Bank of Korea Governor Rhee Chang-yong has announced a downward adjustment to South Korea’s economic growth forecast, estimating it may reach only 2.2% this year compared to the previously projected 2.4%. This revision comes on the heels of disappointing third-quarter GDP growth of just 0.1%, significantly below the anticipated 0.4%. The central bank’s report indicated that weak exports are major contributors to this subdued economic performance, which has prompted policymakers to reconsider their growth projections and respond proactively to the evolving economic landscape.

In light of these developments, the Bank of Korea (BOK) recently decreased its benchmark interest rate, shifting the focus of monetary policy toward supporting economic growth rather than combating inflation. The previous rate of 3.25% was adjusted downward as BOK officials expressed heightened concern about the slowing economic momentum and household debt growth. Governor Rhee hinted at future growth projections, suggesting that the economy may expand at rates of either 2.2% or 2.3% in 2024, a slight recovery that nonetheless remains above the economy’s potential growth rate.

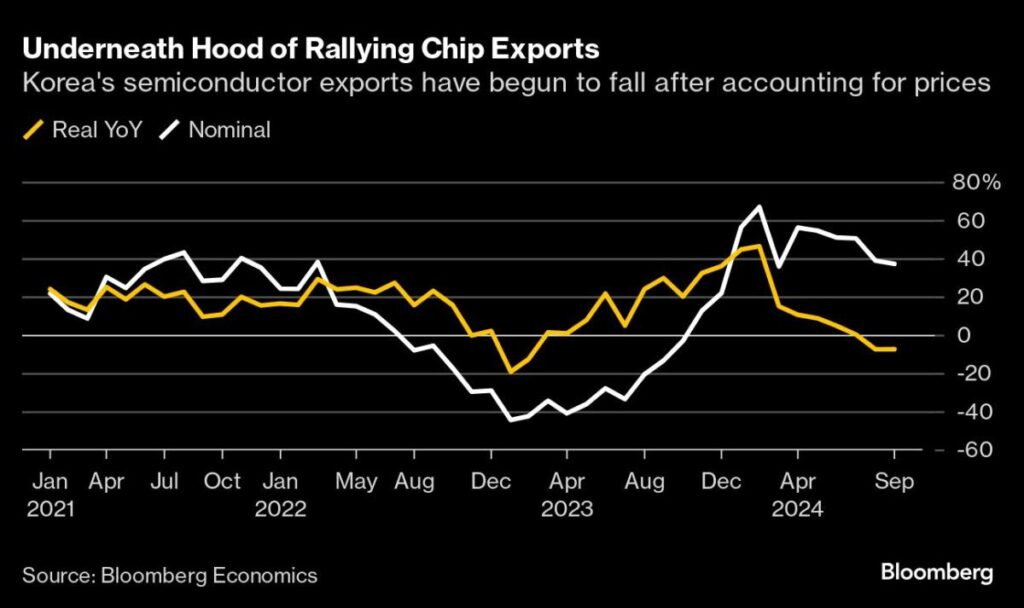

The complexity in predicting growth for 2025 arises from several external factors, including the recent decline in real exports. Rhee cited uncertainties stemming from the upcoming US presidential election, which could have significant implications for trade agreements and foreign relations. Additionally, whether China can effectively stimulate its economy remains a crucial variable that could impact South Korean exports and overall growth, underscoring the interconnectedness of global economic dynamics in influencing local markets.

Amid these economic challenges, policymakers are closely monitoring currency fluctuations that have arisen due to speculation surrounding the US election, particularly with the potential for Republican nominee Donald Trump’s victory. As the value of the dollar has surged, the South Korean won has weakened, prompting Rhee to express concerns about currency volatility. He indicated that the BOK is prepared to intervene in the foreign exchange markets if necessary, asserting that they possess sufficient “ammunition” to manage any adverse impacts on the economy.

President Yoon Suk Yeol has echoed these sentiments during recent cabinet meetings, emphasizing the need for swift governmental responses to prevent fluctuations in currency, supply chains, or oil prices from detrimentally affecting the national economy. His administration intends to prioritize stability in these areas to safeguard economic prospects, demonstrating a coordinated approach between the government and the central bank in navigating the current economic uncertainties.

As the BOK prepares for its upcoming policy meeting in November, most economists anticipate holding the interest rate steady; however, speculation surrounding a potential acceleration of monetary easing grows. The intricate balance between stimulating growth and managing inflation remains a central challenge for the BOK as it responds to indicators of slowing economic activity, with the overarching goal of sustaining economic resilience amid evolving global pressures.