Investors are bracing for increased volatility in the U.S. Treasury market following the release of the latest employment report, which may provide critical insights ahead of the upcoming Federal Reserve policy meeting. As October wrapped up with the worst month for U.S. bonds in two years, yields have risen significantly, with traders speculating that 10-year Treasury yields could surpass 4.5% within the next three weeks. The heightened volatility is evident, as the recent instability surrounding labor market data, influenced by recent strikes and hurricanes, complicates assessments of economic strength. A robust jobs report released on Friday could have substantial implications, potentially paving the way for the Fed to lower interest rates while also indicating that the central bank may hold off on further cuts in the near future.

The recent selloff in Treasuries has raised yields by approximately 60 basis points, primarily triggered by surprising strength in September’s job figures. Traders are currently facing uncertainty, with significant events on the horizon, including the upcoming presidential debate and the Fed meeting. The ICE BofA Move Index shows the highest bond market volatility this year, illustrating the market’s cautious stance. To hedge against this turbulence, traders have engaged in various protective plays. Notably, one substantial move saw a long volatility position executed through options linked to the Secured Overnight Financing Rate, indicating heightened sensitivity to fluctuations.

Market participants are also adjusting positions in anticipation of the Fed’s actions. According to JPMorgan Chase & Co., there has been a notable reduction in both long and short positions among clients, leading to an increase in neutral positions. Specifically, options trading is reflecting expectations of further selloffs, with significant bets placed on rising yields. On Thursday, traders made a noteworthy $6.5 million wager on the 10-year yield reaching 4.4% by late November, while the most popular option positions indicate expectations for yields to rise to 4.5%.

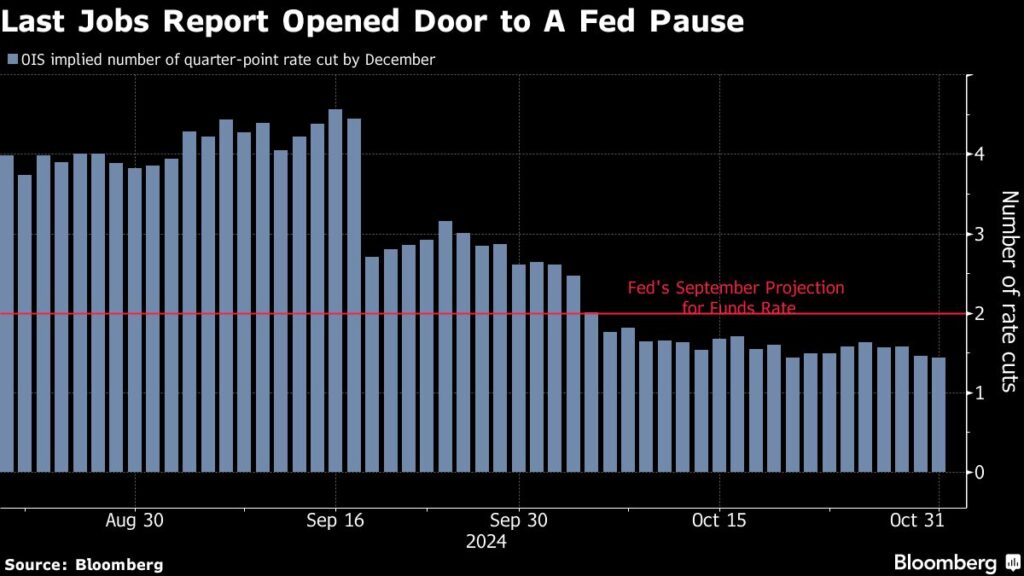

Despite the anticipated Fed rate cut next week, many analysts believe the October job figures may not dramatically alter projections for forthcoming rate adjustments but could influence outlooks for subsequent policy meetings. The unemployment rate is expected to remain steady at 4.1%, and strong labor market data could reinforce beliefs that the Fed will pause or moderate the pace of interest rate reductions in early 2024. Ian Lyngen, from BMO Capital Markets, notes a growing consensus around the Fed’s strategy of moving to a more deliberate pace of rate cuts post-January.

While the Fed is widely expected to proceed with a quarter-point cut, the overarching sentiment deducing from investor optimism is that future cuts may follow a less aggressive trajectory. The market appears to be anticipating that the Fed will pause to assess the economic landscape after the proposed cuts, aligning with the broader economic narrative that emphasizes caution amidst volatility. Thus, any signs of economic resilience, as indicated by the employment report, may have lasting implications for monetary policy guidance moving forward.

As uncertainty looms over the Fed’s direction, the intricate dynamics of the labor market, coupled with heightened bond market volatility, illustrate the complex financial landscape investors must navigate. Market responses to the upcoming job figures and the Fed’s decision will be crucial in shaping yields and overall sentiment. Overall, the convergence of labor market strength and Fed policymaking will be pivotal in establishing the contours of interest rate strategies and their implications for the Treasury market in the foreseeable future.