Australia’s economic landscape is grappling with persistent inflation, particularly in core consumer price measures, which complicates the central bank’s monetary policy. In the last quarter, the trimmed mean measure of consumer prices, a key indicator that excludes volatile items, increased by 0.8%, maintaining a yearly rise of 3.5%. These figures align with the Reserve Bank of Australia’s (RBA) predictions as the bank continues to navigate a landscape dominated by government subsidies that keep some price pressures muted. Consequently, the RBA emphasizes core CPI due to its importance in understanding underlying inflation trends. As the RBA prepares to release new economic forecasts and policy decisions, analysts suggest that the data reinforced the prevailing view that inflation will remain above the desired 2-3% target range for an extended period.

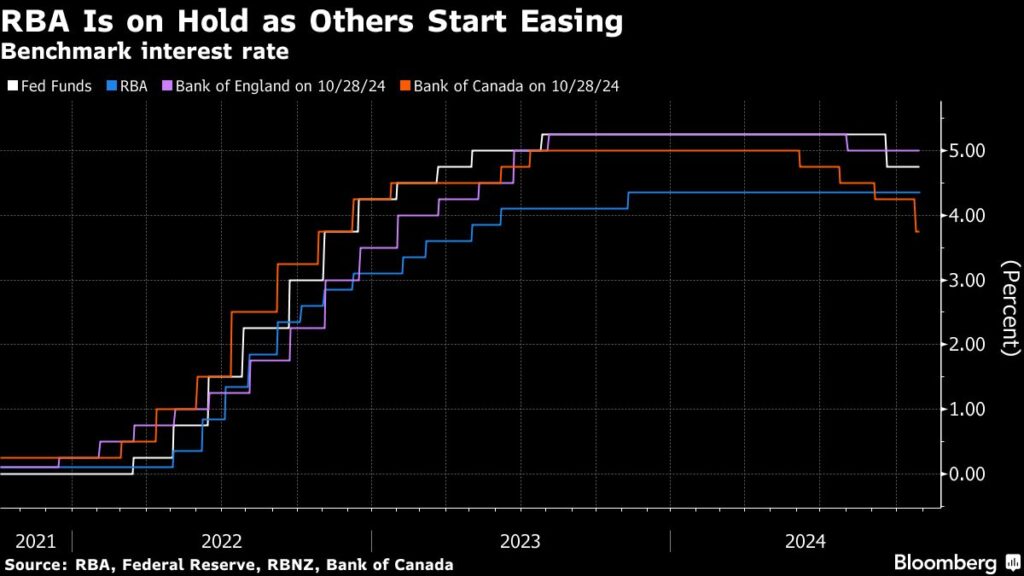

This situation is accentuated by the RBA’s cautious approach to interest rates. The bank’s policy has held the key rate at a 12-year high of 4.35% since November, and economists largely predict that cuts are not likely before February 2025. One reason for this conservative stance is the RBA’s concerns regarding the ability of heavily indebted households to manage potential increases in mortgage repayments. Current interest rates indicate a lower peak compared to rates seen in other countries, reflecting the bank’s cautious policy choices in light of Australian household debt levels. Policymakers remain vigilant regarding potential inflationary pressures stemming from increased consumer spending after recent government income tax cuts, demonstrating the RBA’s broader focus on aggregate demand dynamics in the economy.

Despite these challenges, recent economic indicators, including a strong employment report, suggest that the RBA is succeeding in maintaining job gains achieved during the post-pandemic recovery. However, tight labor market conditions present a dilemma for the RBA, which must balance supporting employment while managing inflation. Observers note that the inflation data released hints at incremental progress, yet the ongoing struggles in the labor market could sway the RBA to keep interest rates steady at their current level. With core inflation measures pointing to persistent price pressures, market participants are watching closely to see how the RBA navigates upcoming decisions.

Government interventions, particularly in energy, have played a significant role in reducing headline inflation figures, which dipped to 2.8% in the third quarter. This drop was below market expectations and reflects a broader shift in inflation dynamics, though some experts caution that it may not be sufficient to prompt immediate rate cuts. Analysts see the moderating headline CPI as potentially positive for the RBA, but it doesn’t alone mandate a change in monetary policy direction. The RBA appears poised to hold firm on rates for the foreseeable future amid market uncertainties and potential consumer spending shifts following the recent tax cuts.

Furthermore, the report highlights variations in inflation across sectors, with annual services inflation rising to 4.6%, driven by costs in areas like rents and medical services. In contrast, non-tradables, heavily influenced by domestic factors, showed a more significant increment, illustrating distinct inflationary pressures affecting different aspects of the economy. In contrast, tradables, which are impacted by global market factors, displayed a more modest increase of 0.6%. These variations underscore the RBA’s challenges in managing its inflation mandate while ensuring economic stability in light of diverse inflation drivers.

In summary, Australia finds itself in a complex economic situation marked by persistent core inflation and an RBA that is carefully navigating interest rate policy in response to evolving circumstances. As data rolls in, the central bank’s cautious approach aims to balance the risks of rising inflation with the realities of household debt and labor market pressures. The focus remains on achieving stability in consumer prices, with expectations that significant downward shifts towards the target band may still be a couple of years away. Moving forward, the RBA’s upcoming forecasts and decisions will be crucial in determining the country’s monetary policy direction amid these ongoing challenges.