According to Torsten Slok, chief economist at Apollo Management, the likelihood of the Federal Reserve maintaining its interest rates during its upcoming November meeting is increasing as the US economy shows signs of continued growth. Slok cites several reasons for this optimism, including a dovish Fed stance, rising share and home prices, stable credit spreads, and accessible corporate financing in both public and private markets. He argues that these factors indicate an ongoing economic expansion, referencing the Atlanta Fed’s projection of a 3.4% GDP growth for the third quarter. Slok posits that the US economy is on a “no landing” trajectory, suggesting persistent growth and the potential resurgence of inflation.

Market reactions have corroborated Slok’s perspective, with US Treasuries experiencing a downward trend. On a recent Monday, the yield on two-year notes climbed above 4%, while yields on longer-dated securities rose in tandem, leading to a significant sell-off in the bond market. The 10-year yield saw an increase of 9 basis points, hitting levels not seen since late July, while the 30-year bond suffered from option-related trades, pushing its yield close to 4.5%. This volatility in the bond market reflects broader expectations about the Fed’s forthcoming decisions and the squaring of investors with economic realities.

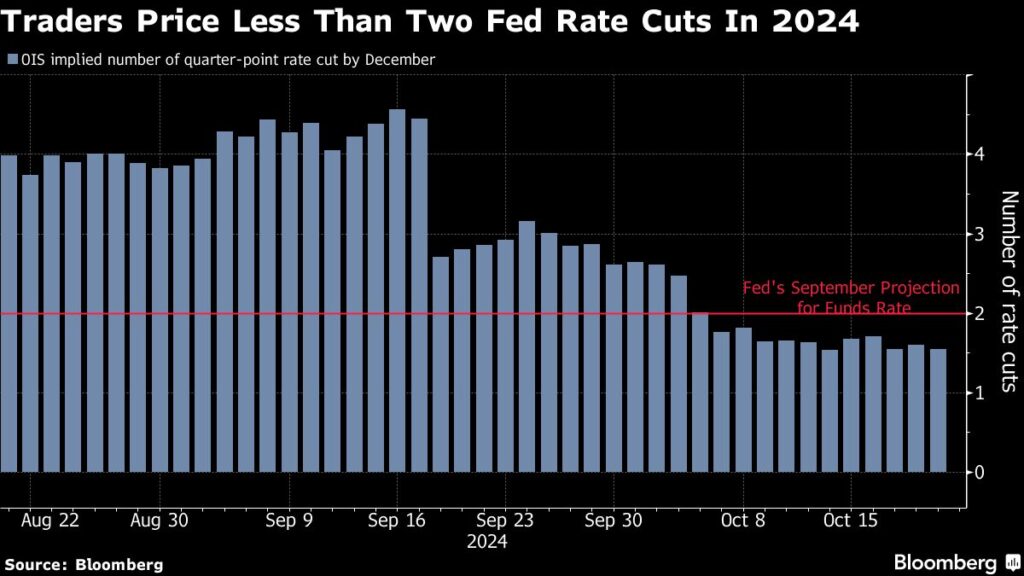

Slok’s analysis aligns with sentiments from key Federal Reserve officials. For instance, Dallas Fed President Lorie Logan emphasized a cautious approach for the central bank at a recent event. Slok outlined “10 tailwinds” for the US economy, suggesting that these forces may compel the Fed to reconsider its previously planned rate cuts at the November meeting. Looking back at the September Fed forecasts, which indicated the potential for two additional rate cuts by the end of the year following a significant reduction of 50 basis points at the last meeting, market participants appear to be weighing alternative scenarios.

In light of recent data, traders are now pricing in only 20 basis points of easing around the Fed’s upcoming meeting in November—suggesting a more conservative outlook than previously anticipated. A strong employment report for September has further shaped these expectations, with the upcoming October employment report set to play a crucial role ahead of the US election and a two-day Fed meeting soon after. The evolving economic landscape, juxtaposed with employment figures, continues to be a focal point in these discussions.

The bond market has faced significant challenges this October, with the Bloomberg Treasury index indicating its first monthly loss since April. Following a burst of hiring in September, 10-year yields climbed sharply from a low of 3.69% at the start of the month. Investor concerns about potential fiscal spending in the US have compounded the market’s turbulence, with analysts at T. Rowe Price predicting that 10-year yields could reach 5% within the coming six months, driven by inflationary expectations and limited rate cuts by the Fed.

Slok believes that consumers and businesses currently benefit from having “locked in” low interest rates, aiding them during this economic cycle. Additionally, he points to persistent government spending support through initiatives like President Joe Biden’s economic development programs and legislative measures such as the Chips and Inflation Reduction Acts. With the uncertainties associated with the upcoming elections likely to dissipate soon, Slok suggests that these systemic tailwinds will continue to bolster the US economy as the Fed navigates its monetary policy decisions.