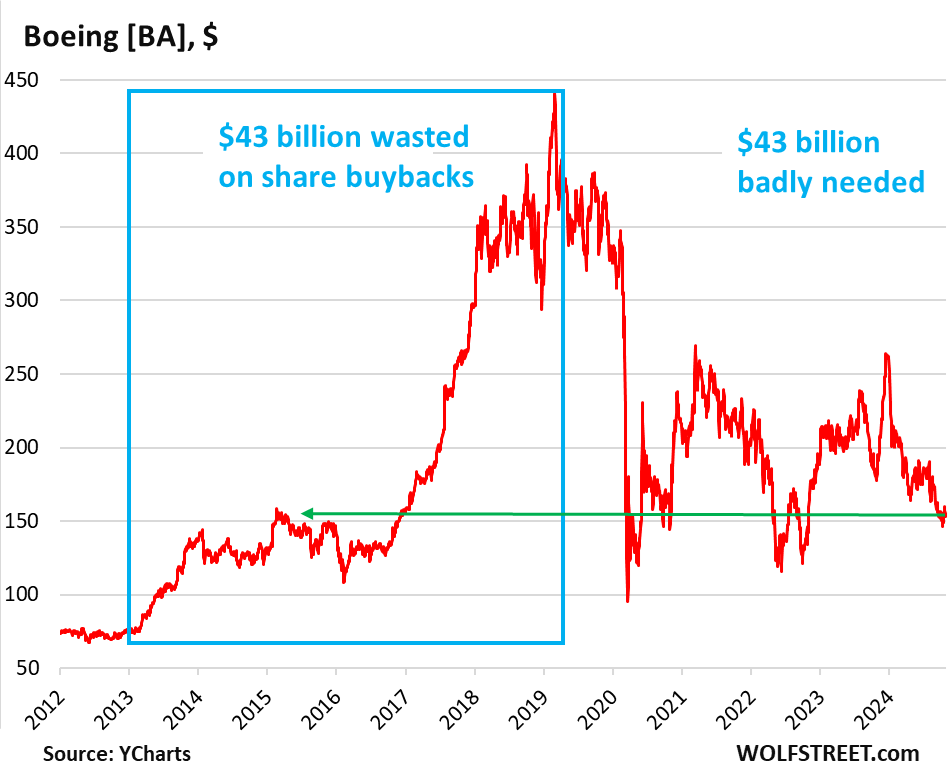

Boeing has faced significant financial turmoil since 2019, sustaining net losses nearing $32 billion and accumulating a staggering debt of $58 billion, which has led to a negative stockholder equity of $23.6 billion. The company’s struggles have been exacerbated by a strategy that prioritized share buybacks over fundamental corporate growth, spending $64 billion to inflate its stock price. The short-sighted shift from engineering aircraft to financial engineering, which initially pleased Wall Street, has resulted in dramatic losses for shareholders. After peaking in early 2019, Boeing’s stock has plummeted to levels reminiscent of early 2015, undermining the long-term value proposition for investors who once celebrated the company’s performance during an artificial growth period.

In response to its dire financial situation, Boeing announced a substantial stock offering to help restore some balance to its shattered equity. This includes selling 90 million shares and $5 billion in mandatory convertible preferred stock, totaling approximately $19 billion, with expansion options potentially raising the total to $22 billion. The resulting dilution for existing shareholders is substantial; with around 618 million shares outstanding, the new offering represents about a 15% dilution. This capital infusion is crucial to mitigating the impact of past share buybacks and to address the negative equity the company has faced, although shareholders may not welcome the immediate consequences of their investments becoming less valuable.

Boeing’s historical reliance on share buybacks—executed to elevate stock prices—has proven detrimental, especially in light of its current financial distress. The company’s stock price had skyrocketed by 500% from 2013 to early 2019, largely due to these buybacks, only to collapse thereafter. Analysts and investors have expressed concerns that the company could have allocated those funds more prudently, such as developing a new aircraft model to replace the aging 737 instead of pertained financial maneuvers that yielded no tangible growth in product offerings or innovations. The decision to halt share buybacks in 2019 came too late, following high-profile crises involving the 737 Max, which overshadowed the financial strategy and its long-term repercussions.

Compounding Boeing’s challenges is its precarious credit rating, currently hovering just above junk level. Ratings by Moody’s, S&P, and Fitch reflect the credit agency’s concerns about the company’s operational problems and high debt load. A potential downgrade to junk status would significantly hinder Boeing’s ability to raise funds, further complicating its efforts to stabilize its finances and repay substantial debts due in the coming years. The apparent need for urgency is evident, given the company’s cash flow difficulties and production complications, as it seeks to navigate an ever-challenging business landscape.

With the proposed equity raise, Boeing is positioned to secure some much-needed financial relief, potentially staving off an immediate downgrade to junk credit ratings. However, while this infusion of capital may provide limited breathing room, it fails to address underlying issues—production inefficiencies, quality control problems, and labor disputes—that continue to plague the company. Boeing’s strategic missteps over the past decade have not only damaged its fiscal health but have also raised questions about its operational integrity and long-term viability in a competitive market dominated by technological innovation and evolving consumer demands.

Ultimately, while the stock offering serves as a temporary remedy for Boeing’s financial inadequacies, the decision to prioritize financial engineering over genuine manufacturing efforts may have lasting ramifications. The future of Boeing rests on its ability to rebuild trust with investors and stakeholders, restore its operational prowess, and innovate in a rapidly changing aviation landscape. Existing shareholders, left grappling with significant dilution, will undoubtedly be watching closely to see if this equity raise can genuinely facilitate a turnaround, or if it constitutes yet another chapter in Boeing’s tumultuous recent history—a narrative marked by financial recklessness and a drastic need for operational transformation.