In a recent meeting, Federal Reserve Chair Jerome Powell announced a cut in interest rates, a decision anticipated by bond traders. However, Powell did not offer clear guidance regarding future monetary policy, leading to a lukewarm reaction in the bond market. Following this announcement, Treasury yields saw a modest decline, with the 10-year yield dropping to 4.31%, marking an eight basis points reduction over the week, the largest decrease since September. This environment, characterized by lingering uncertainty, stems from the potential impact of President Donald Trump’s impending policies, which may include higher tariffs, tax cuts, and deregulation—measures likely to heighten inflationary pressures in a robust economic landscape.

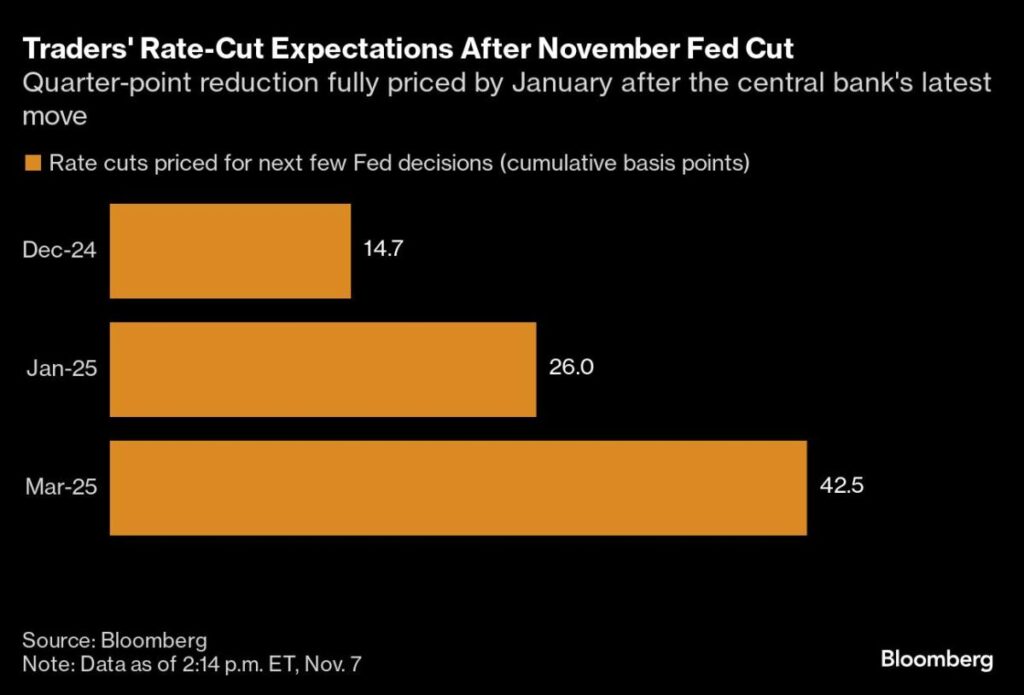

Despite the lowering of interest rates, sentiments in the bond market remained cautious. The potential for the federal deficit to widen due to Trump’s policies was highlighted by Powell, who called the current fiscal trajectory “unsustainable.” The markets are closely monitoring significant changes stemming from the upcoming elections as they could influence future Treasury supply and economic conditions. Although traders had hoped for more clarity regarding future rate cuts, Powell’s communications left much to interpretation, suggesting that the next Federal Open Market Committee (FOMC) meeting in December might see a reduced likelihood of aggressive rate changes, depending on emerging economic data.

Federal Reserve officials modified their economic outlook statement, omitting previous language that emphasized a need for “greater confidence” in the return of inflation toward the 2% target rate. This omission has led some market analysts, like Omair Sharif from Inflation Insights, to speculate on the possibility of a pause in rate changes come December. However, despite Powell’s comments and the slight shifts in yields, the prevailing expectation in the market remains that the Fed may still pursue further rate cuts in alignment with economic trends and data leading up to the end of the year.

Key economic indicators have played a pivotal role in shaping bond traders’ expectations and the overall market sentiment. Despite the Fed’s recent rate cuts, the 10-year Treasury yield has been on the rise, increasing from 3.6% in mid-September. The volatility in yields has been tied to better-than-expected economic data, and anticipatory movements in response to the political landscape and Trump’s potential policies. Powell mentioned the importance of monitoring these emerging trends but refrained from making definitive statements on future monetary policy, emphasizing the ever-changing nature of the economic environment.

The Federal Reserve’s actions and the reactions in the bond market represent a complex interplay of economic signals, governmental policy, and trader sentiment. With two-year yields reflecting expectations closely tied to central bank policies, they closed lower at 4.20%. This shift is indicative of the market’s anticipation of future rate decisions and potential pauses in the FOMC’s easing cycle. Meanwhile, analysts continue to stress the importance of strong economic performance data as a determinant factor for the Fed in its forthcoming meetings.

In summary, while the Fed’s recent interest rate cut has introduced some volatility and cautious optimism in the bond markets, longer-term expectations have shifted based on a broader evaluation of the economic landscape and fiscal policy implications triggered by the upcoming elections. With inflation concerns and potential fiscal changes on the horizon, market participants are preparing for a period of uncertainty, closely watching for data that may dictate the Fed’s next moves.