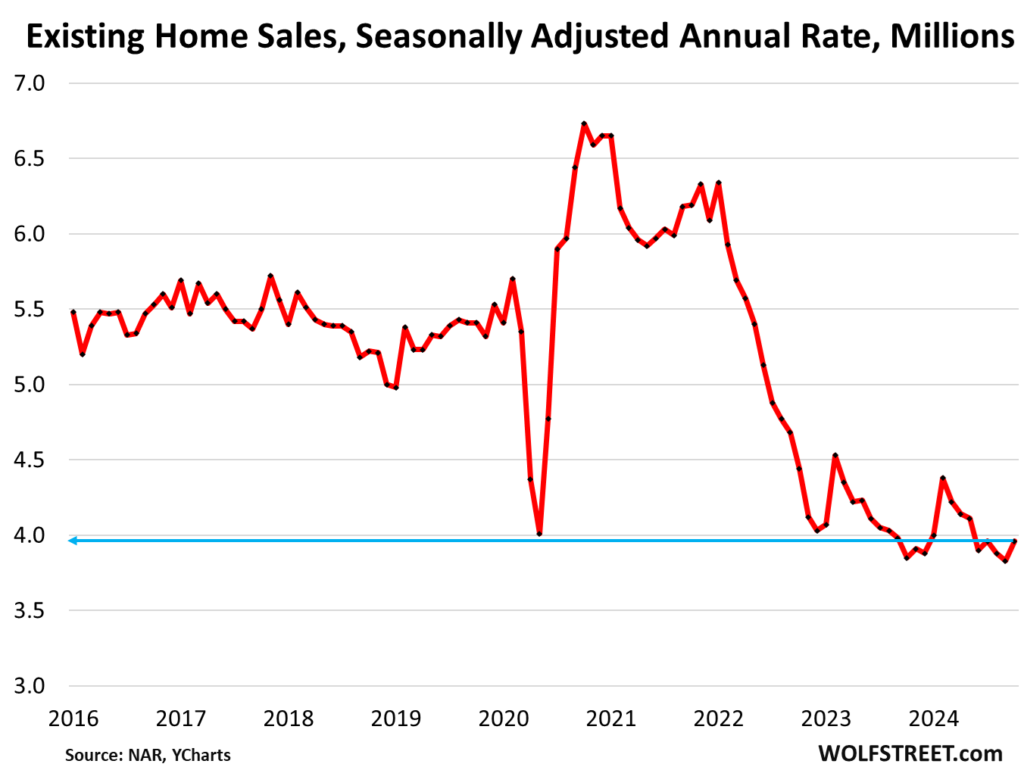

The real estate market has experienced a dramatic decline in demand, resulting in epic “demand destruction” primarily driven by skyrocketing home prices. Recent statistics reveal that sales of existing single-family houses, condos, and co-ops hit a seasonally adjusted annual rate of 3.96 million in October 2023. While this marks a slight increase from the prior month, it also represents a stark 36% decrease compared to October 2022 and a 26.8% drop from 2019 levels. This downturn mirrors conditions observed during the peak of the housing crisis, indicating that many prospective buyers are effectively on strike, unwilling to enter a market where prices have surged to unsustainable heights since early 2020.

The National Association of Realtors (NAR) reported a total of 348,000 actual home sales in October, with a total of 3.42 million sales reported for the year to date, showcasing a modest decline of 2.1% compared to the prior year. Based on current patterns, projections suggest that 2024 may see only 4.02 million sales, the lowest since 1995 and marking a new low during a non-recessionary environment. Unlike the housing crisis of 2008, which was prompted by economic turmoil and job losses, the current demand collapse stems from exorbitant home prices that render homeownership out of reach for many potential buyers.

This buyers’ strike is evident in the significant reductions in mortgage applications, which have fallen by 50% compared to the same period in 2019, as reported by the Mortgage Bankers Association. The weak demand continues to cast a shadow over the housing market as the year comes to an end. Furthermore, unsold inventory remains high at 1.37 million homes, showing a modest decline from September but a 19% increase year over year. The number of available single-family homes and condominiums has also increased, leading to a significant supply figure of 4.2 months in October, the second-highest for any October in the last seven years.

Sellers are beginning to feel the pressures of this market dynamic. The median number of days homes spent on the market reached 58 days in October, the longest duration recorded since 2019. Increased days on the market are often indicative of seller motivation; as homes languish without offers, sellers may become desperate, leading to price reductions. Currently, while sellers are not highly motivated, the trend indicates they may become increasingly compelled to adjust their pricing strategies in response to market conditions.

Additionally, rising mortgage rates are exacerbating the challenges facing both buyers and sellers. As of October 2023, the average 30-year fixed mortgage rate climbed to 6.84%, creating additional barriers for potential homeowners. This increase in rates has not yet significantly impacted recent closed sales, but it is reflected in the declining mortgage application rates. Aligning with broader economic patterns, home prices have also shown mixed results; while the median price for single-family homes edged up slightly, condo prices saw reductions, indicating a polarized market responding to varying demands.

Despite evidence of price-related obstacles faced by buyers, the NAR often attributes sluggish sales to external social factors, such as inventory shortages or consumer hesitancy linked to political events. Nevertheless, as property values have escalated approximately 50% between 2020 and mid-2022, they have hindered buyer activity and stifled transactions. In contrast to the residential sector, the commercial real estate market has undergone price corrections that have restored investor interest. Additionally, many homebuilders are adjusting their strategies with price reductions and incentives to attract buyers, reflecting shifting dynamics as potential homeowners consider renting options as viable alternatives amid a landscape marked by high prices and rising mortgage costs.

Ultimately, these trends highlight how regional disparities in housing markets across the U.S. contribute to varying sales and prices. For instance, while some regions are seeing modest increases in transactions, overall demand continues to falter significantly due to inflated prices. As we approach the end of the year, the ongoing reduction in buyer activity poses questions about the sustainability of current market conditions and the future trajectory of home prices. The overarching narrative confirms that prices, as the fundamental concern affecting supply and demand, remain unaddressed by leading industry representatives, raising doubts about recovery and growth in the housing market moving forward.