The Education Department has announced a significant extension of the student loan payment pause for borrowers enrolled in the SAVE plan, amid legal challenges that have prevented its implementation since July. The SAVE (Saving on a Valuable Education) plan, designed to provide borrowers with lower monthly payments and a potential expedited path to loan forgiveness, has faced obstacles primarily from lawsuits filed by Republican state attorneys general. As a result of this ongoing legal battle, the Education Department has placed approximately 8 million borrowers into a forbearance status, meaning they will not have to make payments and will not accrue interest during this period. This decision aims to alleviate financial strain while the future of SAVE hangs in the balance.

With the SAVE plan currently on ice, the Education Department has indicated that it plans to reopen other existing repayment options. These include the PAYE (Pay As You Earn) and income-contingent repayment plans, which had previously been closed due to the comparable benefits offered by the SAVE program. A department spokesperson noted that as the agency continues to navigate the complexities of the legal situation, they anticipate needing at least six more months to “re-program” their systems. This lengthy process is critical for complying with the preliminary injunction that has been issued against the SAVE plan. Therefore, borrowers who are already enrolled, as well as those who applied for SAVE during this period, will remain in forbearance until systemic changes can be effectively implemented.

As the Education Department recalibrates its approach, they have made it clear that the PAYE plan will be the most efficient route for those seeking Public Service Loan Forgiveness (PSLF). This is particularly critical for PSLF borrowers, who, during the forbearance period, cannot earn credit towards forgiveness—the reopening of PAYE provides a swift alternate pathway. The ongoing legal ramifications necessitating these adjustments highlight the challenges the Department faces in managing its repayment systems in the face of external legal pressures. It underscores the potential for additional legal complications that may arise as the Department works to defend the SAVE plan in court.

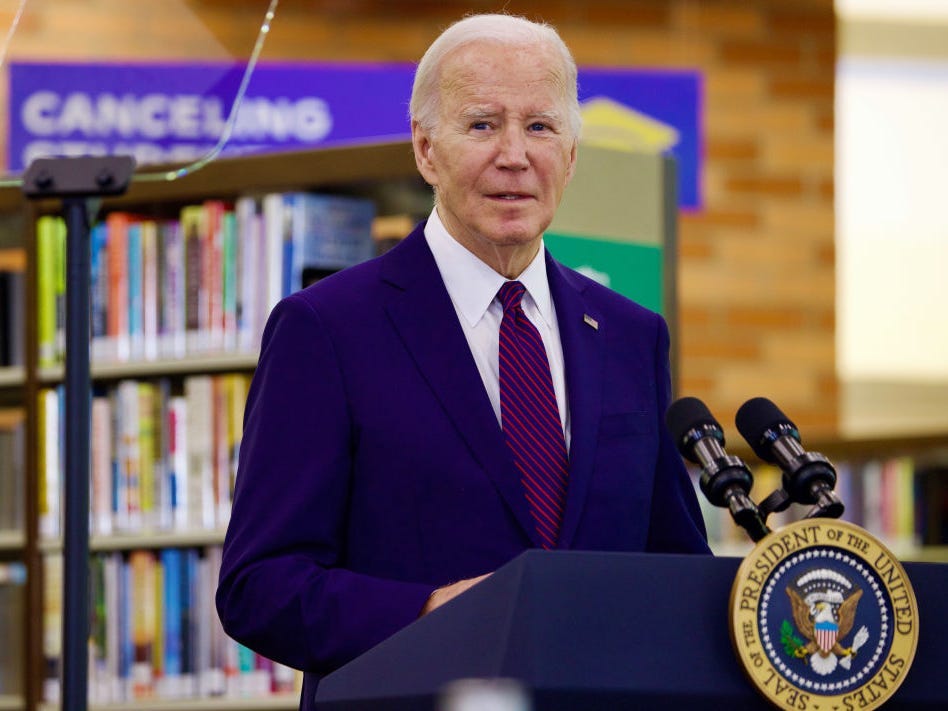

Currently, student-loan borrowers are awaiting a decision from the 8th Circuit Court of Appeals, which is expected to address the status of the SAVE plan after hearing oral arguments. Alongside this principal challenge, President Biden’s broader initiative for student loan forgiveness, which has the potential to assist over 30 million individuals, is also entangled in legal issues due to separate challenges posed by GOP state attorneys general. The Education Department has pledged to continue advocating for both the SAVE plan and the broader forgiveness initiative as these legal battles unfold.

Despite the hurdles, the Department has remained committed to providing targeted relief to borrowers. Recently, it announced the cancellation of $4.5 billion in student debt for 60,000 borrowers who have served in public service roles. This action illustrates a commitment to alleviating the burden on specific groups within the larger pool of student-loan borrowers, an effort that continues in parallel with the ongoing litigation surrounding the SAVE plan and other community-wide relief efforts.

In summary, the extension of the student-loan payment pause reflects the Education Department’s response to the currently blocked SAVE plan, as it seeks to provide borrowers relief amid challenging legal contexts. With alternative repayment options becoming available again, especially for those pursuing Public Service Loan Forgiveness, the Department is taking steps to assist those affected. As the wait for a definitive court ruling continues, the federal agency is prepared to adapt its strategies to meet the needs of borrowers while remaining engaged in the legal disputes that shape the future of student loan repayment in the U.S.