As Bitcoin embarks on a new chapter of price discovery, the cryptocurrency market is rife with curiosity about whether retail investors are experiencing a sense of “Fear of Missing Out” (FOMO) comparable to previous bull cycles. Observers are analyzing the current market dynamics using various metrics, including the number of active Bitcoin addresses and historical performance indicators, to understand if a retail surge is imminent or if it remains on the horizon. Notably, the data reveals nuanced trends in investor behavior and market engagement as Bitcoin explores new price levels.

One of the key indicators of retail interest in Bitcoin is the creation of new addresses on the network, which typically spikes during periods of heightened market enthusiasm. In recent months, however, the pace of new address creation has been notably slower than the explosive growth witnessed in past bull runs; for instance, there was a day in 2022 when nearly 791,000 new addresses were created. While there has been a slight increase in new addresses recently, it does not approach the levels indicative of full-blown retail FOMO. Complementing this observation, Google Trends shows a moderate rise in searches for “Bitcoin,” yet these levels are still well below the peaks reached during the frenzy of 2017 and 2021, indicating a cautious beginning to renewed retail engagement.

Beyond address creation, there is evidence of a transfer of Bitcoin supply from long-term holders to shorter-term investors. Historically, such identifiable shifts have often signaled the initiation of new market phases, where seasoned investors begin taking profits. This transition appears to be in its infancy, as the volume of coins changing hands remains low; long-term holders seem reluctant to sell substantial amounts of their holdings, suggesting a collective confidence in Bitcoin’s potential for further price appreciation. This contrasts with the prior bull market, where significant outflows from long-term holders helped stoke price increases, pointing toward the importance of long-term strategic holding in the current market.

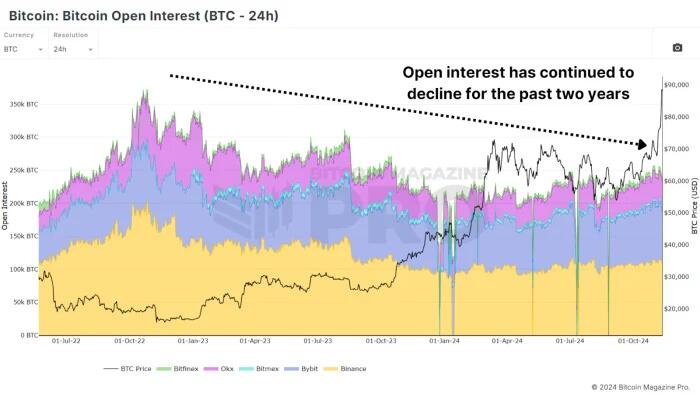

Amidst these trends, Bitcoin’s latest upward movement has been characterized as spot-driven rather than reliant on excessive leverage, contrasting sharply with previous markets. The current state of open interest in Bitcoin derivatives demonstrates only minimal increases, a stark contrast to the peaks seen before the FTX crash in 2022. This moderation in leverage contributes to the stability of the market; a spot-driven environment, marked by fewer leveraged positions, means that there are fewer potential liquidations during downturns, thus creating a more robust and resilient market structure.

Interestingly, while retail engagement has not surged, an increase in transactions among “whale” addresses (holding at least 100 BTC) indicates a notable trend of accumulation among large holders. Over recent weeks, these addresses have increased their holdings significantly, amassing billions in value. This accumulation is a bullish indicator, suggesting that large investors are optimistic about the continuing strength and potential growth of Bitcoin’s price. Historically, large holders tend to divest near market peaks; the current trend diverges from this behavior, signaling confidence in long-term value.

In summary, although current indicators show that Bitcoin’s price rally has attracted some renewed interest, the overwhelming signs of FOMO among retail investors are still absent. The market appears to be in its early stages of what could be a more extensive rally, characterized by sustained confidence among long-term holders, continuing accumulation by whales, and a stable spot-driven environment. As the market progresses, it remains plausible that heightened retail interest could emerge, potentially driving Bitcoin to new heights in the coming months. This evolving narrative underscores the significance of observing market dynamics closely as they unfold.