Two days prior, China disclosed disappointing import and export figures, highlighting its ongoing economic struggles. Import levels unexpectedly dropped, signaling significant challenges for the world’s second-largest economy. Amid these declines, speculation is rising about potential fiscal and monetary measures that Beijing may employ to revitalize the economy. However, a critical component might involve devaluing the yuan, which could help stimulate the export sector. Current statistics from November show that exports grew by 6.7% year-over-year, falling short of the 8.7% forecast, while imports plummeted by 3.9%, contrary to anticipated growth. As China grapples with these figures, there are indications from policymakers about a possible increase in the yuan’s depreciation amid mounting trade tensions with the United States.

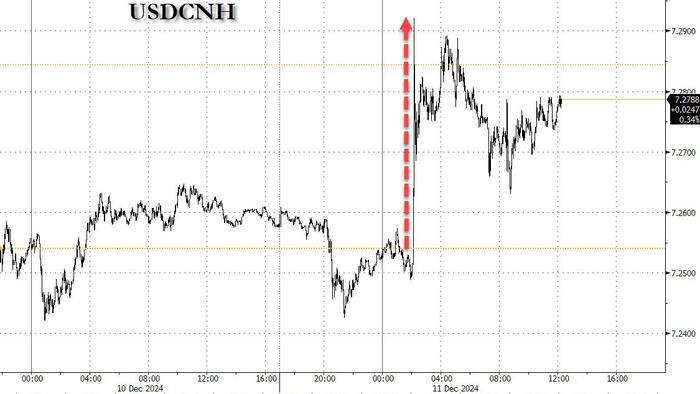

Reporting from Reuters suggests that Beijing is contemplating a more significant fall in the yuan, potentially targeting a rate around 7.5 per dollar. The rationale behind this policy shift is to bolster the competitiveness of Chinese exports and counterbalance tariffs imposed by the U.S. The Chinese yuan experienced a notable decline following this news, reflecting investor trepidation regarding China’s currency strategy and broader economic health. The depreciation of the yuan may be seen as a necessary response to safeguard the Chinese economy from the repercussions of ongoing trade conflicts, particularly in light of former President Trump’s re-election and his pledge to impose new tariffs on China.

Experts in the currency market are closely monitoring the situation, with some predicting further depreciation of the yuan over the coming year. The persistent weakness in the Chinese economy, coupled with low inflation, calls into question how long Beijing can maintain its current currency policies before resorting to significant changes. Jane Foley of Rabobank is among analysts who suggest that the yuan’s depreciation might be an unavoidable measure as China’s economic landscape becomes increasingly challenging. However, if executed too rapidly, massive capital outflows could trigger additional volatility, further destabilizing financial markets.

The backdrop for this assessment includes a sluggish property market and waning consumer confidence, making it crucial for China to adopt more aggressive policy measures. Recent statements from Chinese officials about “moderately loose” monetary strategies imply a need for greater economic stimulus to reverse declining growth rates. Furthermore, the disparity in yields between Chinese and U.S. sovereign bonds places additional pressure on the yuan, with lower rates in China likely reinforcing bearish sentiment about its future value. Analysts from banks like BNP Paribas and Nomura are forecasting yuan values weaker than the current levels as early as mid-2025, pointing to an urgent need for traders to anticipate changes in currency behavior.

Conversely, some economists caution against precipitated moves towards devaluation, emphasizing the necessity for a measured approach. The People’s Bank of China (PBOC) traditionally employs a reference rate for the yuan, and any sudden deviations could signal to market players a willingness for further depreciation. As markets react to the potential for increased yuan volatility, there is a heightened sense of uncertainty, leading investors to reconsider their positions across various asset classes, including commodities such as gold and bitcoin, both of which have shown tendencies to respond positively to currency instability.

Historical context reflects China’s wrestling with currency management during previous trade conflicts, particularly during the last trade war with the U.S., when the yuan was allowed to cross the psychological 7 threshold for the first time in years. This time, Beijing is likely to balance the need for exports with the risks of creating excessive volatility in the currency markets. The latest suggestions of a yuan depreciation have caused a swift reaction in global equity markets and commodity prices, signaling potential upheaval given China’s significant role in global demand dynamics. With energy prices and metals initially reacting negatively to depreciation fears, and the dollar gaining strength, the investment community remains on high alert, as the long-term path of China’s currency policy continues to unfold amid escalating geopolitical and economic pressures.