Trump Media Stock’s New Uptrend Phase: An Overview

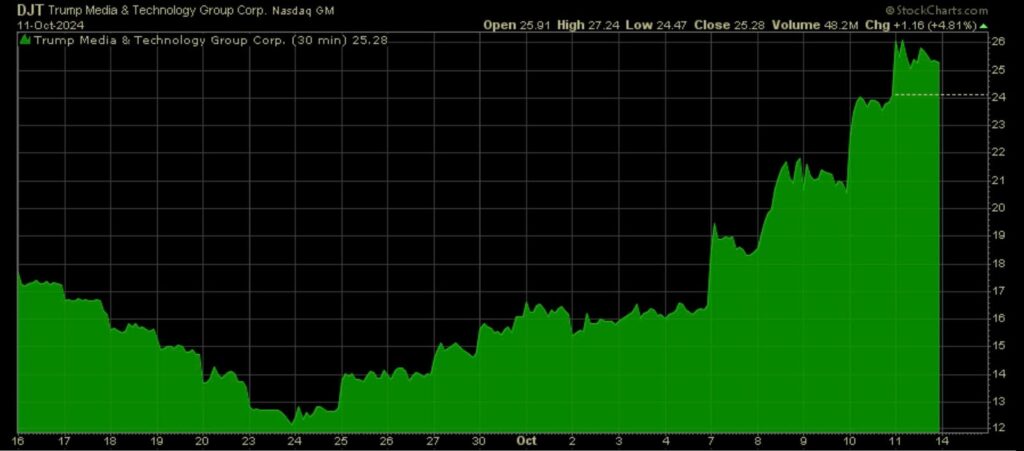

Trump Media Stock (DJT) experienced a remarkable surge over the past week, with an impressive increase of over 50% alongside a trading volume of 200 million shares. After navigating a volatile period that saw its stock price fall to a low of $12.50, DJT successfully breached significant resistance levels that included a major barrier at $15 and its January starting point at $17.50, ultimately returning to its previous downside barrier at $25. This rapid rise has attracted media attention, fueling optimism and speculation about further gains. However, the stock market’s inherent volatility and propensity for contrarian moves must be carefully considered, as just weeks ago, DJT’s plummet elicited a wave of pessimistic sentiment regarding its future performance.

The uptick in DJT’s stock has created renewed enthusiasm among investors and speculators alike, particularly those who had held onto their shares during the last downturn. The decision by some shareholders to retain their investments, rather than selling during the previous drop, suggests a potential shift in strategy and confidence in the stock’s future performance. Current market sentiment appears to be leaning towards the possibility of continued gains as traders react positively to the recent momentum, yet the fickle nature of day-traders and speculators, who often chase short-term trends, introduces a level of uncertainty concerning the sustainability of this upward movement.

Technical analyses reveal that DJT’s trading patterns indicate speculative buying, along with a notable lack of covering by short sellers following the stock’s significant decline. As of the end of September, short interest remained high at 11.4 million shares, only slightly reduced from a peak of 14.5 million shares earlier in the month. This suggests that many short sellers have yet to exit their positions, which could be contributing to the stock’s recent volatility and upward price movements as they may be forced to cover their positions. As of now, the next scheduled report on short interest will be critical to understanding the full extent of its role in DJT’s price trajectory, with insights expected after the market closes on October 24.

In addition to speculative trading dynamics, it is important to note the fragile underpinning of DJT’s financial health. The company’s fundamentals are weak, supporting a stock price that traditionally would not extend beyond single digits, raising questions regarding the sustainability of its current valuations. The impending earnings report for the third quarter, expected in mid-November, will be significant in either solidifying the recent price uptick or confirming ongoing financial struggles. Investors will need to look beyond short-term movements and assess whether this recent uptrend can hold in the face of potential negative revelations from the upcoming financial disclosures.

Moreover, the political landscape surrounding Trump Media, particularly as it relates to the upcoming presidential election, introduces another layer of complexity affecting the stock’s value. The perceived strength of the "Trump brand" could significantly influence investor sentiment and market performance leading up to and following the election. Changes in public perception and the political environment may have direct repercussions on the stock’s viability and could sway the decisions of potential investors, particularly if the election outcomes create a favorable or unfavorable atmosphere for Trump Media.

In conclusion, while Trump Media’s current growth phase has spurred optimism and excitement among traders and shareholders, market participants must remain vigilant and critically assess the underlying financial health of the company, the implications of upcoming earnings reports, and the potential volatility stemming from fluctuating short interests. As speculators engage in a complex interplay of buying and selling, driven by both emotion and strategy, the necessity for cautious observation of DJT’s long-term fundamentals cannot be overstated. In an environment characterized by significant short-term trading and speculative activity, maintaining a focus on the fundamentals will be essential for investors looking to navigate the turbulence surrounding Trump Media Stock effectively.