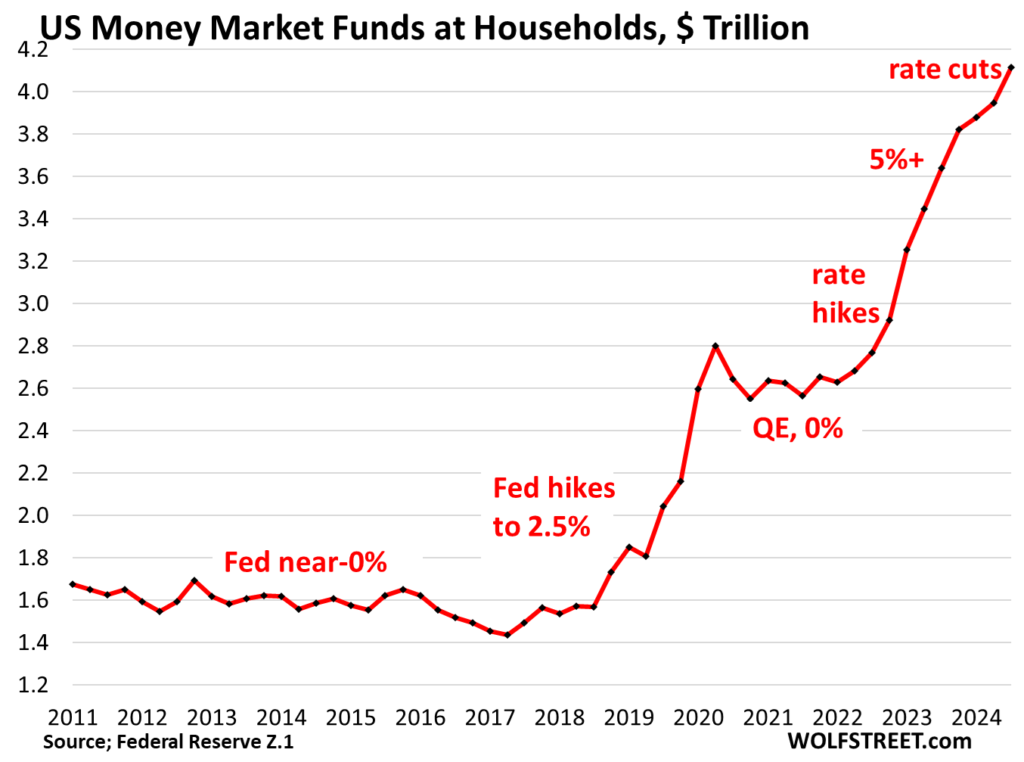

In the third quarter of 2023, household cash balances in money market funds (MMFs) reached unprecedented levels, climbing by $167 billion to an all-time record of $4.11 trillion. This surge in MMF holdings occurred even as the Federal Reserve initiated a rate-cutting cycle on September 18, which involved a reduction of rates by 50 basis points. Despite a decline in yields associated with MMFs since July, households continued to invest heavily in these funds, underscoring a persistent demand for safe financial instruments amid a shifting interest rate landscape. MMFs invest in low-risk, short-term financial assets, such as Treasury bills and high-grade commercial paper, providing a safe haven for households seeking liquidity and stability.

Total MMFs, which encompass both household and institutional holdings, grew by $291 billion to reach $6.84 trillion by the end of September. In fact, MMF balances have soared by 53% since the start of the recent rate hikes in early 2022, and more than doubled since 2018 when the Fed’s policy rates were raised to 2.25%. Historically, even during prior rate-cutting phases, cash inflows into MMFs remained relatively robust until the economic landscape changed significantly. After the rate hikes in 2022, there was a notable influx of cash into MMFs, a trend that persisted despite lower yields as households sought refuge in low-risk investments.

As MMF yields rose, banks faced pressure to offer competitive interest rates on certificates of deposit (CDs) and savings accounts to retain customers and attract new deposits. Even with increased rates, banks typically observed a level of “stickiness” in deposits, as many customers remain reluctant to shift their funds, especially in lower-yield checking and savings accounts. Although some deposits moved to higher-yielding options like MMFs, many remained entrenched in traditional bank accounts due to a combination of inertia and the perceived security of familiar banking relationships.

However, by early 2024, the dynamic shifted as banks, having regained sufficient deposits, started reducing interest rates even though MMF yields remained appealing at over 5%. This change contributed to a decline in cash inflows into CDs, which had peaked at $2.37 trillion in February but slipped to $2.35 trillion by November. The growth rate of large time-deposits, which increased significantly since the start of rate hikes, seemed to stall in response to the decreased rates being offered by banks amidst changing economic conditions.

In contrast, small time-deposits, or CDs under $100,000, have evidenced a more pronounced volatility, dropping to $1.09 trillion post-first rate cut in October, demonstrating a direct sensitivity to interest rate fluctuations. Following a significant decline in CD balances from 2008 to mid-2022—which saw a 97% decrease due to unfavorable rates—the recent uptick from rate hikes proved temporary as rate reductions prompted renewed shifts in household investment strategies. These smaller CDs are not as stable as large time-deposits, reflecting a more transient relationship between households and banking products in relation to interest rates.

As overall deposits across commercial banks in the U.S. edged up to $17.9 trillion in November, the backdrop includes a historical $1 trillion drop in deposits between the start of rate hikes in March 2022 and mid-2023. This unprecedented decline in bank deposits, along with the collapse of several banks, including Silicon Valley Bank and Signature Bank, highlighted the systemic risks associated with rapid changes in interest rates and depositor behaviors. Following this tumultuous period, however, deposits began to recover gradually from June 2023 onwards, indicating a potential stabilization in the banking sector as economic conditions adjust to the evolving landscape of interest rates and monetary policy.