In the third quarter of 2024, Meta Platforms, Inc. (META) reported remarkable financial performance, characterized by a substantial 19% year-over-year revenue growth, culminating in total earnings of $40.6 billion. This impressive growth was largely fueled by the robust advertising ecosystem surrounding Meta’s primary platforms, which includes Facebook, Instagram, and WhatsApp. The company’s ad revenue alone soared to $39.9 billion, demonstrating similar 19% YoY growth, attributed to improved pricing strategies for ads and an uptick in ad impressions. This positive trajectory can be largely linked to Meta’s emphasis on utilizing artificial intelligence for enhanced ad targeting, allowing for a more intricate understanding of user preferences and behavior. As a direct consequence, the engagement levels on Facebook and Instagram saw a notable increase of 8% and 6%, respectively, reflecting the success of these AI-driven strategies in attracting and retaining users on the platforms.

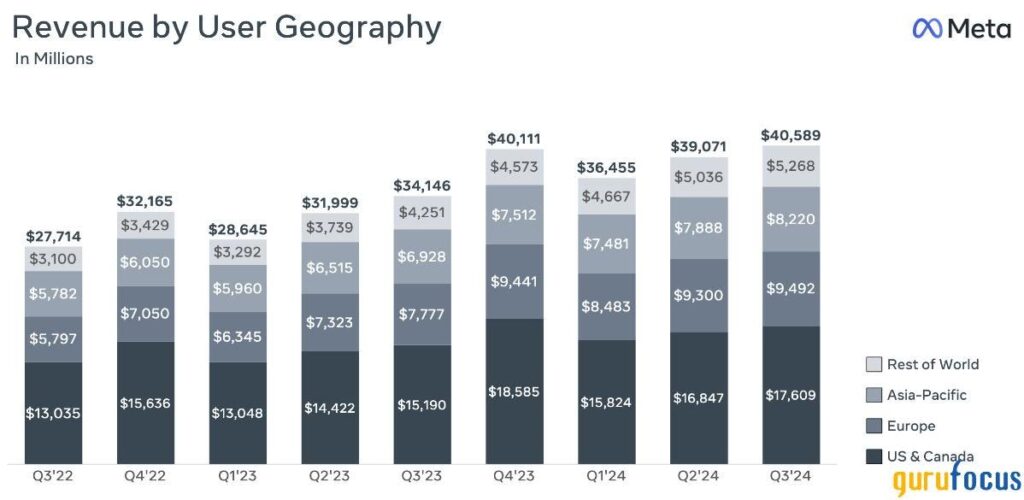

The geographical distribution of Meta’s advertising revenue showcased promising trends, especially in the Asia-Pacific and European markets. The Asia-Pacific region benefited from a rapidly growing mobile-first user base, while Europe displayed resilience in ad demand amidst economic uncertainties. In contrast, North America, while still the most lucrative market for Meta, experienced more tempered growth due to market saturation. The diversified revenue streams from different global markets underline Meta’s ability to capitalize on emerging opportunities beyond its traditional base, emphasizing its adaptive business strategy to accommodate varying regional dynamics.

Aside from the revenue boost, Meta also witnessed a significant increase in net income, which surged by 35% YoY, translating into profit margins expanding to 43%, up from 40% the year prior. This financial enhancement was not merely a product of enhanced revenue but stemmed from stringent cost-management practices and operational efficiencies. The company’s successful reallocation of resources toward strategic growth areas, despite ongoing investments in artificial intelligence and its volatile Reality Labs segment, indicates a deliberate approach to fortifying its core business while pursuing forward-looking technology initiatives.

Reality Labs continues to be a focal point for Meta, albeit with acknowledged challenges, as it undertakes substantial losses in pursuit of its metaverse ambitions. CEO Mark Zuckerberg reaffirmed Meta’s commitment to pioneering immersive digital experiences through virtual and augmented reality technologies, positioning Reality Labs as a critical component of Meta’s long-term vision. Despite the current financial strains from this segment, the core business’s robust profitability provides a buffer sufficient enough to absorb the losses, thus showcasing the resilience and overall health of Meta’s operations.

In terms of investment evaluation, Meta’s fair value is projected to be $734, derived from the Discounted Cash Flow (DCF) model, reflecting optimistic growth potential linked to its AI and Reality Labs initiatives. The model anticipates a high 28.80% growth rate in earnings per share over a 10-year horizon, supported by significant returns on investments in advanced technologies. Following this growth period, the terminal growth rate is expected to moderate to 4%, suggesting a transition into stabilization after a period of robust expansion. This valuation implies a 22.13% margin of safety when considering Meta’s current stock price, suggesting a potential undervaluation for investors, though it comes with the caveat of inherent risks tied to execution and market conditions.

However, with great potential comes considerable risk. Meta faces high operational costs related to its capital expenditures, primarily directed toward advancements in AI and Reality Labs, expected to reach $38-40 billion in 2024. If these investments do not yield expected returns, they may exert pressure on the company’s profitability and cash flows in the interim. Additionally, Meta must navigate an increasingly complex landscape of regulatory and geopolitical challenges. The scrutiny being applied to data privacy and AI ethics in both the United States and Europe may impose additional compliance costs, and any geopolitical disruptions, especially in rapidly growing markets like Asia-Pacific, could impact operations and advertising demand.

In summary, while Meta’s Q3 2024 earnings demonstrate a commendable balance between immediate profitability and long-term investment in growth initiatives, the company must strategically navigate the evolving market landscape. The solid growth in advertising revenue driven by AI, coupled with prudent cost management, positions Meta favorably for its ambitious goals in AI and the metaverse. Nonetheless, investors should remain cognizant of the associated risks, as the pursuit of high growth often entails the possibility of substantial investment failures or increased operational challenges.