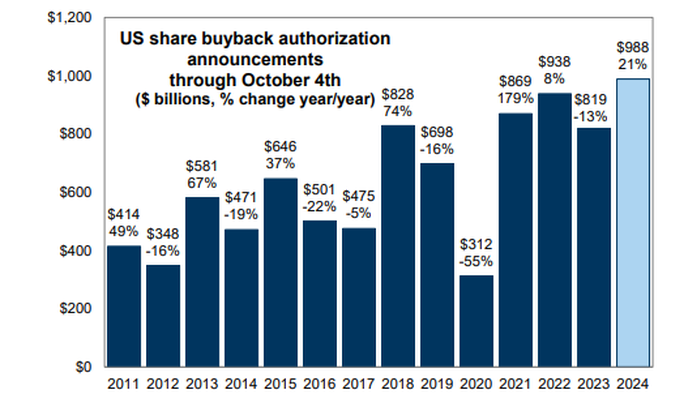

Last week, we explored the dynamics of the current market environment, particularly focusing on the perplexing behavior of major trading players. Even the premier derivatives trader at Goldman Sachs expressed confusion about the identity of the continued purchasers driving the market’s ongoing upswing. The assumption that retail traders are the primary force behind this relentless ascendance has come under scrutiny. Instead, a more compelling explanation has emerged: the prevalence of stock buybacks is the driving force behind the market’s performance. This revelation sheds light on how companies are actively participating in the market through repurchasing their own shares, thus contributing significantly to rising stock prices and investor sentiment.

Furthermore, we highlighted that the week ending October 11 marked the end of a buyback blackout period for many corporations. During this time, companies are typically restricted from repurchasing their own shares due to regulations surrounding earnings reports and significant disclosures. As we enter the current week, we anticipate a surge in buyback activities as firms resume their share repurchase programs. This re-entry into buyback intervals indicates a possible influx of capital into the market, as corporations invest back into their own stocks, potentially exacerbating the ongoing market rally.

The mechanics of stock buybacks are essential to understanding their impact. When corporations buy back their shares, they reduce the total number of shares outstanding, thereby increasing earnings per share (EPS), which can lead to higher stock prices. Moreover, buybacks signal to the market that management believes the company’s stock is undervalued, boosting investor confidence and possibly attracting additional buyers. As more companies initiate their buybacks, this self-reinforcing cycle can lead to further enhancements in market performance, creating an environment where stock prices continue to rise, independent of broader economic indicators.

In addition to the quantitative aspects of buybacks, the qualitative implications are also noteworthy. Buybacks can shape corporate behavior and financial strategies by emphasizing shareholder value over other potential investments, such as research and development or employee compensation. Critics of aggressive buyback strategies argue that this focus on short-term stock performance can stifle long-term growth and innovation, suggesting that companies may be prioritizing immediate returns for shareholders at the expense of sustainable business practices. This dynamic has implications for broader economic health, as capital allocated to buybacks may detract from other productive investments.

Another important aspect to consider is the potential future landscape of the market as buyback activities increase. The behavior of corporate executives amid rising stock markets can be influenced by several factors, including compensation structures tied to stock performance and pressures from investors for higher returns. As buybacks become a ubiquitous trend, the reliance on this mechanism raises questions about market stability and the viability of continued growth if earnings from the underlying business do not support inflated stock prices. This condition may lead to increased volatility as market corrections occur when reality fails to match the expectations fueled by buybacks.

In conclusion, the current market trends suggest that stock buybacks are a considerable driving force behind the recent performance of equities. With the end of the buyback blackout period, we are likely to see a resurgence of buyback activity, which can further propel stock prices upward while also raising important discussions about the implications of such actions for long-term company health and market stability. As we analyze the interplay between buybacks and market movements, it is crucial for investors and market participants to remain mindful of the underlying economic indicators and the potential for market correction as the cycle continues.