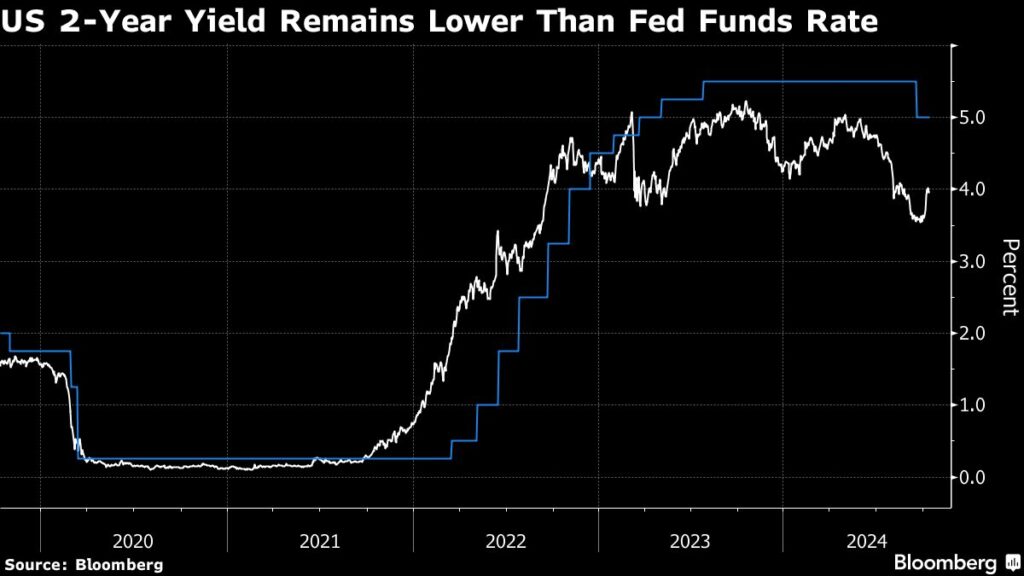

The bond market is increasingly skeptical about the Federal Reserve’s plan to implement two additional interest-rate cuts this year, a shift that has reflected in rising Treasury yields. Currently, traders assess only about a 20% chance that the Fed will maintain steady rates in November or December, a significant decrease from the expectations just a week prior. Following a robust jobs report, previous swaps indicated the likelihood of more than a 50-basis-point reduction by the end of the year. Consequently, Treasuries have faced declines, with a Bloomberg index tracking U.S. bonds on track for its worst performance since April, showing a fourth consecutive week of losses. Yields on 10-year notes have soared above 4%, and 30-year bond yields have hit their highest points since late July, suggesting a more cautious outlook among investors regarding the Fed’s next moves.

This shifting sentiment among bond traders comes amid a series of mixed economic reports that have not clearly justified the need for significant monetary policy easing. The Federal Reserve’s dot plot suggests that officials anticipate two rate cuts this year; however, a division is evident, as nine out of the 19 members forecasted only a single cut at most. This disparity among Fed officials has prompted varied responses to economic data. Some, like New York Fed President John Williams, have largely dismissed concerns about rising consumer inflation and indicated support for continued rate reductions. Conversely, other officials, including Atlanta Fed President Raphael Bostic, hinted at a more cautious approach, considering the possibility of pausing any further cuts.

Market reactions have reflected confidence in avoiding a severe economic downturn, particularly as the yields on 10-year Treasuries experienced a nearly 50-basis-point rise since mid-September. Analysts at Societe Generale SA argue that this trend indicates that both “no-landing” and “soft landing” scenarios are gaining traction, with inflation risks potentially resurfacing if fiscal restraint does not materialize. The latest consumer price index data for September displays increased wage pressures, reinforcing the impression of underlying inflationary pressure within the economy, even as wholesale price data appeared more tempered.

Despite the prevailing uncertainty, some investors view the recent selloff of Treasuries as an opportunity to buy, particularly within the shorter maturity sectors, as the Fed continues to seek a path toward normalizing interest rates. Leslie Falconio from UBS Asset Management highlighted the potential value in shorter-term bonds, reinforcing the notion that the Fed’s commitment to policy easing remains intact, albeit at an uncertain pace. Derivatives market behaviors also indicate a trend toward hedging against the anticipated rate cuts, as investors have focused on options that suggest only a single additional reduction by year-end.

In the realm of Treasury options, bearish strategies have emerged, contributing to the steepening of the yield curve. Key trades include purchases targeting specific yield increases on 10-year notes and bond contracts, reflecting growing concern about future bond performance. Additionally, the looming U.S. presidential election is influencing bond market strategies, with investors like Ella Hoxha from Newton Investment Management reducing their exposure to long-dated Treasuries in light of imminent event risks associated with the election cycle. This proactive adjustment aims to mitigate potential volatility as uncertainties prior to the November 5 election loom large.

In summary, the bond market’s evolving outlook is characterized by rising yields and skepticism regarding anticipated interest-rate cuts by the Federal Reserve. Despite mixed economic signals and debates within the Fed regarding the pace of monetary easing, many traders are re-evaluating their strategies, with some viewing current market conditions as buying opportunities. As the presidential election approaches, risks and uncertainties surrounding both economic data and political events may further complicate the bond landscape, necessitating cautious consideration from investors navigating this complex environment.