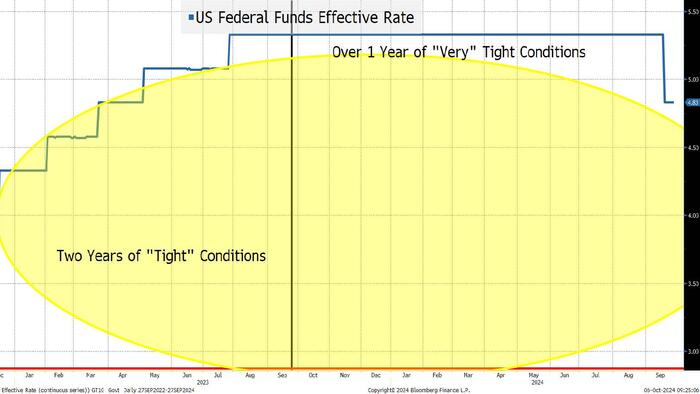

Peter Tchir of Academy Securities discusses the pivotal week ahead, focusing on the Federal Reserve’s actions, the implications of the upcoming elections, and their potential impact on the markets. Highlighting the Fed’s recent data, Tchir predicts a 25 basis point cut, driven by recent labor market reports and inflation stabilization signs, though concerns linger about the neutral interest rates. Tchir emphasizes that while markets have responded to recent economic events, the Federal Reserve’s positioning remains crucial. With bond yields spiking shortly after a weak jobs report, he reflects on the unpredictable nature of financial markets and how reactions to economic data can often defy expectations.

Shifting to the election, Tchir expresses skepticism about forecasting outcomes, citing the complexity and unpredictability ahead for both the presidency and congressional seats. He believes both a clear electoral result or a hotly contested election could significantly influence market sentiment. A decisive outcome that led to unified control could trigger reactions based on policy mandates, with potential short-term negativity for markets. Conversely, extended disputes or unresolved outcomes could lead to wider uncertainty and create a power vacuum that adversaries may exploit.

Tchir details the best possible scenario for the markets: a clear presidential winner accompanied by gridlock, which would encourage confidence in stocks and bonds. However, he counters this with potential worst-case scenarios, including a sweeping win for one party, requiring markets to navigate possible backlash to new policies. Furthermore, he stresses that markets are equipped to handle some periods of uncertainty but might struggle if contentious narratives persist beyond election night.

With the election anticipated to provide clarity, Tchir notes that existing fears of a prolonged contested result might have a disproportionate effect on sentiments and responses from both markets and the public. Drawing from historical contexts, he suggests there remains a fine balance between sentiment and economic realities, where perceived market strength can coexist with uncertainties arising from political developments.

Closing with reflections on societal reactions to political events, Tchir believes the general resilience of systems and norms will endure amid heated dialogues prevalent on social media today. He draws analogies from cultural references, like the Sex Pistols, to underscore how public life can often distort perceptions of reality. Despite the turbulent discourse, Tchir maintains that institutions will continue functioning effectively, and the fervent reactions will likely subside over time, proving to be less consequential than anticipated.

In his concluding thoughts, Tchir urges readers to approach the coming week with cautious optimism, aware of challenges but confident in systems collectively moving forward. He punctuates his message with a note on the importance of navigating uncertainties, using humor and light-heartedness to acknowledge the complexities of politics and economics. Encouraging resilience and preparedness, Tchir sets a baseline for action strategies in anticipation of the unfolding events, reminding everyone to remain grounded amidst the chaos.