Boeing has announced its intention to raise up to $25 billion through the issuance of bonds, shares, or other securities as part of its strategy to stabilize cash flow amid ongoing production challenges and a significant labor strike. This revelation came in a regulatory filing, highlighting the company’s struggle with halted production lines and the financial toll of a protracted work stoppage. The move is reflective of a broader approach to navigating the mounting crises the company is experiencing, and with a recent $10 billion credit line secured from various banks, Boeing is seeking to enhance its financial positioning.

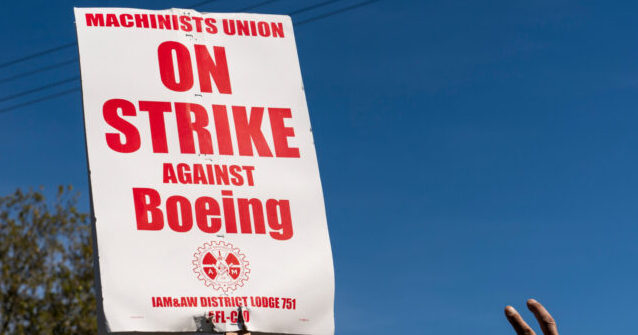

Boeing’s difficulties intensified following the commencement of a strike by the International Association of Machinists and Aerospace Workers (IAM) on September 13, when over 33,000 workers rejected a new contract offer. This industrial action has already incurred estimated losses exceeding $3 billion within just the first month. In anticipation of sustained financial losses, the company has initiated plans to reduce its headcount by 10 percent. The anticipated impact of the strike further compounds the challenges Boeing faces, as the company had hoped to recover from a series of setbacks throughout the year.

Adding to the general unrest in labor markets, Boeing’s situation is exacerbated by inflationary pressures observed under the Biden-Harris administration. These economic conditions have spurred a wave of strikes across various sectors, including autoworkers and port workers, as unions endeavor to negotiate wage increases that reflect the rising cost of living. This phenomenon of price instability correlates with labor instability, creating a complex environment for corporations like Boeing as they attempt to manage production and maintain adequate staffing levels.

The convergence of challenges for Boeing has included setbacks unrelated to labor actions. For instance, in January, a serious incident involving a Boeing 737 MAX led to an emergency landing, reigniting scrutiny of the model, which has already faced public relations challenges following two fatal crashes in recent years. Regulatory responses from the Federal Aviation Administration (FAA) have further hampered Boeing’s operations by tightening oversight, limiting the company’s ability to enhance production rates effectively.

As operations remain disrupted by the strike, Boeing’s production of the widely used 737 MAX aircraft has ground to a halt, undercutting the company’s anticipated recovery trajectory. With significant financial losses piling up and increasing federal oversight, Boeing’s ability to navigate these turbulent waters is uncertain. Investors have, however, reacted positively to the news of the proposed fundraising, interpreting the move as a proactive step to bolster the company’s balance sheet, despite the dilution that new share issuance could create for existing shareholders.

In light of these developments, Boeing has confirmed intentions to reduce its workforce by approximately 10 percent over the coming months, necessitated by the operational and financial strains faced. As of late 2023, the company employed about 171,000 individuals, with approximately 41,000 based outside the United States. The need for such drastic measures reflects the critical nature of Boeing’s current situation as it seeks to restore stability and confidence in the face of ever-mounting challenges.