On October 4, 2024, American Express (AXP), NetApp (NTAP), and Helios Technologies (HLIO) will all be trading ex-dividend, marking a significant date for dividend investors. This means that investors who purchase shares on or after this date will not receive the upcoming dividend payment. American Express has announced a quarterly dividend of $0.70, which is scheduled to be paid on November 8, 2024. NetApp is set to pay its quarterly dividend of $0.52 on October 23, 2024, and Helios Technologies will distribute a quarterly dividend of $0.09 on October 21, 2024. These dates are crucial for investors who seek to capitalize on dividend payouts, as the ex-dividend date is the cutoff for qualifying for the upcoming distributions.

The relationship between a company’s dividend and its stock price is significant, especially around the ex-dividend date. For American Express, with a recent stock price of $268.60, the $0.70 dividend translates to an approximate yield of 0.26%. This suggests that, all else being equal, AXP shares may open about 0.26% lower on the ex-dividend date. Similarly, NetApp shares are expected to decrease by about 0.43%, given their dividend of $0.52, while Helios Technologies shares may open approximately 0.19% lower, reflecting their $0.09 dividend. These anticipated changes highlight the market’s adjustment to account for the dividend payout and illustrate the impact that dividends can have on stock prices.

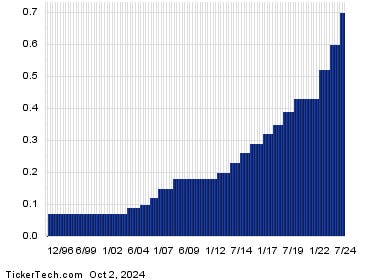

A historical perspective on dividends can provide investors with insights into the reliability and stability of these payments. The dividend history charts for AXP, NTAP, and HLIO depict the patterns of dividend distributions over time, which can serve as a critical tool for investors assessing future dividend prospects. Understanding past performance helps in anticipating whether a company is likely to maintain or increase its dividend payments. Analyzing these trends is essential, as past performance is often seen as an indicator of future behavior, allowing investors to gauge the risk associated with investing in these equities based on their dividend track records.

From a broader perspective, the expected annualized yields based on the upcoming dividends can give investors a sense of income potential. American Express’s estimated yield is approximately 1.04%, indicating a steady income stream for those invested in the company. In contrast, NetApp’s yield is higher at around 1.71%, suggesting a more attractive income opportunity based on its current dividend policy. Helios Technologies presents a yield of about 0.76%, which, while lower than the other two companies, still represents a consistent return for dividend-focused investors. These yields are crucial metrics for investors seeking income, particularly in a market where stable dividend payouts can offer a buffer against volatility.

In the context of recent trading activity, the stocks of these companies have experienced slight declines. On Wednesday, American Express shares were down about 1%, while NetApp and Helios Technologies shares fell approximately 1.8% and 0.7%, respectively. Such movements in stock prices may reflect broader market trends or company-specific developments that warrant investor attention. These fluctuations highlight the dynamic nature of the stock market and remind investors that even when anticipating dividends, stock performance can vary due to multiple factors beyond the company’s control.

In summary, the ex-dividend dates for American Express, NetApp, and Helios Technologies present important considerations for dividend investors. Understanding the implications of these dividends on stock price adjustments is critical. Historical dividend performance provides a helpful lens through which to analyze potential for future dividends and associated yields. Current trading trends indicate slight downtrends across all three companies, suggesting that market conditions are at play. For income-focused investors, these developments underline the necessity of due diligence, not only to capture dividends but also to navigate the complexities of the stock market effectively.