In response to a struggling economy, the Chinese government has recently introduced a series of stimulus measures aimed at revitalizing economic growth. These measures have sparked some optimism within financial markets; however, skepticism remains among investors and economists regarding their longer-term effectiveness. Many assert that these stimulus actions provide only temporary relief, failing to tackle fundamental structural challenges that have historically undermined growth in China. As a result, unless urgent reforms are enacted to increase domestic consumption, the fleeting gains seen in the stock market are unlikely to sustain.

The stimulus measures introduced last month by the People’s Bank of China include various initiatives such as interest rate cuts, improved liquidity for banks, and targeted property reforms. While these steps were designed to encourage spending and bolster financial markets, critics highlight significant limitations. One of the predominant uses of these stimulus funds is to reduce mortgage rates for existing homeowners. Analysts warn that such measures may divert household savings away from immediate investments in the economy and into debt repayment instead. Even Goldman Sachs projected that the financial relief afforded by these cuts would ultimately assist residents without significantly reviving consumer confidence or stimulating the beleaguered real estate market.

Indeed, the deterioration of investor confidence in the Chinese real estate sector is profound. The sector’s contribution to the GDP has dramatically dropped from 30% in 2018 to about 15% today, reflecting a serious decline in consumer demand. There is an apparent oversupply of housing, with estimates suggesting around 60 million unsold apartments across the country. Despite government attempts to incentivize purchases in over 200 cities, only a small number have taken action to alleviate this surplus. Efforts to stimulate the property market seem futile against the backdrop of broader economic woes: rampant youth unemployment, weak consumer spending, and a downturn in economic outlook create a set of challenges that current stimulus measures do not adequately address.

The broader economic landscape poses additional obstacles to recovery, particularly in the face of persistent overcapacity issues in various industries. This chronic overcapacity is a consequence of China’s export-driven growth paradigm, heavily reliant on investments that often originate from extensive borrowing. For instance, in the solar panel industry, China’s production exceeds global demand, forcing producers to offload products internationally at unsustainable prices that exacerbate trade tensions. Furthermore, this emphasis on unprofitable industrial expansion burdens local governments with rising debt levels, complicating their fiscal health and curtailing the viability of future investments.

China’s economic difficulties are compounded by weak domestic consumption, which has lingered as a significant hinderance to sustainable growth. Despite the country’s attempts at fostering consumption, factors like low wage levels, insufficient social safety nets, and rising inequality have stymied progress. As global trade tensions escalate and protective tariffs against Chinese exports rise, the nation’s vulnerability to external economic shifts grows more pronounced. This vulnerability has been further exacerbated by the government’s rigid economic policies that favor state enterprise over private sector dynamism, stifling the innovation necessary for a truly balanced economy.

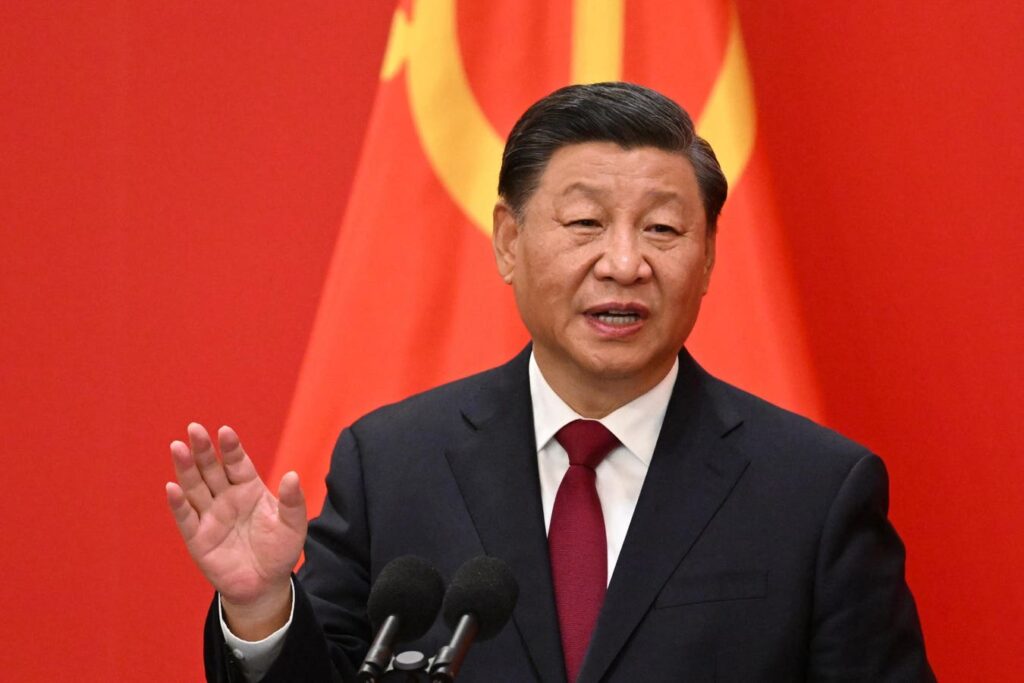

Political dynamics also play a fundamental role in shaping China’s economic trajectory. The Chinese Communist Party’s prioritization of state control has, historically, been a double-edged sword; while it may have spurred initial growth, it now acts as a barrier to necessary reforms. President Xi Jinping’s efforts towards achieving common prosperity have resulted in a crackdown on entrepreneurship, leading to a stark decline in startup activity. At the heights of venture capital investment in 2018, China saw around 51,000 startups; this figure plummeted to approximately 1,200 by 2023. The resulting stagnation in innovation leaves the economy continuing to lean on its outdated, export-driven model rather than adapting to new growth paradigms.

Compounding these issues are demographic pressures, primarily driven by the ramifications of the one-child policy, which has led to a rapidly aging population. Current projections suggest China could see its population decline by over 100 million by 2050, impacting workforce capabilities and increasing healthcare costs. The implications of an aging demographic pose profound challenges to economic growth as the country braces for potential labor shortages in its manufacturing sector.

Although recent stimulus measures may offer short-term relief for certain economic sectors, they fall short in addressing the more profound, systemic challenges faced by China. Long-term recovery demands decisive action on multiple fronts—overcapacity issues, strengthening domestic consumption, local government debts, fostering an entrepreneurial environment, and enabling greater economic reform. The critical question remains whether the Chinese government is willing to embrace these necessary changes, especially when such reforms could undermine the central authority of the Communist Party. Without a commitment to substantial reform, the prospects for an enduring economic resurgence remain bleak, reflecting a continuing trend of stagnation rather than sustained growth in the years to come. The recent stock market rally, while impressive in the moment, may be no more than a fleeting response to policies that ultimately do not address the realities of China’s economic landscape.