage at Goldman Sachs, has distilled his observations into two primary instincts regarding the current financial landscape. Firstly, there is a growing sense that macro trading opportunities are beginning to expand. This signals a potentially fruitful period for traders as they seek to capitalize on new market conditions. For instance, recent fluctuations in the US Treasury market have prompted significant reflection, underscoring the evolving dynamics within the macro trading space. This shifting backdrop suggests that traders should be vigilant and prepared to act as opportunities arise, marking a clear pivot towards more robust macro trading prospects.

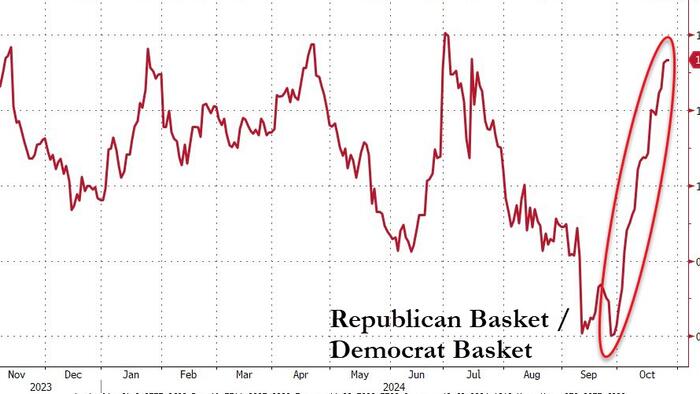

On a more localized level, however, Pasquariello warns that the risk/reward profile for equity investments may remain uncertain until the outcomes of upcoming elections become evident. In this context, the current investment landscape is characterized by caution and a lack of clarity. As election results loom, traders may find themselves in a precarious position regarding equity positions, leading them to adopt a more conservative stance. Nevertheless, Pasquariello emphasizes that following the resolution of electoral uncertainties, the technical indicators heading into year-end could become significantly more favorable, setting the stage for improved trading conditions.

Pasquariello notes that the trading community currently holds some positional length, which may lead to reductions in exposure as traders navigate the impending binary event of election results. This adjustment strategy is likely to set a precedent for anticipated market behavior post-election. As traders look to position themselves favorably amid this uncertainty, substantial buyback activity could follow any reassurance provided by a clear electoral outcome. This potential rebound indicates the importance of waiting for definitive signals before making large-scale investment moves, demonstrating a nuanced understanding of market psychology in the face of political events.

In an effort to articulate his insights more clearly, Pasquariello has effectively simplified his conclusions into concise bullet points and a select few charts. This method serves to distill complex market dynamics into digestible information that can be easily understood by his audience. By breaking down the prevailing sentiments and trends in the market, he makes it easier for traders and investors to grasp the underlying currents influencing macro trading opportunities as well as equity market strategies.

The key takeaway from Pasquariello’s reflections is the expectation of an evolving environment within both macro and equity markets. With macro trading opportunities on an upswing, traders are encouraged to stay engaged and alert for potential opportunities to leverage. Conversely, the imminent election introduces a layer of complexity into equity investments, necessitating a cautious approach until clarity is achieved. Understanding these dynamics is crucial for stakeholders seeking to optimize their trading strategies during this transitional period.

In conclusion, Pasquariello’s insights portray a dual narrative: one of opportunity in the macro trading space, and another of uncertainty in equities until a pivotal political event unfolds. As market conditions continue to shift, embracing a adaptable and informed trading strategy will be essential for navigating the forthcoming challenges and capitalizing on potential gains. As we move forward, keeping an eye on macro signals, coupled with disciplined positioning around equity exposures, will likely define the success of traders and investors in the coming months.