On October 29, 2024, Alcoa Corp. (ticker: AA) is scheduled to trade ex-dividend for its quarterly dividend payment of $0.10 per share, which will be payable on November 15, 2024. With AA’s recent stock price at approximately $42.02, this dividend represents around 0.24% of the stock value. This event is crucial for investors to consider, especially those interested in dividend-yielding stocks, as it marks an important date for receiving returns on their investments.

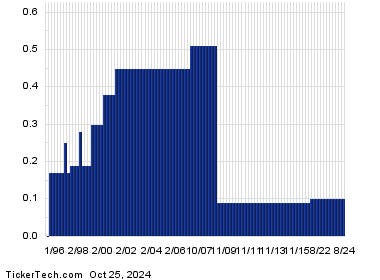

The historical performance of Alcoa’s dividends offers insight into the company’s reliability and potential for future payouts. An analysis of the dividend history reveals varying amounts declared over time, helping investors assess trends and the likelihood of sustained or increased future distributions. Although dividends can fluctuate for numerous reasons, historical data serves as a vital indicator for investors trying to gauge if the newly declared dividend will continue reliably in the future.

In addition to evaluating dividends, it is important to consider the stock’s performance relative to its moving averages. For Alcoa, the one-year performance indicates how the shares have fared compared to its 200-day moving average. The patterns revealed in such assessments can give investors insight into market sentiment regarding the company’s stock and potential fluctuations in value over time as they decide on the viability of holding or purchasing shares.

The 52-week statistics reveal that Alcoa’s stock has fluctuated significantly, with a low of $23.17 and a high of $45.48. With the current trading price noted at $41.34, investors can see that the stock is sitting close to its upper range, suggesting a relatively strong performance within the year. Such metrics are essential for investors who consider factors such as volatility, market trends, and overall financial health when making investment decisions.

In the broader market context, it’s noteworthy that Alcoa shares experienced a modest gain of approximately 0.3% during recent trading sessions. This uptick reflects the current investor sentiment and market conditions, which can affect trading behavior, stock evaluations, and dividend expectations. Positive movements in the stock price might encourage potential investors to evaluate the stock more closely, particularly given the recent announcement of the dividend.

In summary, Alcoa’s upcoming ex-dividend date and its consistently fluctuating dividends are significant aspects of the company’s stock profile. Given the historical dividend record, market performance, and moving averages, investors can make more informed decisions regarding Alcoa shares. Whether they are looking for steady income through dividends or price appreciation through stock value increases, understanding these dynamics is essential for navigating the investment landscape effectively.