In a recent analysis by Eric Hickman of Lantern Capital, the impact of a strong jobs report on Treasury yields is highlighted. The report, which noted an increase of 254,000 jobs, triggered a significant rise in the 2-year Treasury yield, which climbed 22 basis points to 3.93%. The bond market has adjusted its expectations, forecasting that the Federal Reserve (Fed) will reduce rates to around 3.25% by March 2026, anticipating a series of gradual cuts over multiple meetings. Hickman suggests this pricing reflects the Fed’s intention to steer rates back toward a neutral level. However, he warns that such significant shifts in yield are unlikely to be temporary, predicting that yields will continue to rise for a while unless negative economic indicators emerge to counterbalance the current optimism.

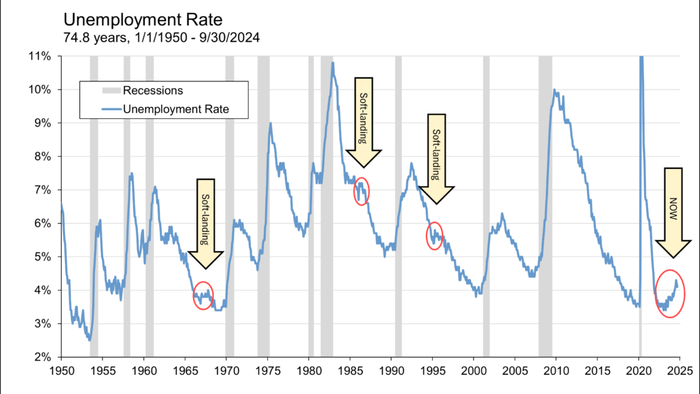

Hickman underscores that the robust jobs data, while seemingly positive, does not alter his recession expectations. He argues that the necessary preconditions for an impending recession—such as an inverted yield curve, rising unemployment rates, and signals from the Leading Economic Index—are in place. Historically, if two of these indicators show recession signals, a downturn is likely, and in this case, all three have indicated such a trend. He argues that the presence of a soft landing scenario typically aligns with one or fewer of these indicators, a stark contrast to the current economic landscape. As both Fed Chair Jerome Powell and influential economist Austan Goolsbee assert a commitment to returning rates to neutral regardless of economic weakness, Hickman posits that inflation concerns may prematurely halt any cuts.

The commentary highlights ongoing ambiguity regarding the timing and scale of potential Fed rate cuts. Hickman challenges the notion that the Fed can operate without regard for rising inflation, noting that significant rate reductions cannot occur without clear evidence of economic deterioration. He posits that factors such as US fiscal deficits—the country’s deficit to GDP ratio for 2023 stands at 6.3%—have forestalled the onset of a recession. In comparison, other G-7 economies, which have initiated rate cuts amid more manageable deficits, support the idea that significant deficit spending can fabricate temporary economic growth.

Hickman also critiques the prevailing optimism in equity markets, asserting that they represent a fundamental economic imbalance. Since the low of the Great Financial Crisis in March 2009, the S&P 500 has surged with a total annualized return of 16.9%. While prolonged high returns are not unprecedented, Hickman believes the current economic conditions are ripe for a correction. Citing past employment spikes preceding recessions in 1990, 2001, and 2007, he warns that today’s jobs report, while strong, fits a troubling pattern that suggests an impending downturn despite the silver lining of job growth.

The sentiment of a soft landing remains pervasive, but Hickman argues that such optimism is misguided in light of the traditional economic indicators currently flashing warning signs. Jerome Powell’s uncertain response to questions regarding the likelihood of a soft landing reveals a cautious stance amid widespread economic speculation. Instead of embracing the optimistic narrative, Powell emphasized the Fed’s commitment to tackling inflation sustainably, refraining from affirming claims of an imminent soft landing. Hickman posits that both Powell’s measured statements and the persistent fears around inflation signal that the economic landscape is fraught with challenges that could overshadow any temporary good news from job growth.

In conclusion, while the recent jobs report has momentarily bolstered sentiment within the financial markets, Hickman stresses that it should not distract from the underlying economic realities signaling a potential recession. The Fed’s balancing act between managing inflation and addressing growth concerns is complicated by fiscal deficits and the risk of economic imbalances reflected in stock market performance. As the labor market shows signs of strain, Hickman remains skeptical about the narrative of a soft landing, contending that historical patterns suggest a corresponding downturn is not only likely but imminent. The disconnect between the current optimism and economic indicators may indicate a growing need for reassessment among market participants as they navigate the shifting economic landscape.