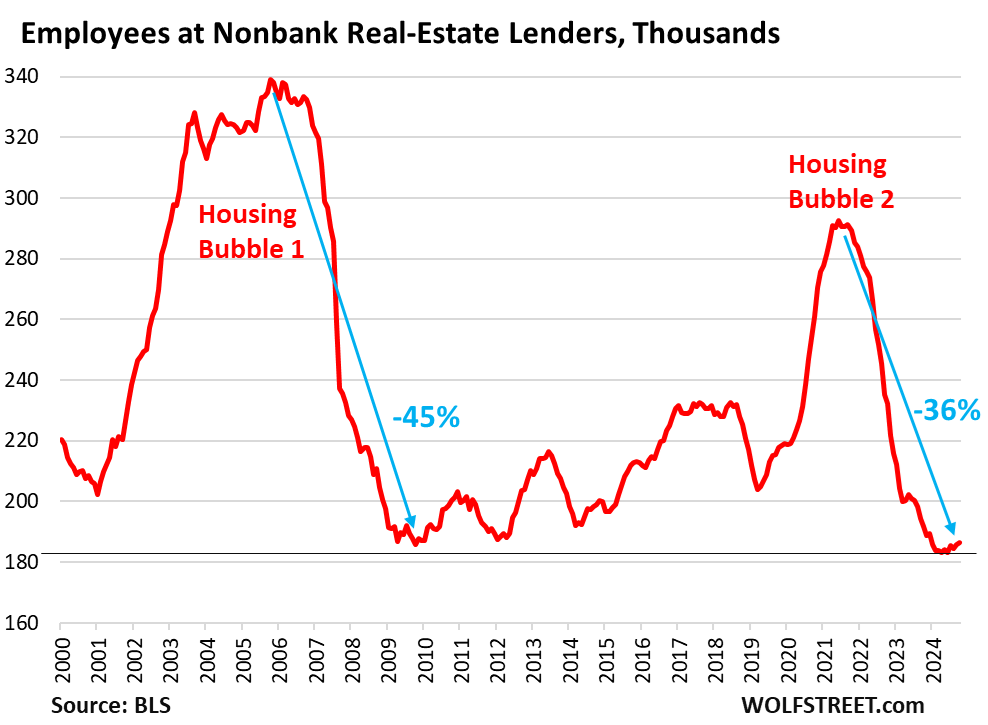

The employment landscape within nonbank mortgage lenders has experienced a significant downturn, resulting in a staggering decline of 37%, marking the lowest employment levels since 1997. The cyclical nature of housing markets significantly impacts job levels at mortgage lenders, as housing bubbles tend to inflate employment during booming periods, which are subsequently followed by substantial declines when the market bursts. Recent data from the Bureau of Labor Statistics highlights a catastrophic drop in employment at nonbank mortgage lenders from June 2021 to October 2024, amounting to a total loss of 35.8%. By June 2024, this employment figure plummeted from a peak of 292,700 employees in June 2021 down to 183,100, a level that not only reflects the impact of the current housing crisis but also eclipses the lows experienced during the first housing bust in the mid-2000s.

Interestingly, this employment crisis has primarily affected nonbank lenders, a segment that has gained dominance in the mortgage market. In contrast, traditional banks have retreated from this space. Interestingly, the two largest nonbank mortgage lenders—Rocket Mortgage and United Wholesale Mortgage—have managed to sustain impressive origination volume, producing $179 billion in mortgage volume in 2023. This figure remarkably surpasses the combined total of the next eight largest lenders, which includes banks, nonbanks, and credit unions, who collectively managed $171 billion in origination. This highlights the shifting dynamics in the mortgage lending industry, where nonbank lenders have increasingly taken the lead, even as employment has dwindled.

Moreover, mortgage brokers have also faced a considerable decline in employment following the collapse of housing bubbles, echoing the wider trends seen in the nonbank lending sector. The mortgage broker workforce experienced a 32% decrease from June 2021 to October 2024, and a 33.6% drop to its low in June 2024. This decline is reminiscent of the first housing bust, during which employment in this area fell by a staggering 57%. The simultaneous drops in employment at both nonbank mortgage lenders and mortgage brokers illustrate how deeply intertwined these sectors are, contributing to a collective loss of approximately 150,200 employees or 36% of their total workforce over the evaluated period.

The backdrop to this drastic reduction in employment is the corresponding collapse in mortgage originations. Mortgage application data reveals a significant decrease in refinancing activities; applications were down a shocking 70% compared to the same timeframe in 2019 and an 81% drop relative to 2022. Historical context shows a parallel during 2018 when similar drops were noted as mortgage rates approached the 5% mark. This cycle repeated itself with a massive refinancing peak during the 0% interest era of 2020 and 2021, indicating dependence on favorable rates to stimulate refinances.

Additionally, applications to purchase homes are also witnessing a decline of approximately 40% when juxtaposed against 2019 figures, revealing a stark contraction in housing demand. This trend correlates with the significant drop in existing home sales, which fell by 35% in 2024 compared to levels in 2021, measuring about 4 million homes sold—the lowest recorded since 1995. The downturn across mortgage origination and application metrics showcases the broader fallout from the bursting housing bubble, emphasizing the widespread impact felt throughout the industry.

The ramifications of these employment declines and the broader housing market crisis, while severe for those directly affected, represent a relatively minor blip within the larger context of the U.S. labor market. The significant job losses in this specialized sector highlight cyclical economic phenomena, particularly the thrill of housing bubbles and the subsequent turmoil of busts. The current state of the job market for mortgage lenders illustrates the volatility and risks inherent in such economic cycles, raising questions about how the industry can adapt to avoid similar upheavals in the future.