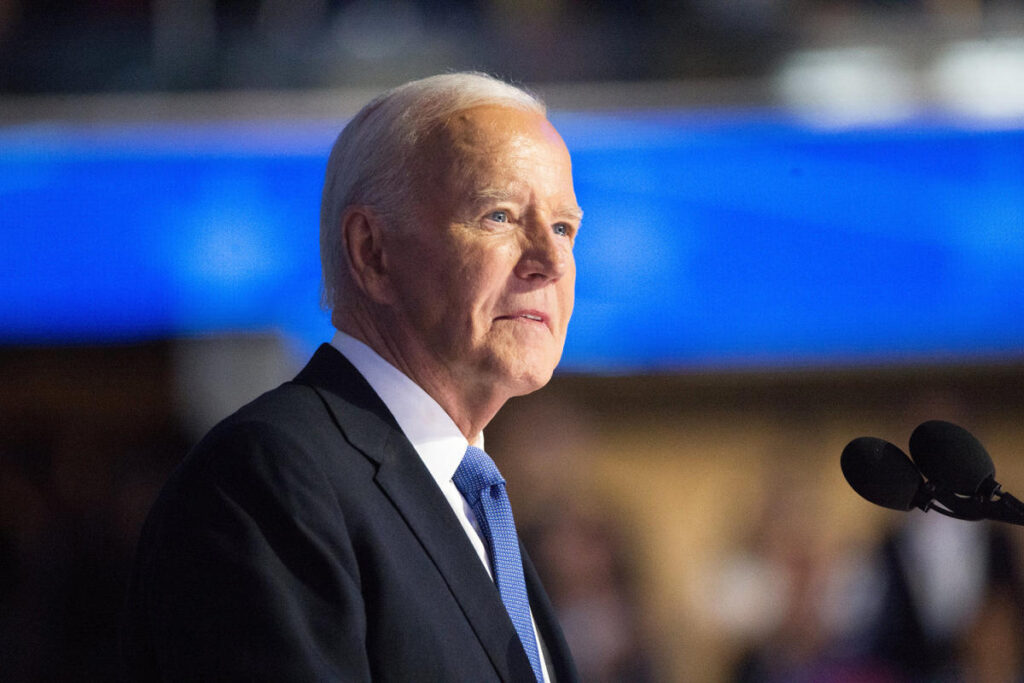

In a recent interview, President Joe Biden expressed his support for banning stock trading among members of Congress, a topic that has gained attention in political discourse and legislative proposals in recent years. During his conversation with Faiz Shakir, an adviser to Senator Bernie Sanders, Biden articulated the ethical concerns surrounding congressional stock trading, particularly how lawmakers can reconcile such activities with their public representation. Biden, who has refrained from stock ownership during his lengthy political career, questioned the morality of members profiting from insider information while serving their constituents. This marked Biden’s first clear stance on the matter, although the timing of his comments is particularly poignant given his administration’s nearing conclusion.

The issue of congressional stock trading has emerged as a significant political flashpoint, spurring debates on ethics and transparency within the government. Critics argue that lawmakers trading stocks could lead to conflicts of interest, as these members may exploit their access to confidential information for personal financial gain. In recent years, various proposals have been introduced in Congress aiming to curb or eliminate stock trading by legislators, yet none have successfully passed into law. Biden’s comments seem to resonate with public sentiment favoring accountability and ethics in government, as citizens increasingly demand greater integrity from their elected officials.

One notable proposal, the ETHICS Act, was recently introduced by a bipartisan group of senators. This legislation intends to prohibit lawmakers from trading stocks and similar investments and imposes restrictions on selling stocks within a specified timeframe after enactment. The measure also aims to extend these trading limitations to the spouses and dependent children of lawmakers, thereby broadening the scope of accountability. Additionally, it seeks to implement restrictions on the president and vice president regarding their substantial investment holdings, with the aim of reinforcing public trust in governmental integrity. Despite its introduction, the bill has not yet been brought to vote in the full Senate.

Concerns about insider trading among Congressional members are not new; former President Barack Obama signed a bill in 2012 that attempted to address similar issues by strengthening reporting requirements for congressional stock trades. However, the ongoing discussions surrounding stock trading in Congress suggest that there is still significant work to be done to mend the perceived ethical breaches. Biden’s emphasis on the need for transformative legislation indicates a strong intent to establish clearer boundaries and guidelines that would prevent any potential exploitation of insider knowledge for personal enrichment.

During his interview, Biden underscored the urgent need for reform, stating that there should be stringent regulations preventing members of Congress from profiting in the stock market while in office. His comments reflect a broader sentiment in the Democratic Party and among progressive advocates, as they push for substantive measures that would improve the ethical landscape of Washington politics. As discussions on this topic continue to evolve, there is potential for renewed momentum around legislative efforts aimed at ensuring greater transparency and accountability among elected officials.

In conclusion, President Biden’s stance on banning stock trading by members of Congress is a significant addition to a longstanding conversation about ethics and accountability in government. His comments, delivered in the context of a wider political climate increasingly scrutinizing the financial activities of lawmakers, reflect the sentiment of a public that demands higher standards from its leaders. While the path toward enacting such reforms remains uncertain, the conversation Biden has sparked could lay the groundwork for future legislative endeavors aimed at cultivating integrity within the halls of power. As his presidency reaches its final months, the lasting impact of his statements on congressional stock trading may yet influence discussions in the incoming administration.