3G Capital: From Beer to Window Shades – The Journey of Jorge Paulo Lemann and Partners

Jorge Paulo Lemann and his partners at 3G Capital have built an impressive portfolio of successful investments, predominantly in banking, Brazilian beer, and the food industry, which has resulted in a significant fortune. Moving forward, they have set their sights on window shades, with their recent acquisition of Hunter Douglas hinting at yet another opportunity for substantial financial success. Notably, one of the firm’s co-founders, Alexandre Behring, who is also a passionate spearfisher, draws parallels between his underwater hunting hobby and the investment strategy of 3G Capital, emphasizing the importance of patience, precision, and the ability to seize high-quality opportunities when they arise.

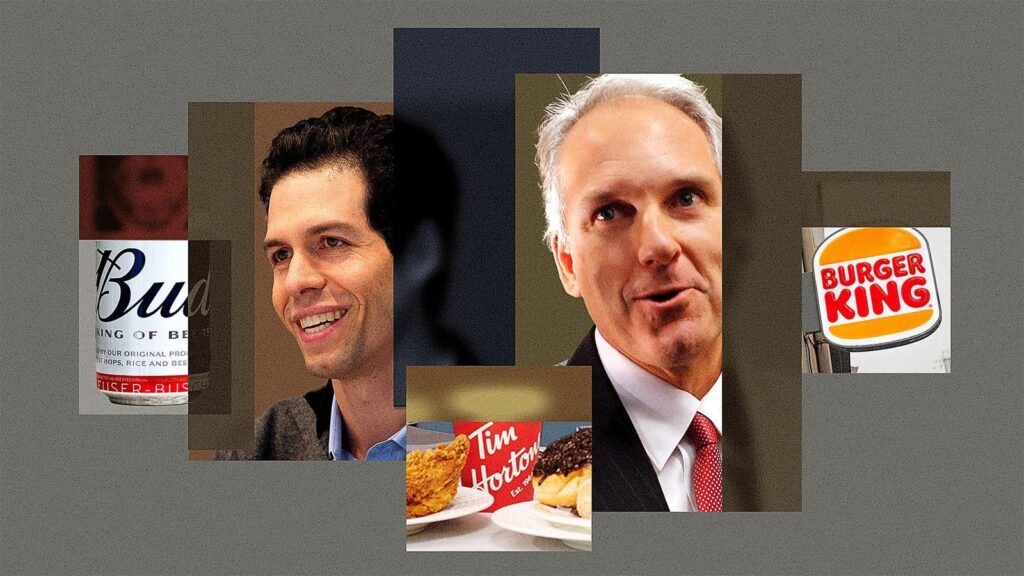

3G Capital, founded in 2004 by Lemann, Behring, Carlos Sicupira, and Marcel Telles, has amassed around $14 billion in assets under management, predominantly funded by their personal capital. The firm operates differently from typical private equity firms by making fewer investments, allowing them to focus on long-term value creation rather than short-term exits. Their strategy involves carefully selecting investments and patiently waiting for them to mature, hence avoiding the rush to cash out even when dividends accrue. This approach has yielded remarkable returns over the years, particularly from key acquisitions like Burger King and Restaurant Brands International.

The landmark investment for 3G was the acquisition of Burger King in 2010, which for a modest investment of just over $1 billion in equity, transformed into a colossal 28-fold return. The firm undertook significant restructuring post-acquisition, streamlining operations through cost-cutting measures and a franchise expansion strategy that significantly increased cash flow. By taking the company public again in 2012 while retaining a majority stake, they leveraged their gains to acquire Tim Hortons, creating Restaurant Brands International, which has added substantial value through complementary acquisitions of Popeyes and Firehouse Subs.

Currently, the firm is focused on maximizing their investment in Hunter Douglas, a market leader in window coverings that offers a fresh direction compared to their historical focus on food and beverages. Acquired for $7.1 billion, Hunter Douglas indicated a crucial entry into a consumer market that 3G believes is ripe for transformation. The company’s prior underperformance, attributed to its family-owned nature, is seen as a significant opportunity for 3G to apply its efficiency-driven model to enhance profitability. By standardizing operations and expanding globally, the firm aims to mirror its previous successes in the consumer goods sector.

3G’s success can be attributed to its unique investment philosophy, which focuses on finding established businesses with the potential for turnaround and optimization. The team, led by Behring and Schwartz, emphasizes the importance of patience and diligence in their search for robust investments. They prioritize building strong management teams, fostering a culture of efficiency, and targeting organic growth before considering mergers and acquisitions, leading to sustained long-term success.

In conclusion, the journey of Jorge Paulo Lemann and his partners at 3G Capital exemplifies a disciplined investment approach grounded in efficiency and long-term value creation. As they transition into new sectors, like window shades, their storied history of resilience and strategic focus serves as a model for navigating evolving markets. With their sights set on the growth potential of Hunter Douglas, they continue to seek high-caliber opportunities that align with their philosophy, promising even more lucrative returns in the future.