In 2024, the S&P 500 Index (SPX) has achieved approximately 45 all-time highs, reflecting a dynamic and robust performance in the stock market. This upward trajectory has been supported by a general optimism around economic indicators, corporate earnings, and the fiscal environment. Notably, Goldman Sachs trader Brian Garrett and his portfolio strategy team have shared insights suggesting that this bullish trend may continue. They point to various factors that could further propel the market, such as ongoing positive earnings reports and favorable macroeconomic conditions.

Garrett’s analysis indicates that the SPX reached a milestone by closing at 5792, marking a new all-time high. This performance not only underscores the index’s resilience but also highlights the underlying market sentiment that has been significantly optimistic. Investors are increasingly confident, driven by strong corporate performances, a recovering labor market, and stimulus measures that continue to fuel economic growth. Such a backdrop generally instills a sense of security among market participants, leading to increased investment activity.

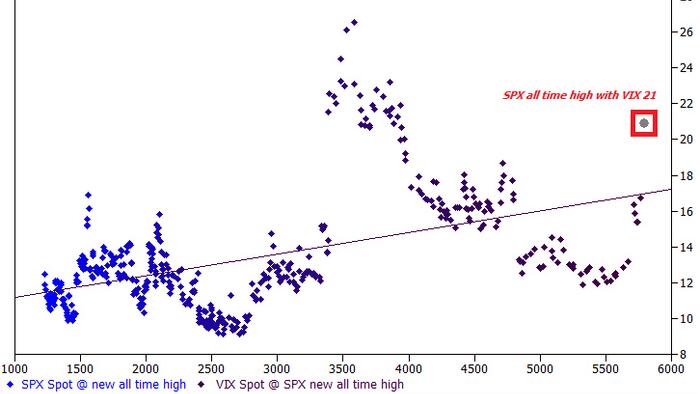

However, Garrett emphasizes the importance of volatility in this scenario, as evidenced by the VIX spot closing at 21. The VIX, often referred to as the “fear gauge,” reflects market expectations of future volatility. A VIX level of 21 indicates a nuanced perception of risk among investors, suggesting they are cognizant of potential market fluctuations despite the bullish outlook. This juxtaposition of soaring index values alongside a moderate VIX signal that while the market is buoyant, there is still a call for caution given historical precedents where rapid increases have led to corrections.

Moreover, the potential for additional all-time highs in the SPX relies on several key factors. The portfolio strategy team at Goldman Sachs hints at the likelihood of sustained upward momentum, contingent upon persistent economic stability and investor sentiment. If these elements align, further highs could be achieved as market participants remain anchored in positive projections for corporate profits and economic growth. This includes a favorable interest rate environment, which often stimulates investment in equities.

Importantly, Garrett’s position reflects a broader market consensus that sees continued growth ahead, driven by technological advancements and sectors poised for expansion. This includes industries like technology, healthcare, and renewable energy, which are expected to outperform due to ongoing demand and innovation. The expectation is that as these sectors thrive, they will bolster the overall growth of the SPX, leading to new all-time highs as investor confidence remains elevated.

In conclusion, the optimistic outlook presented by Brian Garrett and the Goldman Sachs team reflects a complex interplay of economic indicators, market sentiment, and investor behavior that supports the potential for more all-time highs in the S&P 500. While the prevailing sentiment is positive, the awareness of market volatility underscores the necessity for careful navigation through the financial landscape. Thus, while the SPX’s record performance invites enthusiasm, it also serves as a reminder of the unpredictable nature of the markets, where each peak can harbor the potential for subsequent corrections. Investors are advised to remain vigilant in their strategies, balancing optimism with pragmatism as they look to the future trajectory of the S&P 500.